AR continues to prove itself as a shopping tool. It can help consumers visualize products on “faces and spaces,” to make better-informed decisions. This is amplified during a pandemic when it can bring back some of the product essence and dimension that’s lost in retail lockdowns.

On the “sell side,” AR likewise resonates with brands and retailers. On one level, it appeals to their creative sensibilities — erstwhile stuck in 2D media — to demonstrate products in their full 3D glory. On a more practical level, they’re seeing real results from AR-based campaigns.

All of this continues to be validated in case studies and figures we track from AR-forward eCommerce leaders like Shopify. In fact, we recently rounded up several AR shopping performance metrics in a Data Dive article like this one. These proof points continue to roll out.

To continue that narrative, another angle to the story needs to be told. Beyond performance metrics in the aggregate, how do consumers actually feel about AR shopping? Are they asking for it? Are they comfortable with it? Answers to these questions can help to extrapolate demand.

Temperature Reading

Jumping right into the data, we’ve rounded up several data points that indicate consumers’ sentiments towards AR shopping for this week’s Data Dive. Here they are in no particular order.

— Accenture reports that 50 percent of consumers have better brand recall through immersive ads, and 47 percent say they feel more connected to products.

— Nielsen reports that 51 percent of consumers are willing to use AR for shopping, scoring higher than other emerging shopping technologies such as retail self-checkout (44 percent).

— Hubspot reports that 75 percent of shoppers expect AR experiences from retailers.

— Snapchat reported a 2.4x lift in consumer interest for shoppable AR lenses during Q3 2020.

— A Harris Poll survey on behalf of Threekit reports that 60 percent of U.S. adult respondents who shop online are more likely to buy products shown in 3D or AR.

— A GetApp survey reports that 65 percent of consumers surveyed are comfortable using AR as a shopping tool.

— According to consumer research firm, Gfk, 68 percent of consumers are familiar with AR shopping and 25 percent plan to use it in the next year. This scored higher than other emerging shopping tools such as smart speakers (23 percent) and subscription services (21 percent).

— In a survey from IoT software company Arm, 58 percent of consumers say they’re extremely or very likely to buy AR devices designed for everyday use such as shopping. The figure shoots up to 79 percent for respondents aged 16-24.

— According to Parks Associates, consumers familiar with AR prefer it for price comparison overlays (48 percent) and product reviews (39 percent).

