“Behind the Numbers” is AR Insider’s series that examines strategic takeaways from ARtillery Intelligence original data. Each post drills down on one topic or chart. Subscribe for access to the full library and other knowledge-building resources.

Many of us agree that XR will be transformative. But it’s a matter of when and how much. So ARtillry Intelligence ventured to quantify the revenue outlook in more precise terms. The result is our latest XR revenue forecast. This week we examine the enterprise VR portion.

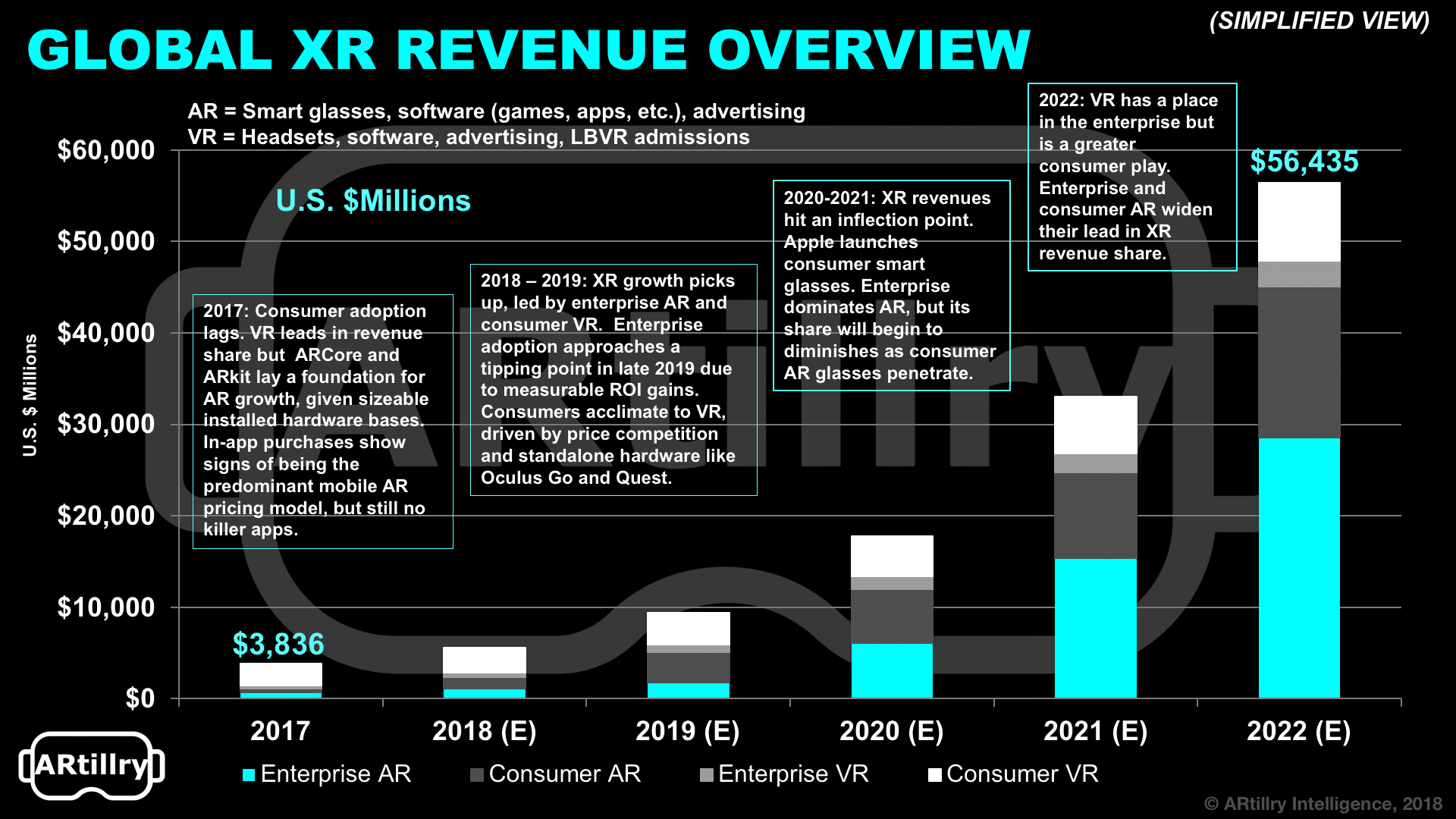

But before we do that, what’s the overall XR revenue outlook? We project it to grow from $3.8 billion in 2017 to $56 billion in 2022. That includes AR, VR, and enterprise and consumer segments of each. Those are then subdivided by hardware, software and advertising revenues.

So where’s that money going? The largest sub-sector is enterprise AR, which will comprise roughly 51 percent of all XR revenues by 2022. That has a lot to do with the scale achieved through wide applicability across enterprise verticals; and a form factor that supports all-day use.

