VR appears to be in the midst of a rebound. Covid-inflicted supply-chain impediments caused shipments to decline an estimated 10 percent in 2020, but that could have been worse if not for Quest 2’s Q4 performance. We’ve also seen a strong overall start for VR in 2021.

We continue to compile evidence to that effect. But going one level deeper, what market signals can serve as formula inputs to estimate Quest 2 unit sales specifically? As the current propellant for VR’s gradual mainstream penetration, Quest 2 sales can reveal key market insights.

So it’s time once again for our ongoing exercise to extrapolate unit sales. Each time we do this, formula inputs vary — everything from Facebook first-party software sales disclosures to public filings that help reveal sales volume and growth within Facebook’s “other revenue” category.

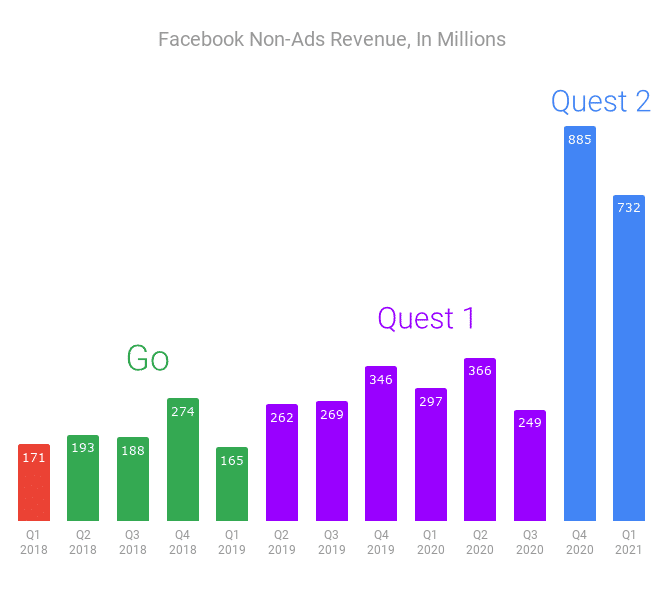

Today, we’re drawing upon the latter — the primary source being Facebook’s Q1 earnings call disclosure that its non-advertising revenue grew 2.5x year-over-year to $732 million. CFO David Wehnert specified that this growth was “driven by continued strong Quest 2 sales.”

With that scene-setting, let’s dive in.

Six Figures

Facebook’s Q1 non-advertising revenue — where Oculus revenues are categorized — were $732 million. As noted, the company specified during its earnings call that Oculus sales were a major growth driver. That’s of course a general statement but we can zero in using other signals.

If we look at Facebook’s non-advertising revenues pre-Oculus, it was a slow-growth quarterly revenue stream of about $250 million. If we estimate the non-Oculus portion today — consisting of Portal and few other things — to be $300 million, that leaves $432 million for Oculus.

By “Oculus,” we mean hardware and software. If we extract the latter, we can isolate the former. We’ve separately estimated average software spend per user to be $125 (3-7 games). That’s about 28 percent of Oculus’s overall ARPU ($454), given $299-$399 hardware.*

That makes hardware revenue $311 million of the above $432 million. Based on other evidence, we estimate that Quest 2 is 90 percent of that — the rest being accessories and end-of-life Rift sales. That yields $279.9 million, or 850,759 Quest 2 units, at an average price of $329.*

Boiling it all down…

((($732,000,000 – $300,000,000)(1-.28)(.90)) / $329) = 850,759 Q1 Quest 2 units

*Quest 2 base model (64GB) is $299 while the 256GB model is $399. This averages out at $349, but we’ve reduced the estimated hardware ARPU to $329 due to weighted sales for the base model (common for new hardware). Third-party reseller markups aren’t included.

Flywheel Effect

One thing you may notice from Facebook’s revenue growth chart above is that non-advertising revenue declined from Q4 2020 to Q1 2021. Quest 2 sales likewise declined on a quarter-over-quarter basis, given our March estimate of just over one-million units sold in Q4.

There’s a good reason for this: the holidays. The calendar Q4 (aligned in this case with Facebook’s fiscal Q4) is friendly to consumer hardware. This is also why you usually hear revenue growth framed in year-over-year comparisons, as it’s a more apples-to-apples view.

