![]() “Behind the Numbers” is AR Insider’s series that examines strategic takeaways from the original data of its research arm, ARtillery Intelligence. Each post drills down on one topic or chart. Subscribe or login to access the full library of data and reports.

“Behind the Numbers” is AR Insider’s series that examines strategic takeaways from the original data of its research arm, ARtillery Intelligence. Each post drills down on one topic or chart. Subscribe or login to access the full library of data and reports.

Like many analyst firms, one of the ongoing practices of AR Insider’s research arm ARtillery Intelligence is market sizing. A few times per year, it goes into isolation and buries itself deep in financial modeling. The latest such exercise zeroes in on mobile AR revenues.

This takes the insights and observations accumulated throughout the year and synthesizes them into hard numbers for spatial computing (see methodology and inclusions/exclusions). It’s all about a strong forecast model and lots of rigor in assembling reliable inputs.

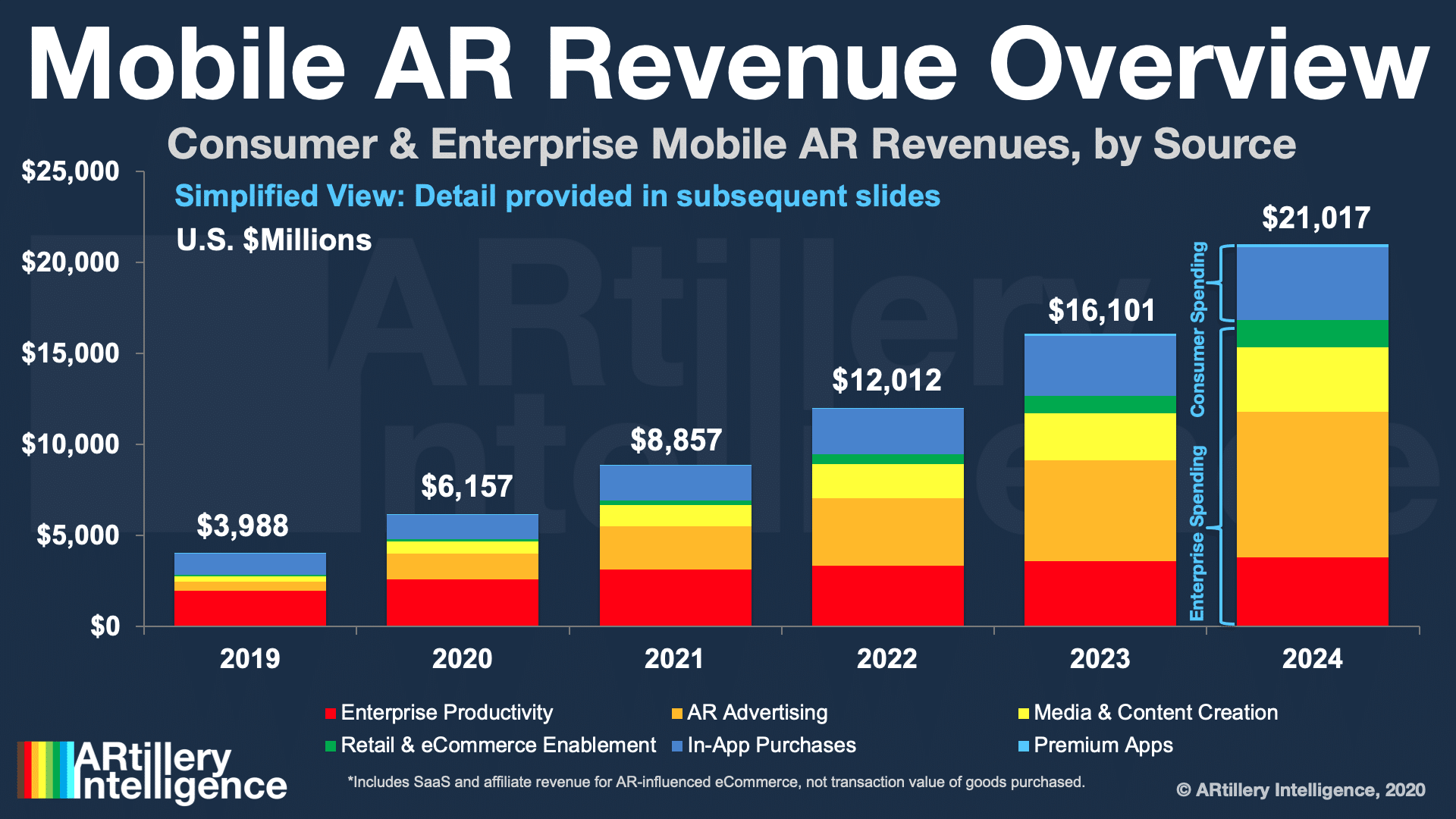

So what did the forecast uncover? At a high level, global mobile AR revenue is projected to grow from U.S. $3.98 billion in 2019 to U.S. $21 billion in 2024, a 39 percent CAGR. This sum consists of mobile AR consumer and enterprise spending and their revenue subsegments.

