Sometimes it pays to be on Twitter. Amidst all the noise and political vitriol (depending on whom you follow), there can be real moments of AR discovery. Combine that with the fact that the AR developer community is highly active on Twitter, and you can encounter some real gems.

A good example of someone you should follow for this reason Daniel Beauchamp. As AR/VR lead at Shopify, he’s launched many side projects to test the bounds of AR development platforms. And then there’s the mad-scientist stylings of Lucas Rizzotto and several others worth following.

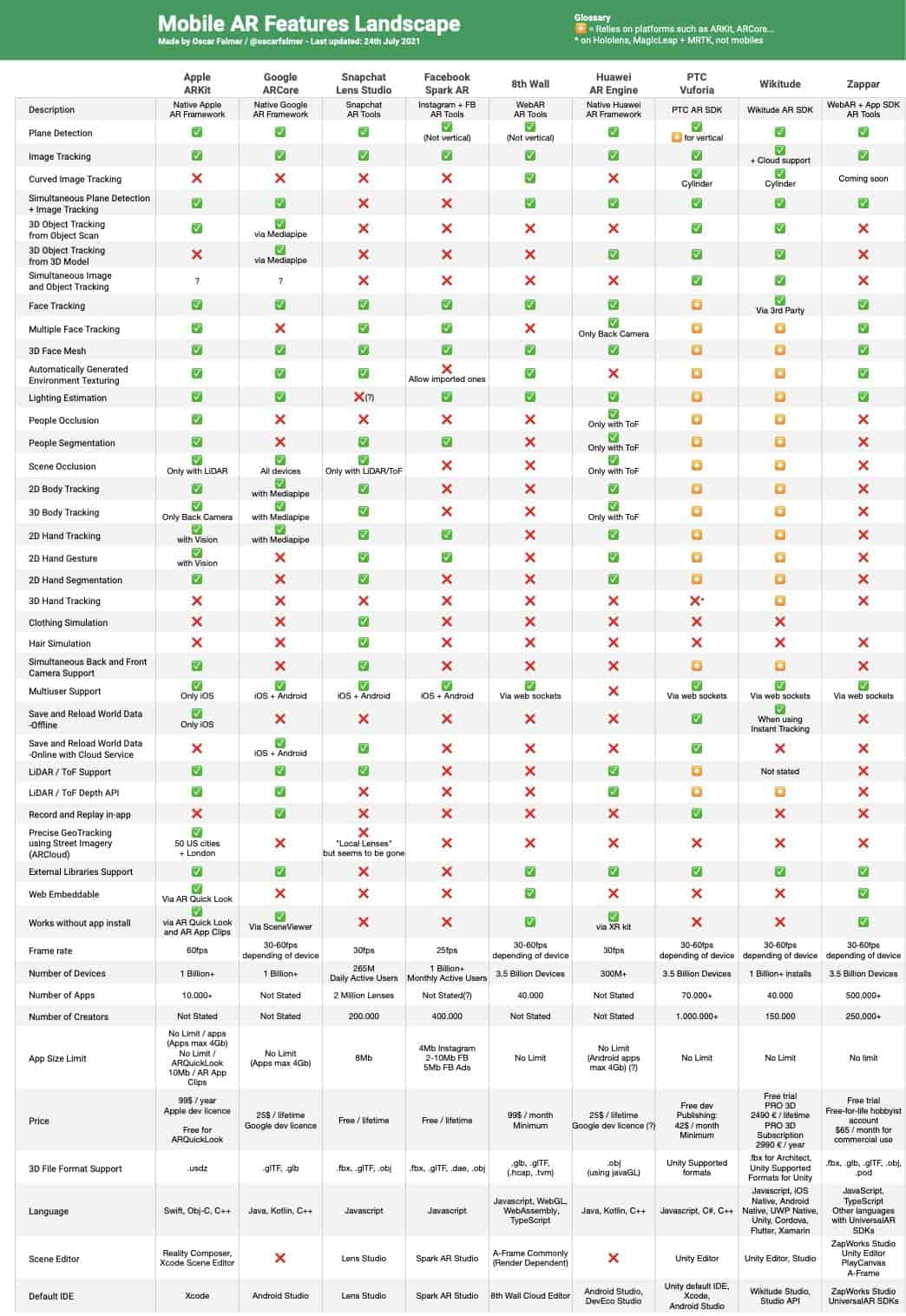

Our latest moment of AR discovery came from AR developer and evangelist Oscar Falmer (via @tomemrich). In this case, it wasn’t an AR creation but a data resource: he’s built a comparative table of mobile AR platform capabilities. As such, we’re spotlighting it for this week’s Data Dive.

Biggest and Best

So what were his findings? You can skip right to the chart below (or Falmer’s live version) to pour over the many platform comparisons. Meanwhile, we’ll break down the things that jumped out at us and, more importantly, Falmer’s own takeaways. Let’s start with the latter…

First, Falmer points out to us that Apple and Snap have the biggest and best feature sets, and are noticeably ahead of competitors on that measure. To us, this partially traces back to the follow-the-money principle, as both companies are highly motivated to build AR businesses.

Drilling down on social AR, Snap’s Lens Studio’s AR functions compare favorably against its chief competitor, Facebook Spark AR. As we’ve examined, this is largely a function of Snap’s AR focus and investment; it’s a primary North-Star that has concrete ties to revenue growth.

But in fairness to Facebook, it has more AR users, partly due to it’s greater global reach. It’s now up to 600 million monthly active AR users (MAUs). Snap meanwhile has about 200 million daily active AR users. Translating the latter to MAU’s (apples to apples) yields around 355 million.

Data Dive: Facebook Reaches 600 Million AR Users

Vertical Integration

Moving on to native app platforms, ARKit is ahead of ARCore. That goes for both features (noted above) and for platform reach. Though Android is inherently larger than iOS in global penetration, its ARCore subset trails ARKit in terms of device compatability (a.k.a. installed base).