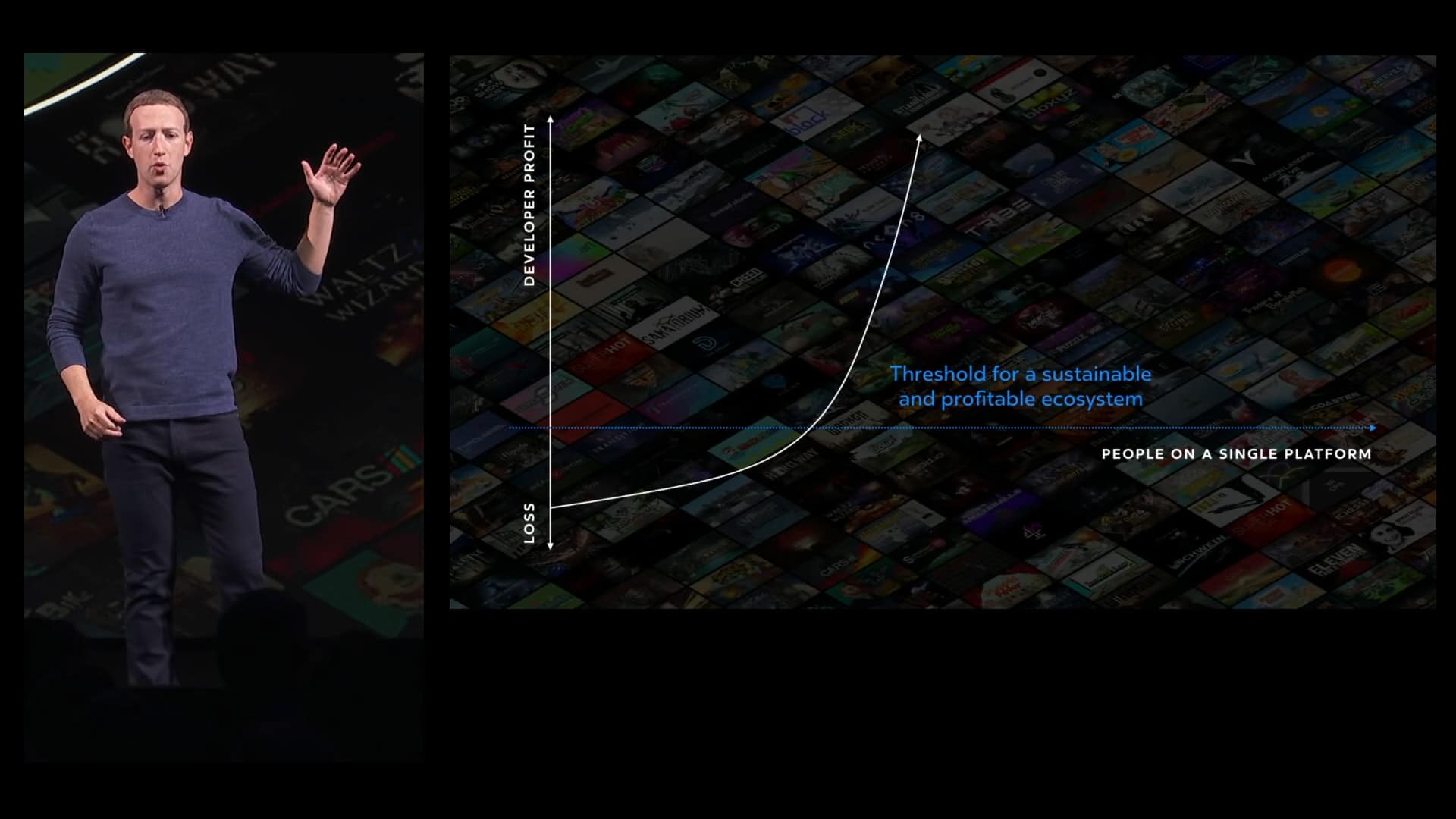

As for cumulative Quest 1 & 2 sales (a.k.a. installed base), we now estimate that at 2.87 million units. This gets Facebook closer to Mark Zuckerberg’s target of 10 million units — the magic number where there’s critical mass to attract content developers en masse.

The thought is that an eight-figure installed base presents financial incentive for developers to flock to a given platform like osmosis. That engenders greater content libraries that attract more users, which in turn attract more developers and around we go. It’s a classic flywheel effect. Mop

As Zuckerberg stated on Facebook’s Q4 earnings call:

”The big question is what is it going to take for it to be profitable for all developers to build these large efforts for VR? To get to that level, we think that we need about 10 million people on a given platform. That’s the threshold where the number of people using and buying VR content makes it sustainable and profitable for all kinds of developers. And once we get across this threshold, we think that the content and the ecosystem are just going to explode. Importantly, this threshold isn’t 10 million people across all different types of VR. Because if you build a game for Rift, it doesn’t necessarily work on Go or PlayStation VR. So we need 10 million people on [one] platform.”

1.5-Year Plan

At its current pace — informed by the above estimates — Facebook could get to 10 million units in about six quarters or 1.5 years. Keep in mind that 10 million references a cumulative installed base of in-market units, which is different than (and builds faster than) period unit sales.

We’ll keep watching closely as this progresses. Though Facebook doesn’t disclose hardware sales, there are clues and formula inputs all around us for thought exercises like above. It’s also possible that Quest 2 sales reach a point soon that compels Facebook to boast exact figures.