XR Talks is a series that features the best presentations and educational videos from the XR universe. It includes embedded video, narrative analysis and top takeaways. Speakers’ opinions are their own. For a full library of indexed and educational media, subscribe to ARtillery PRO.

Industry rhetoric about AR’s world-changing status far outweighs any tangible evidence that it’s captivating consumers today. Though we see some evidence, such as lens engagement figures from Snapchat and others, we’re mostly flying blind when it comes to consumer AR sentiment.

Looking to fill that gap, AR Insider’s research arm ARtillery Intelligence has completed Wave III of its annual consumer survey report. Working with consumer survey specialist Thrive Analytics, it wrote questions to be fielded to 1000 U.S. adults, and produced a report based on the results.

Among the topics: How is mobile AR resonating with everyday consumers? How often are they using it? How satisfied are they? What types of experiences do they like most? How much are they willing to pay for it? And for those who aren’t interested in mobile AR… why not?

ARtillery Intelligence Chief Analyst Mike Boland gave a presentation at AWE to unpack these results and strategic implications. In preparation for that talk, ARtillery replicated and captured the presentation for AR Insider readers. And it’s this week’s featured XR talk (video below).

AR Champions

To tackle the findings in a systematic way, the presentation segments results by mobile AR users and non-users. They show vastly different behavior and sentiments, but they’re both important. Non-users may get shrugged off, but their reasons for non-use have strategic importance.

Starting with users, 26 percent have tried mobile AR (more about frequency in a bit), up from 22 percent in Wave II. AR-as-a-Feature took the lead for the first time this year in terms of most-used format (52 percent), beating ARkit, ARCore, and web AR. But the latter is the one to watch.