To break that down a bit, our research arm ARtillery Intelligence pegs ARKit’s hardware base at 1.25 billion compatible units — almost full coverage of the iOS universe and phasing in fast. Android is conversely at 851 million compatible devices, which is about 30 percent coverage.

These coverage figures can be explained by Apple’s vertical integration. It has a handful of device models, all of which it manufacturers. Android is a fragmented mix of devices as an open platform for OEMs to build on. That enables Google to achieve scale as an OS….but it cedes control.

Back to qualitative measures, ARKit surpasses ARCore in several areas like people oclusion, hand segmentation and others. Here again, we point to organizational priorities and focus. AR is an organizational priority for Google….but not as great as its favored-nation status at Apple.

Mobile AR Users Approach 800 Million

Gaining Ground

Meanwhile, what about Web AR? One thing that jumps out as a surprise is 8th Wall’s performance on Falmer’s chart, trailing in some areas. After closer examination, this makes sense as 8th Wall is building on an inherently different — and more challenging — AR vessel: the mobile browser.

In reaching 3 billion global smartphones, 8th Wall has a balancing act to achieve wide reach among a fragmented hardware base, yet maintain platform standards and common denominators. This inherently means that it won’t stack up to native app platforms on some counts.

Additionally, a large segment of 8th Wall’s constituency is brand marketers. There, the name of the game is branded AR experiences that are lightweight, easy to launch and fun… as opposed to graphically intense. In fact, web delivery precludes the latter, as Web AR’s playbook indicates.

Meanwhile, 8th Wall continues to boost capabilities to catch up to native AR apps. The latest can be seen in its Release 17 which introduces AR portals among other things. Before that, Release 16 boosted SLAM accuracy and frame rates, while its developer profiles breed community.

We’ll put a period there and point you to the full chart to dig into your own findings. The above only scratches the surface and doesn’t go into key platforms like Wikitude and Zappar. Let us know what jumps out at you. Pro Tip: see the live version with ongoing updates from Falmer.