Data Point of the Week is AR Insider’s weekly dive into data from around the XR universe. Spanning usage and market-sizing data, it’s meant to draw insights for XR players or would-be entrants. To see an indexed archive of data and narrative reports, subscribe to ARtillery PRO.

One of the downsides of AR as an ad medium in these early phases is a lack of reach. Brand advertisers are very reach driven and many are dismissing AR with the notion that it only reaches niche audiences. And they’re right in some cases but are starting to be disproven in others.

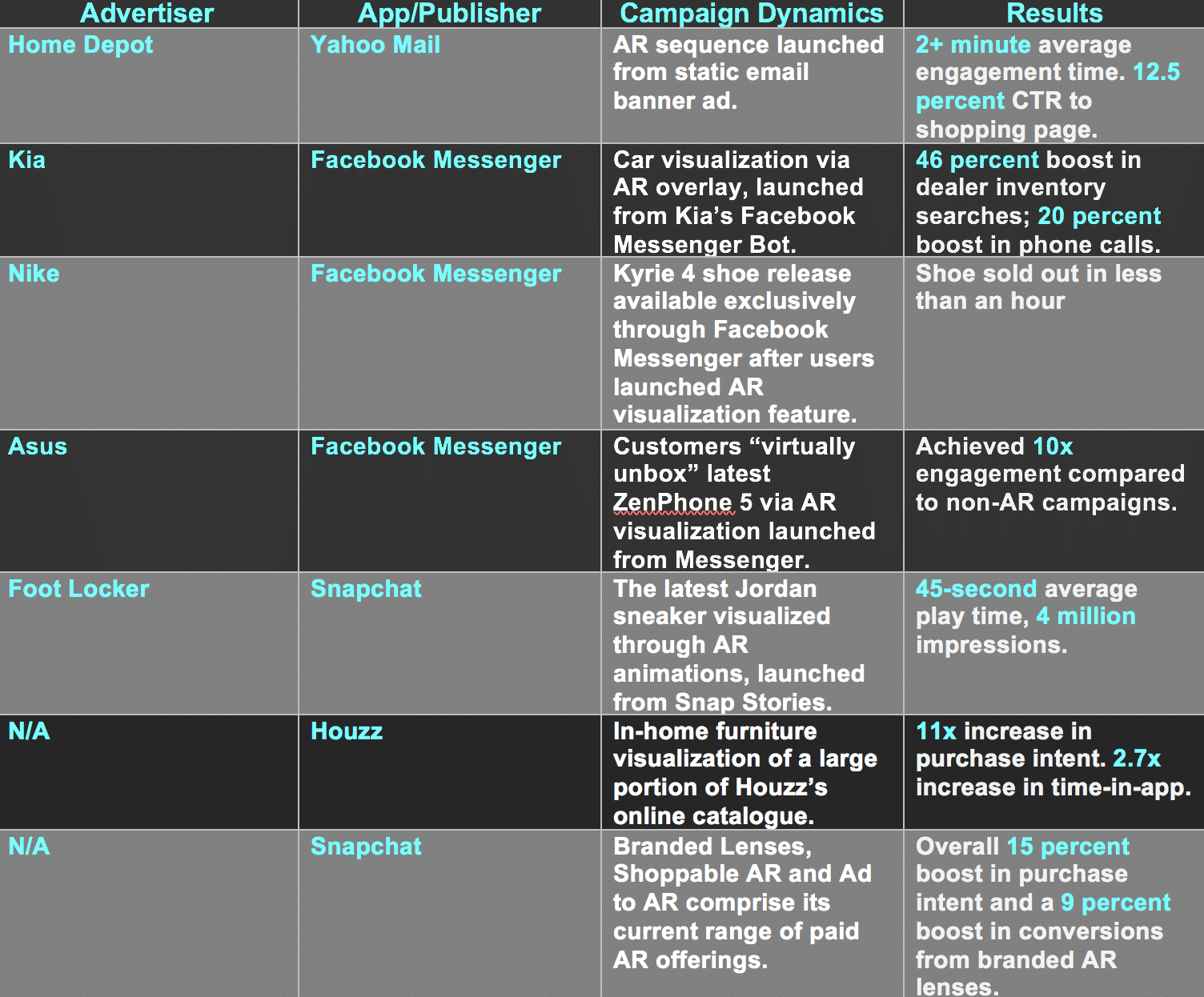

We’re seeing signs that AR can reach “television-sized” audiences. But before going into that, it should be noted that regardless of reach, there are strong performance metrics from AR ad campaigns. We wrote an entire report about it, and our boiled down chart can be seen below.

Now back to the question of reach, niche status continues to be disproven as Snapchat and Facebook offer huge audiences for AR lenses. The latest comes from Snapchat which announced in its most recent 10Q filling that there were 700 million AR lenses viewed on New Year’s Eve.

Of course, that’s not a typical day as it’s ripe for social sharing and digital activity (selfie masks, party hats, etc.). But there’s a strong longitudinal signal in that it’s a 40 percent year-over-year increase. User demand is growing along with lens creation in a flywheel-like dynamic.