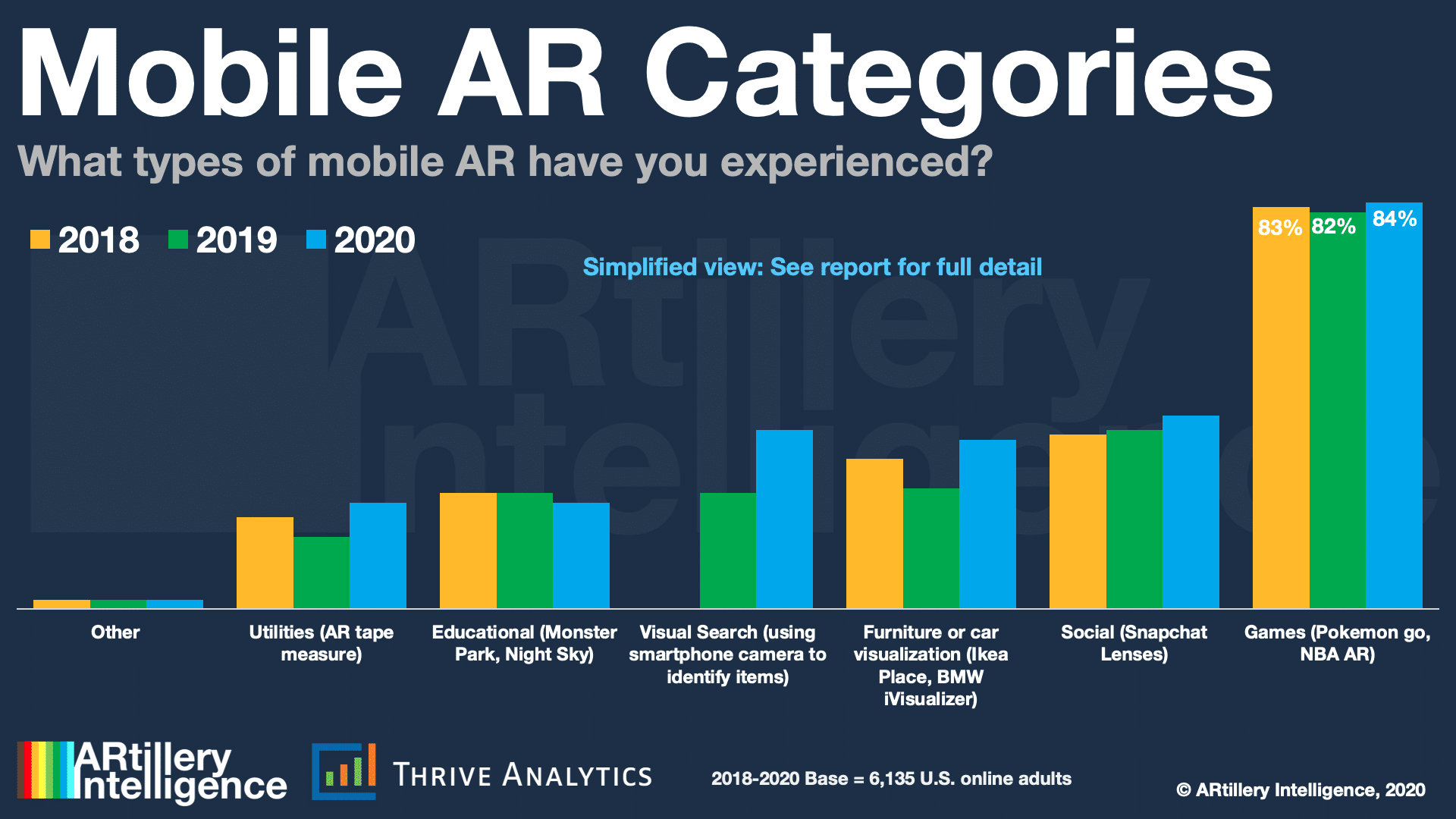

As for types of experiences, gaming leads, followed by social, product visualization and visual search. The last two are notable because they’re so inherently monetizable. Visual search is the standout in this survey wave with 37 percent of respondents having tried it, up from 24 percent.