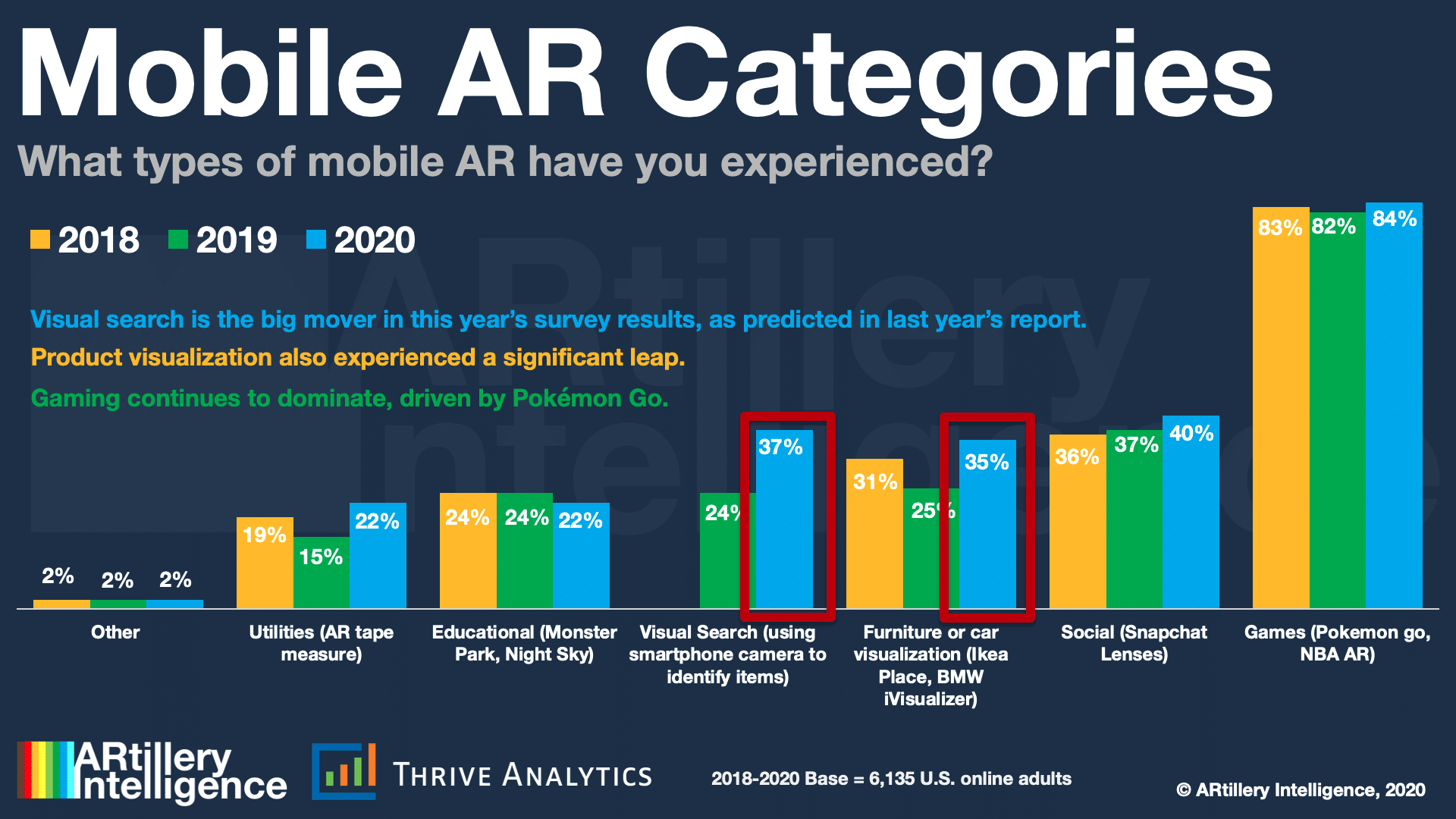

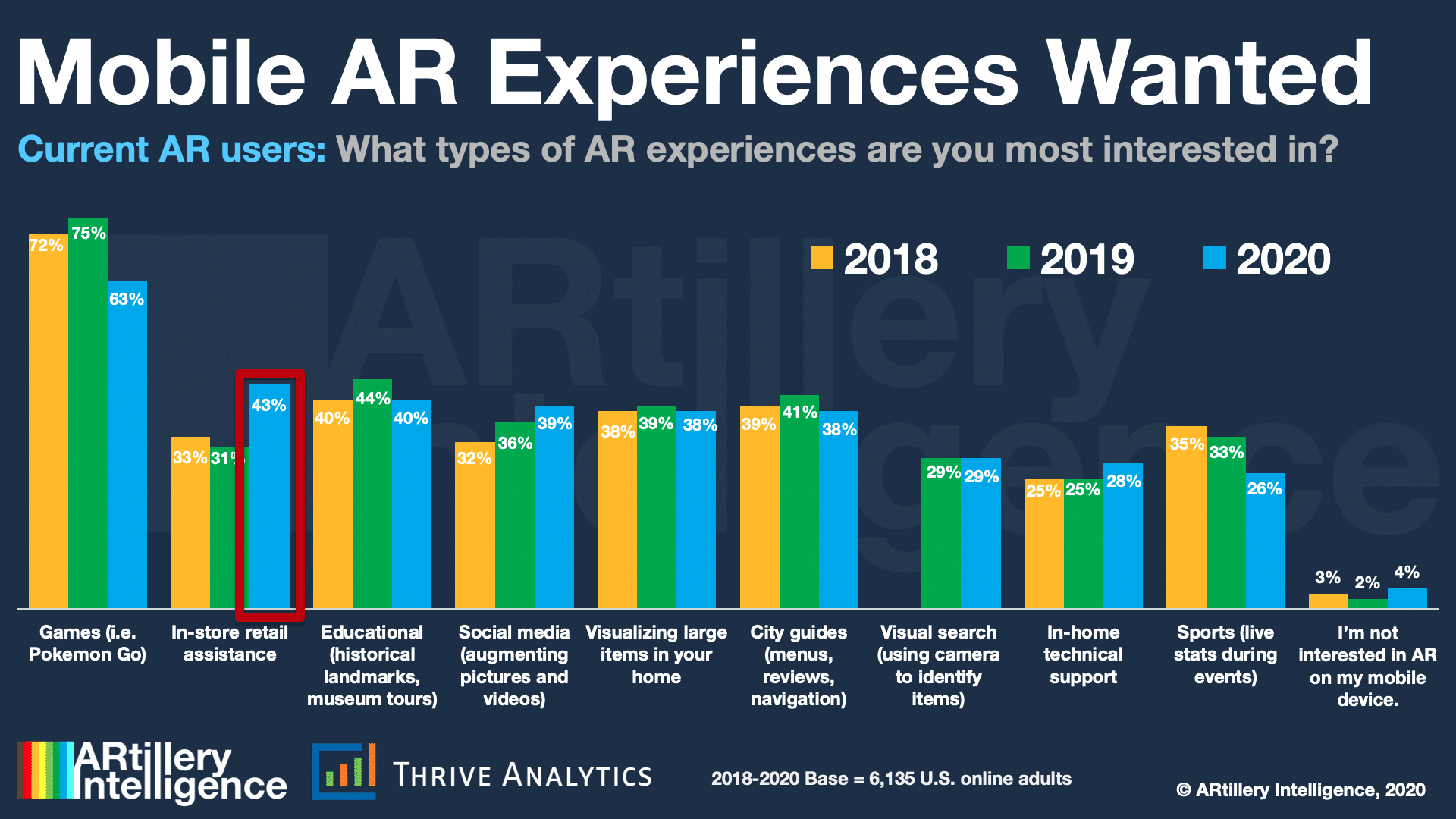

— Lastly, consumer survey data from our research arm, ARtillery Intelligence indicate year-over-year growth in both current and aspirational use for mobile AR shopping (click charts to expand).

Exposure Effect

The data points above have a range of sample sizes, survey wording and focal points. But there’s a directional trend towards comfort and demand for AR shopping. That includes “faces & specs” visualization as well as visual search to contextualize products with one’s smartphone.

Acclimation to AR shopping will also accelerate as Snapchat continues to cultivate rear-facing camera lenses. This shifting use case could bring Gen-Z shoppers with it — offering a broader canvas for a wider range of products, beyond sunglasses, lipstick. and other selfie fodder.

Lastly, to circle back to an earlier point, the value that AR adds to e-commerce is evident in normal times. But it takes on new meaning during Covid-era retail lockdowns when the value of visualizing products remotely is amplified. It brings some dimension back to shopping.

That dynamic is clear, but it’s unclear what will happen next. Will the tools discovered during this period create permanent habits through a “mere exposure effect?” If so, it could bode well for AR’s sustained use in a post-Covid world, and its continued rise as a shopping utility.