Heads Up

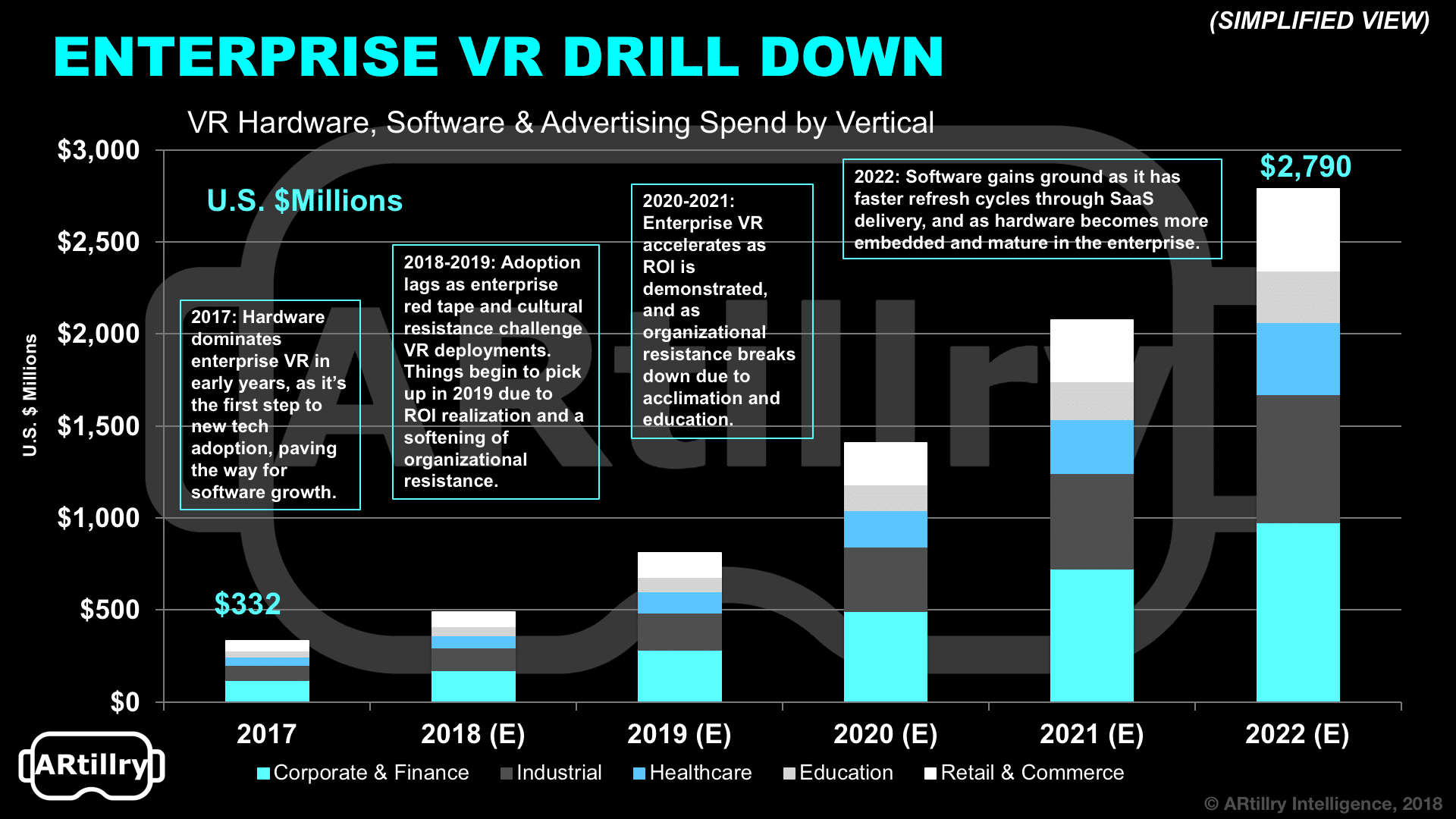

But that contrasts enterprise VR which will be opportune but much smaller than enterprise AR, due mostly to its isolation that inhibits industrial job functions. We project it to grow from $332 million in 2017 to $2.79 billion in 2022, a 55 percent compound annual growth rate (CAGR).

Though strong in its own right, it will hold the smallest share of XR revenues among the sub-sectors measured in this forecast. VR will be stronger and have greater scale as a consumer play, while AR is stronger in the enterprise due to more versatility and applicability.

These VR shortcomings (relatively speaking) in the enterprise stem from the medium’s inherent isolation, which inhibits some job functions and share of time per working day. This is especially true in industrial functions where “heads up” awareness is critical, and where AR will shine.

Seeding a Market

However, VR will excel in corporate and finance settings, such as employee training and data visualization. These functions play to VR’s strengths. VR’s industry/vertical segmentation also hinges on the size of the addressable market, applicability, adoption impetus and spending power.