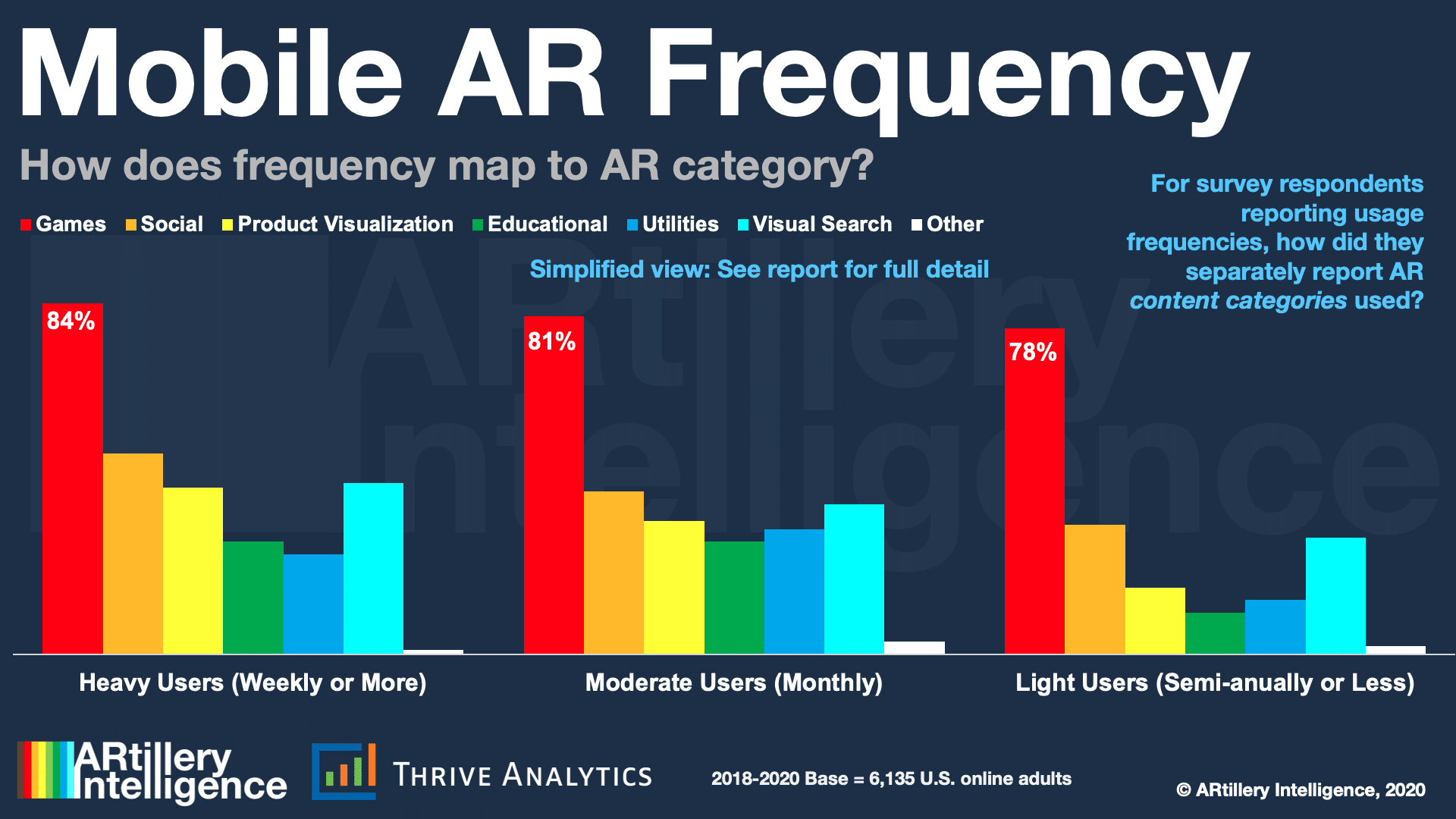

Meanwhile, 71 percent of mobile AR users are active at least monthly, and 46 percent at least weekly. But things get more interesting when cross-referencing frequency responses with the previous answers about AR types. There we see social and visual search as high-frequency uses.

As for how much users will pay for AR apps, the sweet spot is $1-$3. But the price point we’re most bullish on is free (in-app purchases). Pokémon Go has validated this revenue model with $3 billion+ in lifetime revenues, and it builds on the comfort levels established in mobile gaming.

We’ll pause there and move on to non-user sentiments but the full video embedded at the bottom (and the full report itself), has much more on user behavior. Other topics include their satisfaction levels and the types of mobile AR experiences that they want to see and experience next.

AR-Ambivalent

Moving on to non-users, they represent 74 percent of the survey sample (the flip side of the 26 percent of mobile AR users cited above). Once identified, those users were asked a different set of questions than the above, such as reasons for non-use; probability for use; and price sensitivity.

