ARtillery Briefs is a video series that outlines the top trends we’re tracking, including takeaways from recent reports and market forecasts. See the most recent episode below, and past installments are here.

There are several forms of monetization developing around augmented reality. For example in the past, we’ve examined opportunities for AR’s role in everything from advertising (consumer facing) to industrial productivity (enterprise-facing). These and other business models continue to evolve.

One especially promising area of AR is influencing and fulfilling consumer purchases. We’re talking graphical overlays that inform consumers or demonstrate product attributes while shopping. This is the topic of the latest ARtillry Intelligence report and Briefs episode (below).

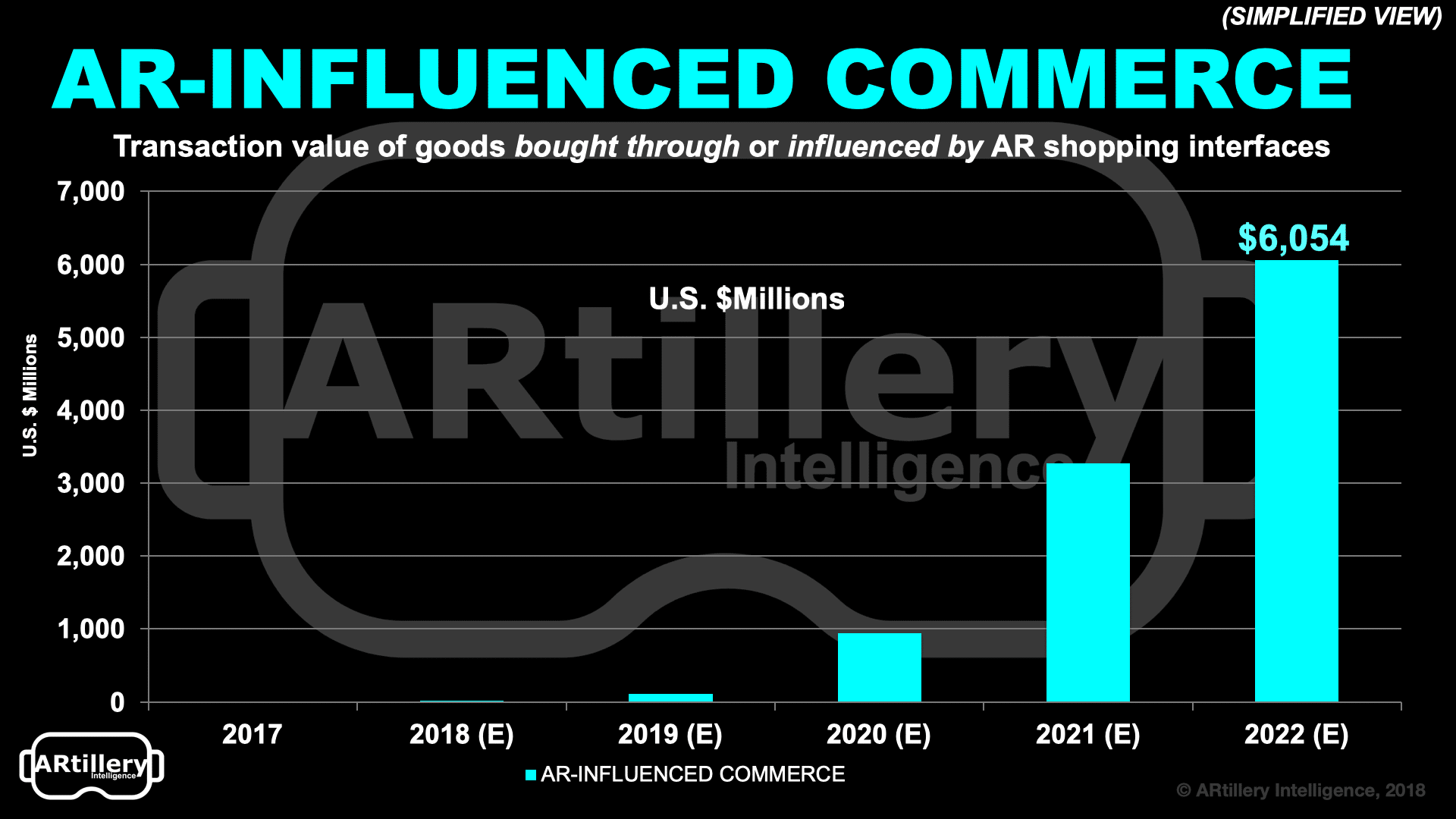

Setting this apart from AR advertising, AR commerce is the next step in the consumer journey involving product visualization that includes the ability to buy a given product. Specifically, we project that $6.1 billion in consumer goods will be purchased through such interfaces by 2022.

