AR’s role in marketing and commerce continues to ratchet up as brands see that it’s working. This plays out through performance and ROI in ad campaigns, as well as signals that AR is gaining traction among consumers as a shopping utility. We call this Camera Commerce.

As we examined recently, the technology is still in early adopter phases but it’s quickly acclimating among mainstream audiences. And like past shopping technologies such as high-end photography, the tipping point will eventually come when it shifts from acclimation to expectation.

As that process unfolds, AR will become table stakes. Then it will begin to ratchet up through competitive pressure among retailers and eTailers. We’re far from that point of ubiquity, but several pieces are moving into place including brand comfort and competency with AR marketing.

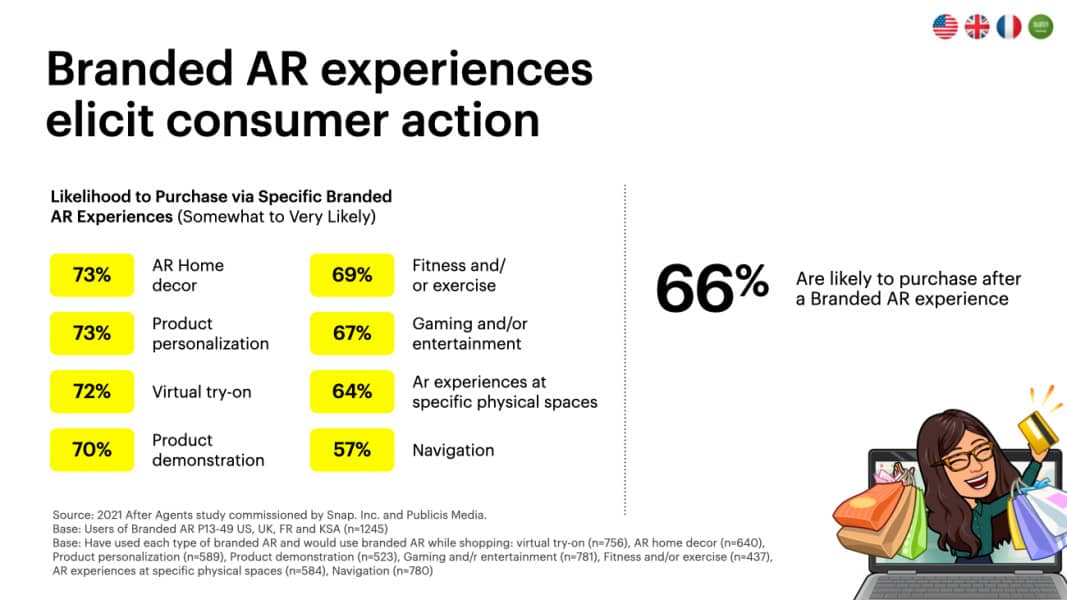

Back to consumer acclimation and demand, they’re likewise pieces in this AR shopping puzzle. So to quantify where they stand today and where they’re headed, Snap and Publicis recently released a report that examines consumer temperature towards branded AR.

Diving In

So what did the report uncover? We’ve pulled out a series of highlights below for this week’s Data Dive. For definitional sake, the term “branded AR” refers to consumer engagement with branded (versus organic) AR experiences such as sponsored lenses.

–– 58 percent of respondents aged 13–49 claim to use AR, and 31 percent use branded AR.

–– Among these respondents, Snapchat users are 56 percent more likely to use branded AR.

–– 76 percent believe AR will play a role in how people shop in the next five years and 57 percent will increase their AR use post-pandemic.

–– 54 percent actively search for AR experiences. The most common method (40 percent) is searching within the camera on digital platforms like Snapchat.

–– 66 percent who use branded AR for shopping say they’re likely to purchase something after a branded AR experience. 72 percent feel this way when the format is virtual try-ons.

–– Millennial and Gen X consumers index higher in both branded AR use and likelihood to purchase something after experiencing AR.

–– 61 percent say that the ability to share a branded AR experience is important to them.

As for the report details and methodology, Snap and Publicis commissioned market research firm Alter Agents to conduct a three-part survey in the U.S., U.K, France and Saudi Arabia. The survey sample includes 1000 consumers, aged 13-49. More details can be seen here.

Puzzle Pieces

These results contain several insights for brands that are developing competency in camera commerce. for example, they should lean into consumers’ social affinity noted above by amplifying their campaigns through shareable AR experiences with clear calls-to-action.

In a broader sense, it’s clear that consumer AR demand is well on its way. But returning to an earlier point, it’s only one puzzle piece required for ubiquitous AR shopping and commerce. Other moving parts include brand education and democratized AR experience creation.

That ecosystem is coming together as we speak, including ubiquitous 3D experience-creation platforms like Unity. For 3D models of physical goods, there are likewise enabling technologies for optimization and distribution, including VNTANA, and these will continue to develop.

Another developing piece is scalable 3D capture technology for physical goods. There are customized tools by AR early adopters like IKEA and Wayfair, but a market-wide standard for large product libraries (and smaller businesses) could really unlock camera commerce.

Lastly, there are cultural challenges. Joining consumer acclimation and comfort, the same is needed on the brand and retailer (often non-techy) side of the equation. Just like past emerging tech that went on to become table stakes in eCommerce, this will be a gradual process.