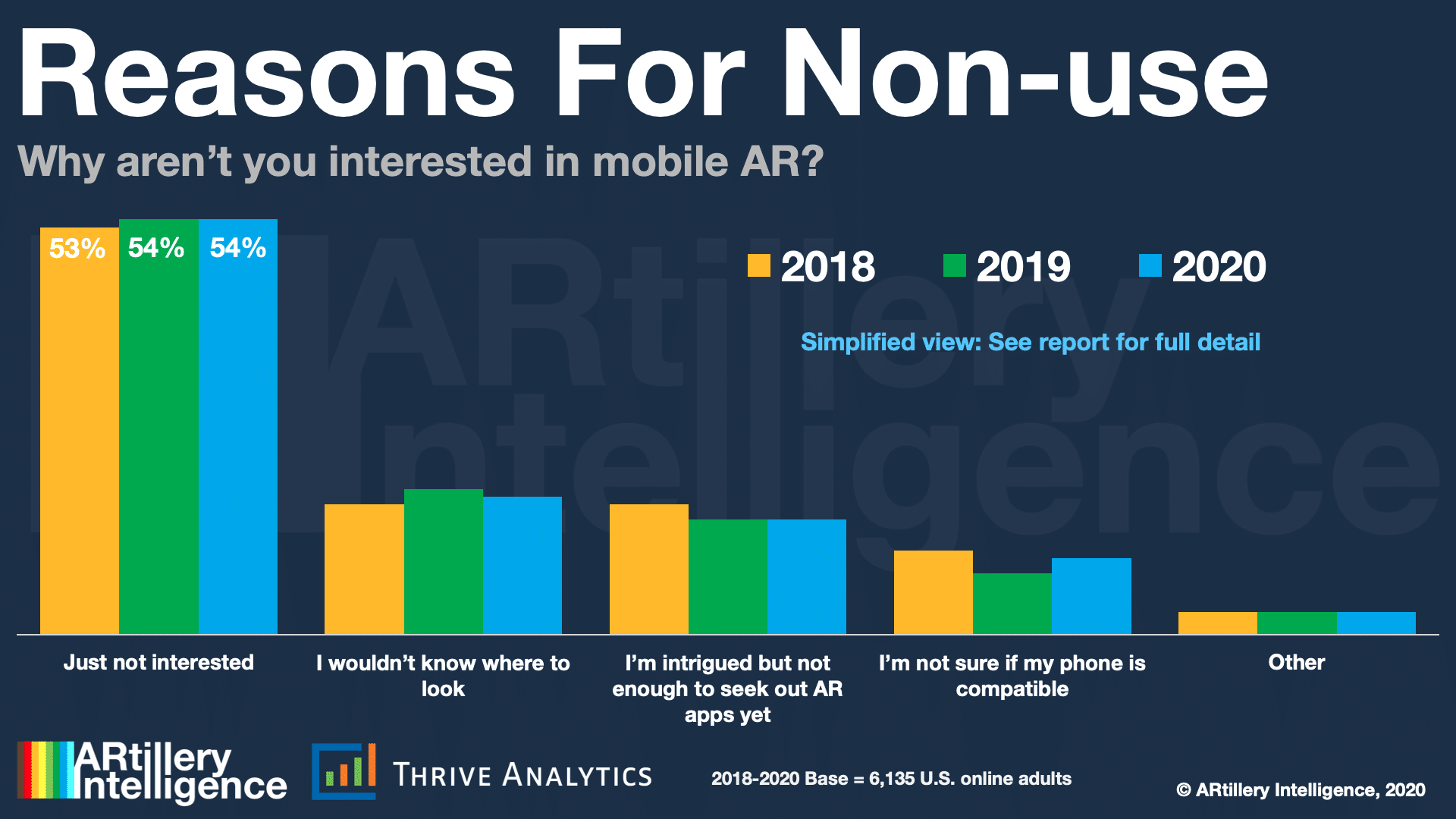

For example, 59 percent of non-users report they’re unlikely or extremely unlikely to adopt. This obviously means the industry has its work cut out for it. The question that flows from there is “why not?” to which the resounding answer is “I’m just not interested.” This is equally deflating.

This raises a theme that comes up wave-after-wave of this research. User satisfaction is high, but non-users are ambivalent, which boils down to a marketing challenge. Consumers have to try it to “get it” but it’s hard to compel them to do so when the UX can’t be captured in images or video.

Beyond the “just not interested crowd,” other sentiments indicate confusion such as “I wouldn’t know where to look” for mobile AR experiences. This signals the need for education. It also requires more plain-spoken marketing that eschews tech jargon and industry acronyms like “AR.”

Evidence can be seen in best practices from the most successful mobile AR such as Snapchat lenses and Pokémon Go. They’re not only AR-as-a-feature (which scored well as noted), but they don’t use the term “AR.” Google visual search is likewise called “Lens” and “search what you see.”