Search What You See

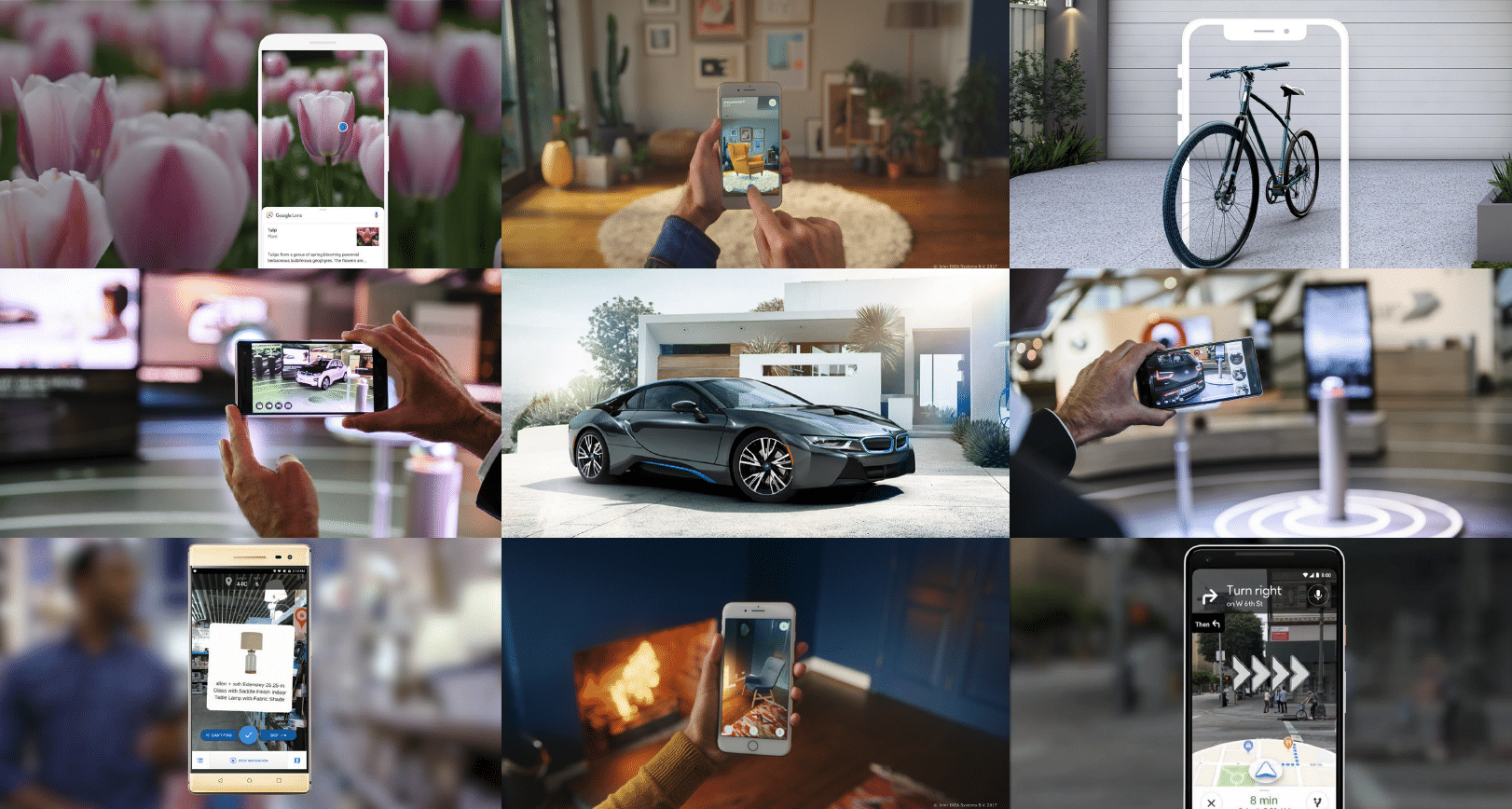

There are two ways this is materializing: visual search and product visualization. Visual search utilizes the smartphone camera and computer vision to identify and contextualize items. Visualization does the opposite, placing product mockups in one’s space to understand them.