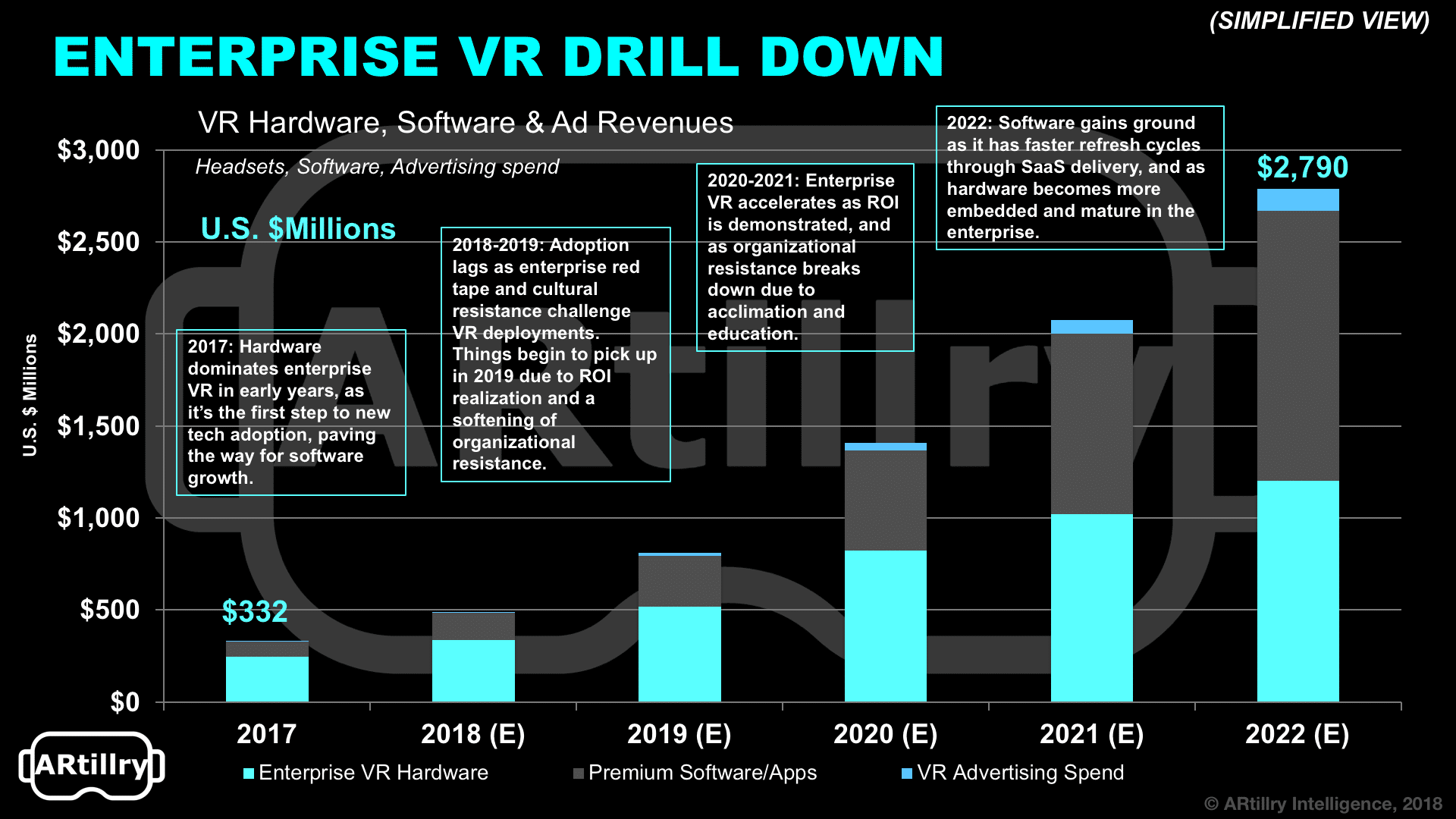

Like AR, VR’s near-term enterprise revenue will be hardware-dominant in the near term as it’s the first step in enterprise tech adoption. But software will gain share over time. As often, hardware creates an installed base for software, which will then dominate enterprise AR in outer years.

The other reason hardware share slows while software accelerates is replacement cycles. Enterprise hardware will mature as it’s established in the enterprise, with replacement cycles outpaced by software refresh rates. The latter will likely be sold in a SaaS manner.

But unlike AR, which will have specialized hardware for enterprise functions, VR will utilize common hardware (the same hardware used in consumer contexts). The availability, evolution and economics of that increasingly penetrated VR hardware will be an adoption accelerant.

Most of the above relates to VR’s role in operational support, such as manufacturing. But it’s also worth noting the enterprise spend for VR advertising. There, we’re pretty bearish on near-term revenue impact (see chart above), due to scale and ad inventory deficiencies.

This will all be a moving target and the above just scratches the surface. Stay tuned for more data slices from this forecast, which we’ll unpack in the coming weeks. Subscribe for the full report and preview more of it here, including methodology and breakdowns of what’s included.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.