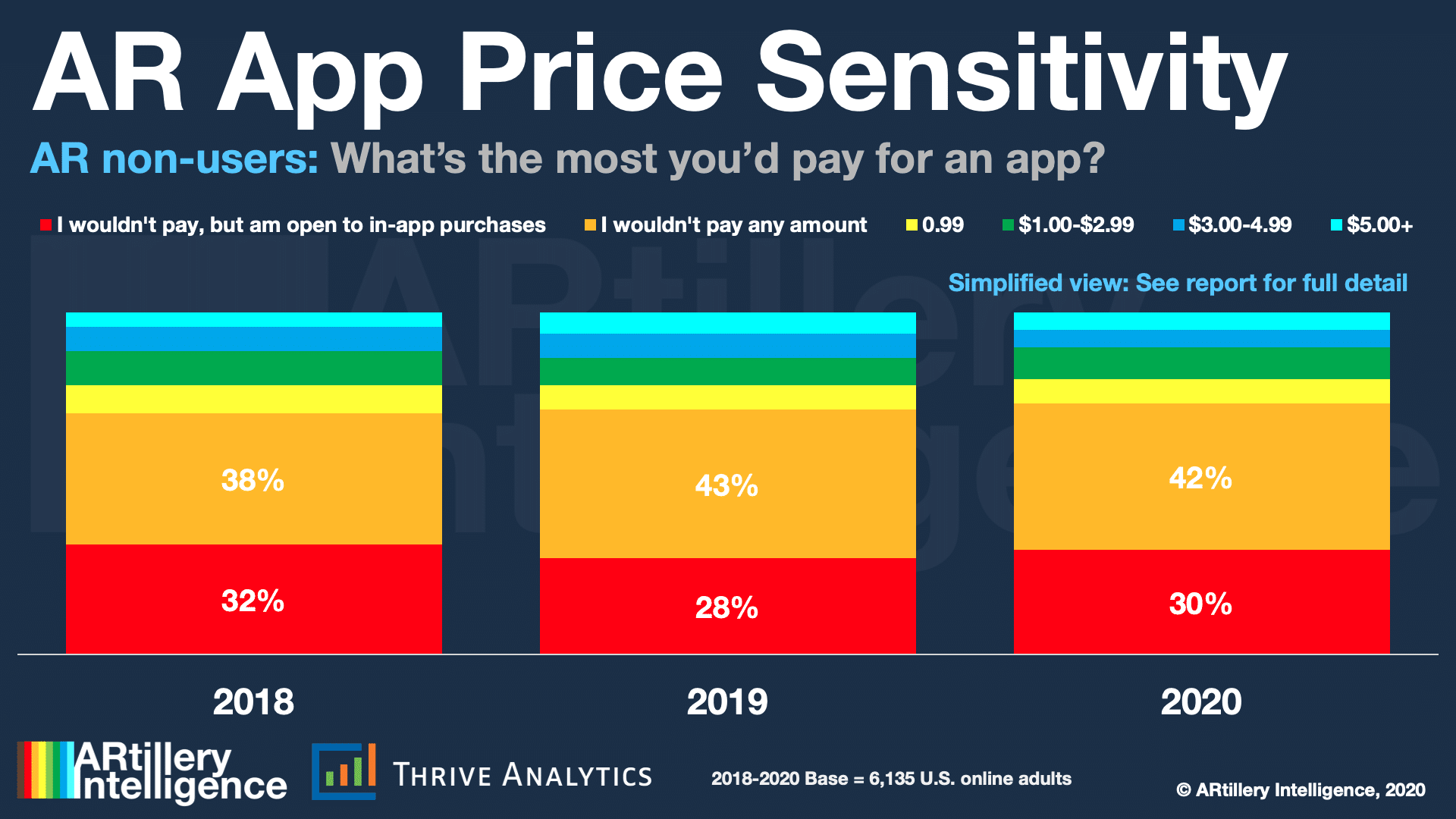

Lastly, what about price sensitivity? Compared to current users explored above, non-users had high price sensitivity, with 42 percent unwilling to pay any amount. But in-app-purchases are a hopeful pricing model with 30 percent willing to try an app for free, then consider payments later.

Boiling it Down

Some of the answers peppered above relate to each other. For example, the challenge of getting non-users users to try AR so that they can see its immersive appeal is all the more challenging if there are pricing barriers. So in-app-purchases can ease them in and reduce front-end friction.

AR-as-a-feature can likewise reduce friction in getting ambivalent non-users to try AR. If it’s placed in their existing path — such as apps they already use — their chances of seeing its appeal are much greater than asking them to take the extra step to go download something.

For all of the same reasons, web AR will be a format to watch closely. It carries lots of the same benefits of frictionless activation through just a web link. And the quality of the experience continues to improve to challenge native apps, given the work of companies like 8th Wall.

Another takeaway is that gaming has led mobile AR to date. But as AR matures, utilities like visual search and retail shopping assistance could rise to the top. Not only are they compelling and high-frequency use cases gaining interest in this survey, but they are inherently monetizable.

Lastly, to get over the hump with ambivalent late adopters, work on AR’s marketing. Make it plain spoken like Snapchat, Pokémon Go and Google all have done. Consider not even using the term AR. For AR to thrive, it first must die.. or at least the term “AR” in mainstream user-facing ways.

See the full talk below and find out more about the report here.