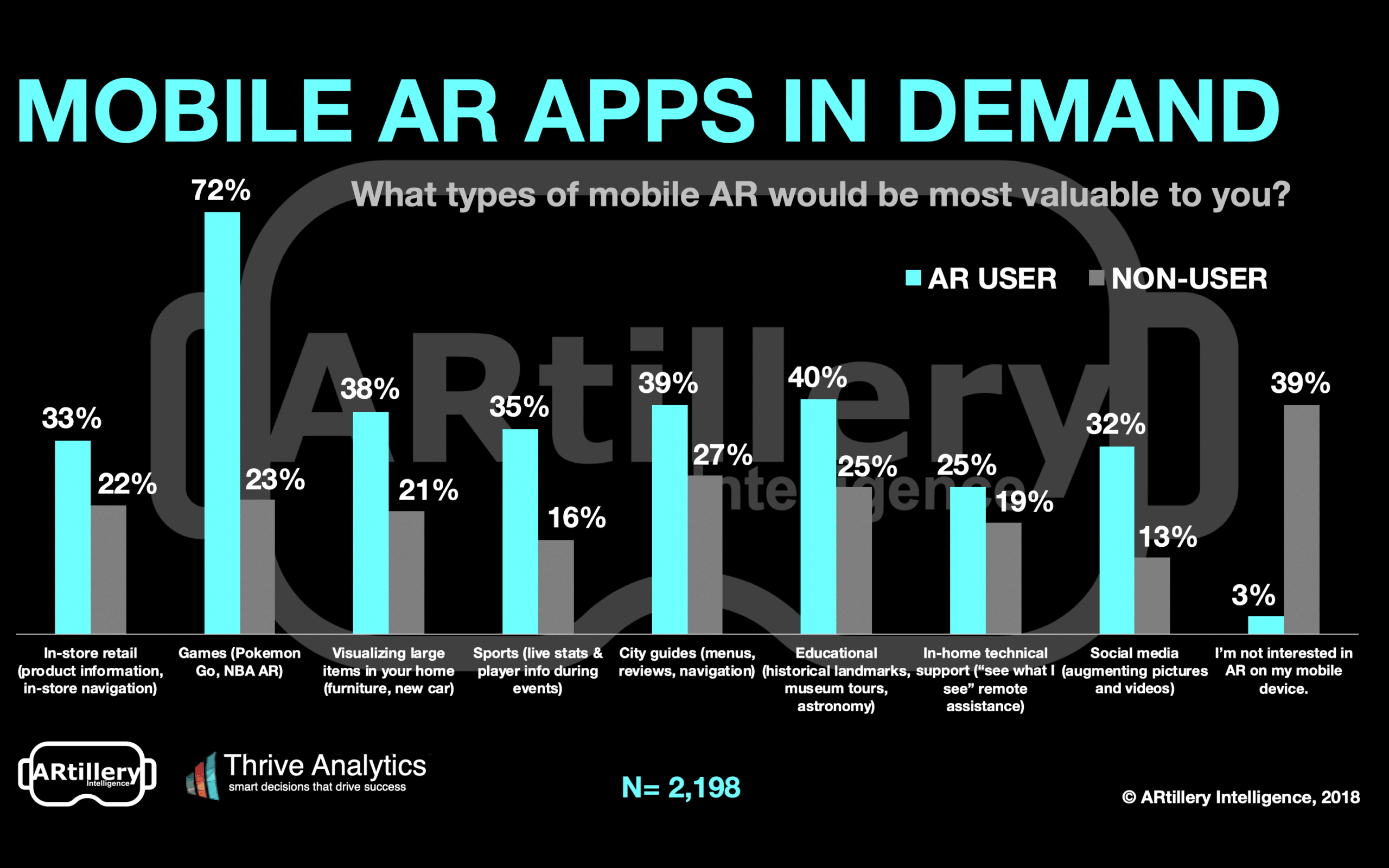

Starting with visual search, it will inherit the benefits and revenue potential of online search. That includes high-intent user queries to get information about items you point your phone at. Currently, one-third of users see this as a valuable shopping utility according to our survey data (see below).

This can happen in retail environments such as store aisles, using apps from retailers like Walmart and Lowes. It can also be outside of retail, where tools like Google Lens can identify a broader range of objects you may encounter in the real world. The latter is where the scale is.

Google is in fact best positioned here, given its search index, knowledge graph and image database. And Google, being Google, will eventually monetize a subset of those searches that are product based, which it sees as a strong corollary to its core search business.

Informed Purchase

On to product visualization, it’s likewise an opportune area. Houzz reports that its product visualization boosts conversions by 11x and consumer spend levels by almost 3X. BMW reports that 25 percent of its iVizualizer app starts go on to an online car configurator.

This customer journey from visualization to conversion makes it a rare “full funnel” medium which will attract brands. And as you can tell by the above examples, it excels with bulky and costly items like furniture and cars, which require a more informed purchase and consumer confidence.

But to make this all happen we need 3D assets to bring all those products into AR. Leaders so far like BMW and IKEA have done this in-house, but what the market really needs is a standardized and scalable AR asset creation engine. We believe this will be one of XR’s biggest opportunities.

Other success factors include building true utilities that move beyond novelty. Killer apps could be mundane but useful “all day” AR experiences with broad capabilities, like Google Lens. And “AR as a feature” is a strong positioning strategy, versus forcing users to download standalone apps.

The underlying takeaway is that transformation in retail, a.k.a “retailpoloypse,” means that winners and losers will continue to map to tech adoption. That’s been underway for the past few years and will be accelerated by AR and visual technologies that are a natural match for consumer shopping.

Those are just a few of observations and strategic implications. You can see more in the full report including lots of case studies from Walmart, BMW, Shopify and others. The coming months and years will move quickly for AR commerce and we’ll be watching closely for best practices.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.