Camera Marketing

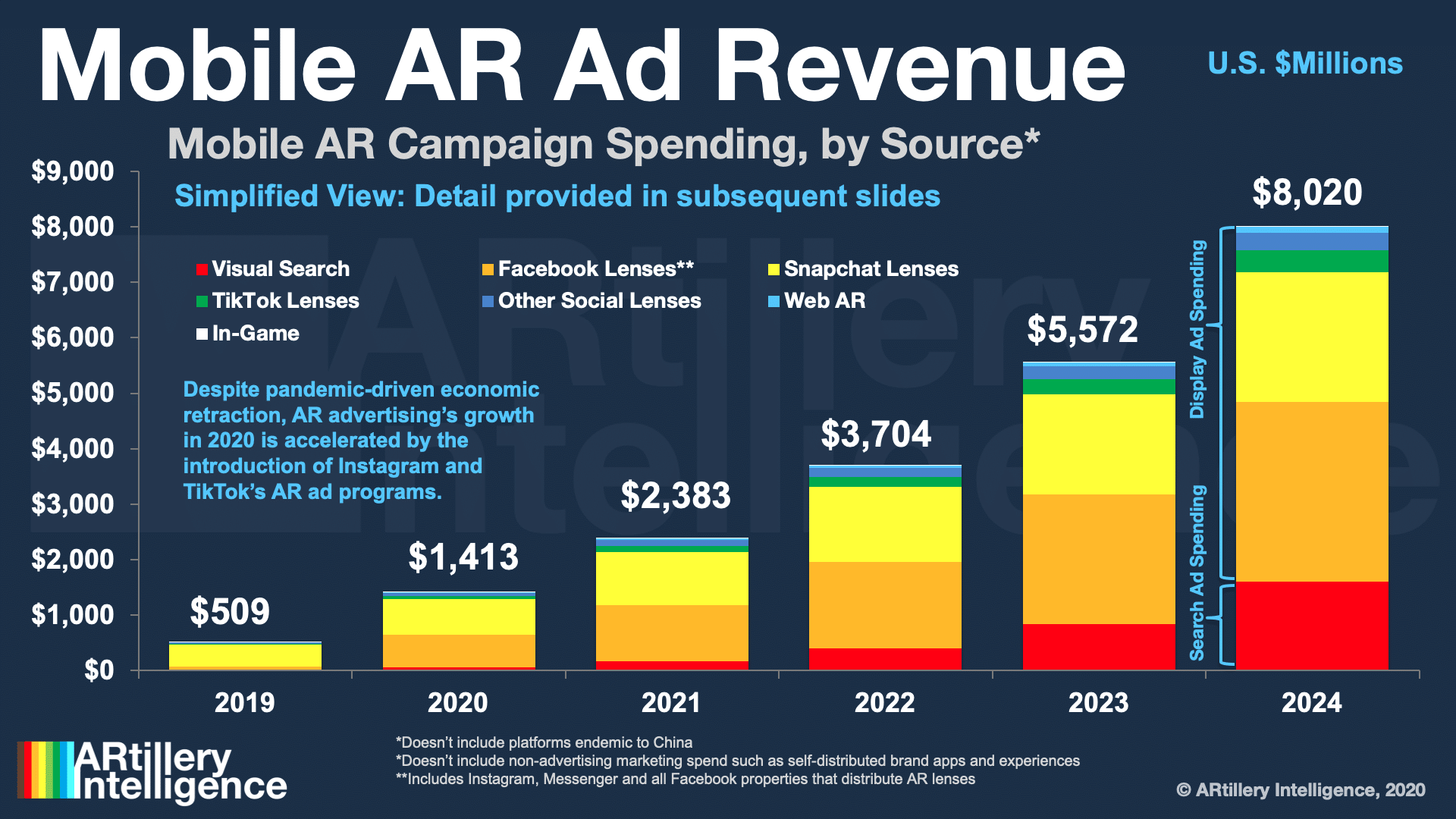

Taking just one segment of this forecast, we’ll focus today on advertising — one of mobile AR’s leading revenue subsectors. ARtillery Intelligence projects it to grow from $509 million in 2019 to $8.02 billion in 2024, a 74 percent compound annual growth rate (see below).

This spending consists of paid AR ad campaigns, while growth is driven by advertiser interest in immersive product visualization. As we examined earlier this week, this resonates with their creative sensibilities, while also carrying a strong business case through high-performing ads.

In terms of formats, AR lenses lead, including face filters from Snapchat, Instagram and others. Snapchat is the revenue leader (see below) despite Facebook’s greater global scale. This is driven by Snap’s camera-company focus and execution as well as its camera-forward user base.

Snapchat will maintain this ad revenue lead for any one app. However, ARtillery Intelligence projects Facebook will surpass it when adding up all its properties including Instagram. TikTok is the wild card, with rapidly growing usage but underdeveloped AR and geopolitical uncertainty.

Beyond the AR lenses, visual search will gain ground in later years. Led by Google Lens, visual search’s appeal will be driven by a utilitarian and high-frequency use case (like web search). Its “pull-based” high-intent orientation also makes it naturally monetizable (like web search).

Elephant in the Room

The elephant in the room in all of the above is a global pandemic. As is the case across the global economy, mobile AR sectors will be impacted unevenly by ongoing global lockdowns. Given that software mostly fares well in shelter-in-place life, the impact on mobile AR will be mostly positive.

For example, quarantine-friendly consumer AR like social lenses are trending up; and social distancing compels enterprise remote-AR support. These factors will boost near-term adoption while exposing the technology… which in-turn supports its longer-term sustained adoption.

But when it comes to advertising, one thing counteracting the above factors is the fact that this is a famously recession-prone spending category. In the end, AR ad revenues will grow in 2020, but estimates have been adjusted down at a slower rate than was projected pre-pandemic.

Long-term, mobile AR advertising could ultimately benefit as recessions cause advertisers to rethink and redeploy budget to more effective and cost-efficient formats. That forced perspective could expose AR’s virtues as an ad medium and accelerate its long-run adoption curve.

Stay tuned for more forecast tidbits and insights over the coming weeks. Meanwhile, find out more about the market-sizing methodology or access the entire thing here. There will be lots to unpack as the AR market unfolds and brings us expected and unexpected outcomes.