Adding to seasonal or event-based AR marketing is Gatorade’s previous 160 million impressions for its Superbowl AR Lens. Again, that’s not a typical day but it’s directionally relevant and one could even argue more challenged by an oversupply of visual stimulus on that day.

And there are other similar campaigns to point to. Since our report, we’ve tracked AR lens campaigns including Nike’s Michael Jordan-themed lens around NBA all-star weekend, and a separate Lebron James-themed lens activated by Snapcode. Both were from Snapchat.

In fact, Snapchat is the revenue share leader in AR advertising due to its head start. But Facebook will catch up and eventually exceed Snapchat due to it’s larger global user base (1.5 million global mobile users), operational scale and its ongoing investment in the Spark AR platform.

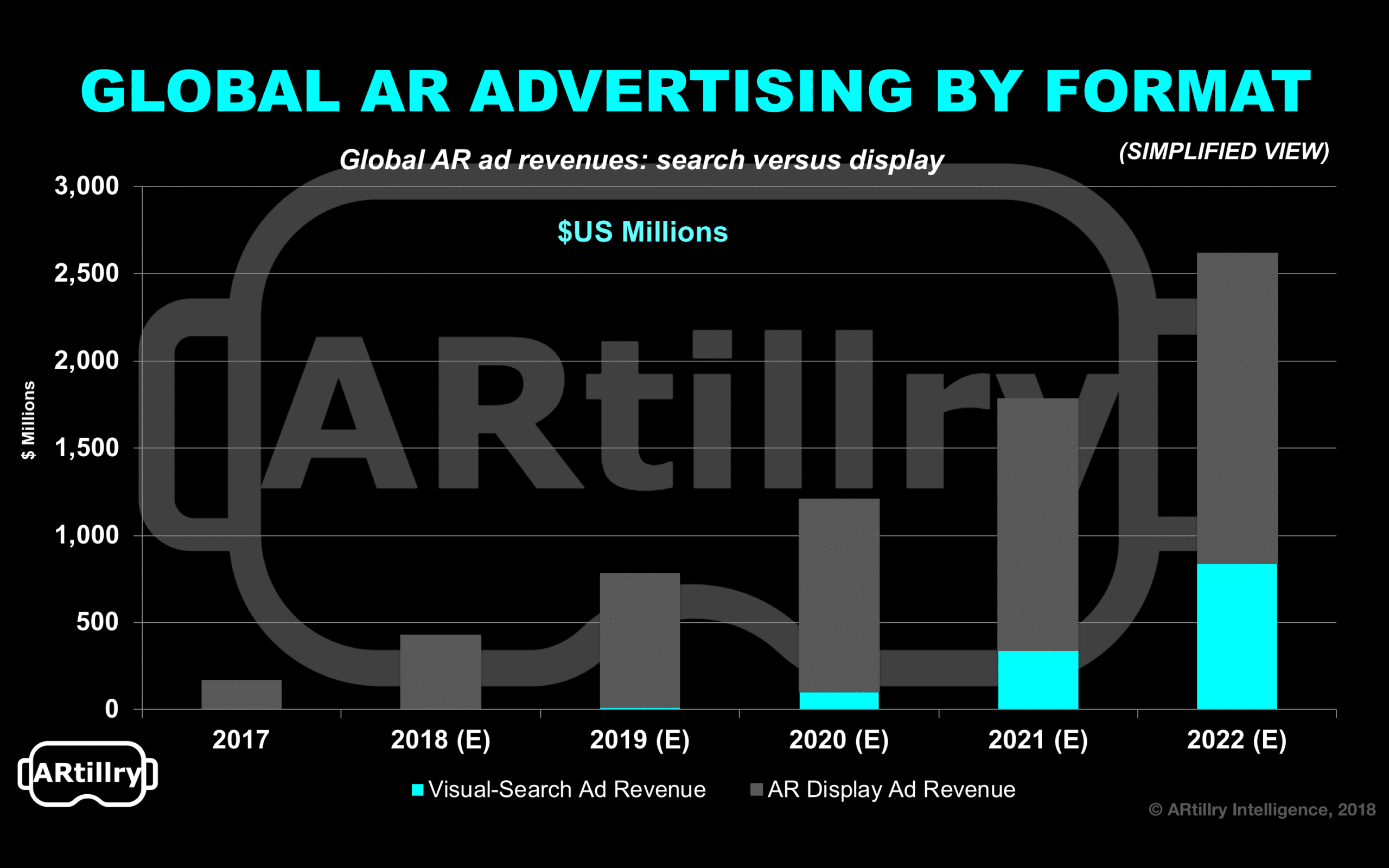

Panning back, we’ll also see the AR ad world mimic the broader ad world. In other words, just as we have digital display and search advertising, AR will evolve into the same dichotomy. And like digital advertising history, display will come first, followed and eventually exceeded by search.

The latter takes form in tools like Google Lens and VPS. The reason they come later is more technical complexity (computer vision, AI, etc.) for visual search. But when Google nails it — and it’s well on the way — it will be more valuable due to pull-based user intent (just like search).

Back to AR display (lenses), the above campaigns add to a growing list of confidence signals. We’re going to have to continue updating the table above (or make a more dynamic version), but that’s a good thing. Due to the aforementioned advertiser misconceptions, education is key.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.