XR Talks is a series that features the best presentations and educational videos from the XR universe. It includes embedded video, as well as narrative analysis and top takeaways. Speakers’ opinions are their own.

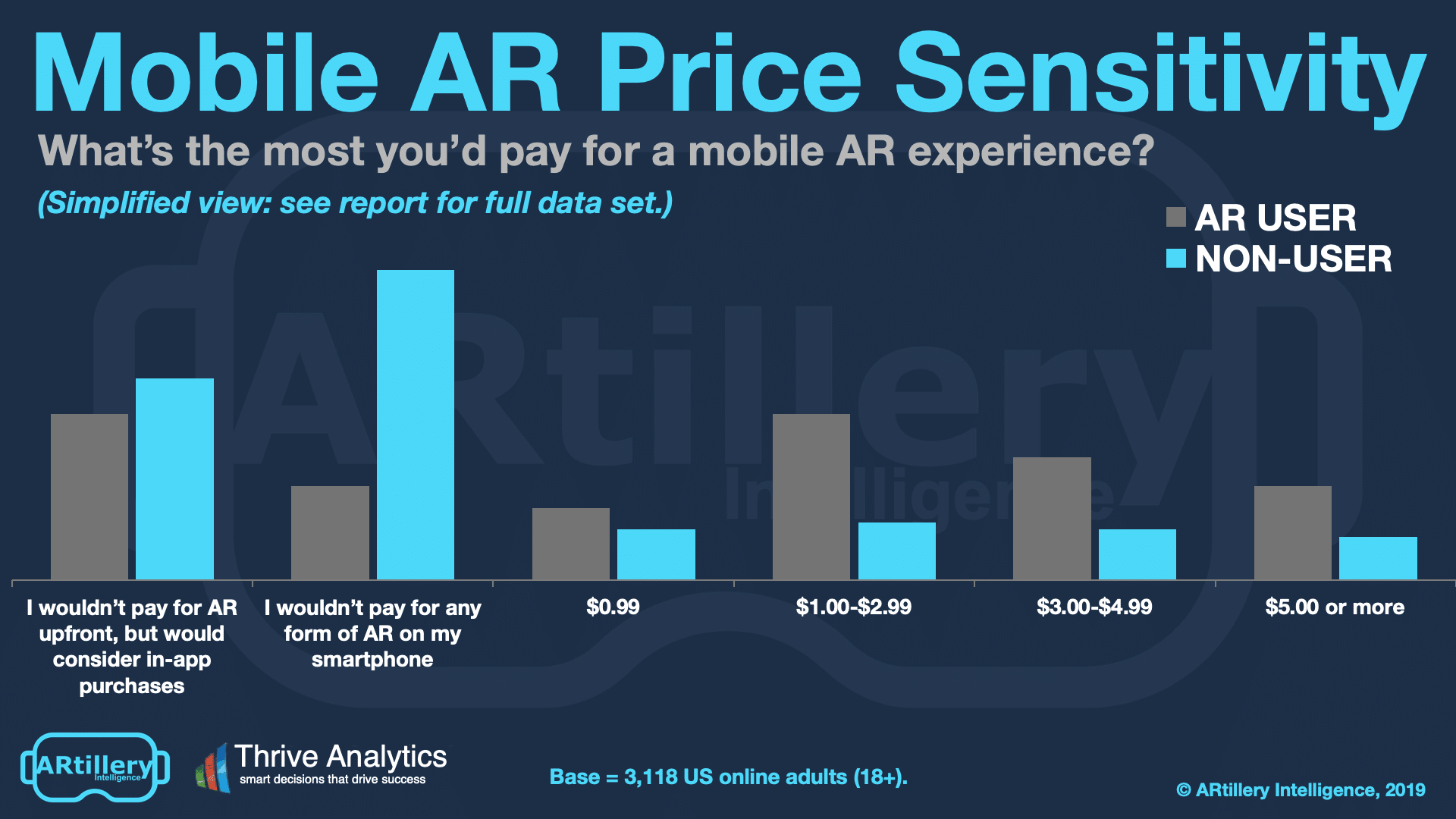

AR’s early stages are defined by lots of experimentation to see what works natively in this new medium. That goes for product design as well as business models. What do consumers want and how much are they willing to pay for it? Our survey data answers some of those questions.

Questions are also being answered by AR pioneers like Snap and Niantic, who are operating at scale. And by scale we mean occasionally Superbowl-sized audiences, and revenue to go with it. But the key word is occasional, as these AR exemplars are the exception rather than the rule.

To make sense of all this, our research arm ARtillery Intelligence recently gave a presentation about three business models developing (and producing revenue) in consumer AR. We’ve captured the presentation in slides and voiceover for this week’s featured talk (video below).

Before we dive into the three models, what are they?

- Advertising (brands pay)

- In-app purchases (users pay)

- AR-as-a-service (b2b)

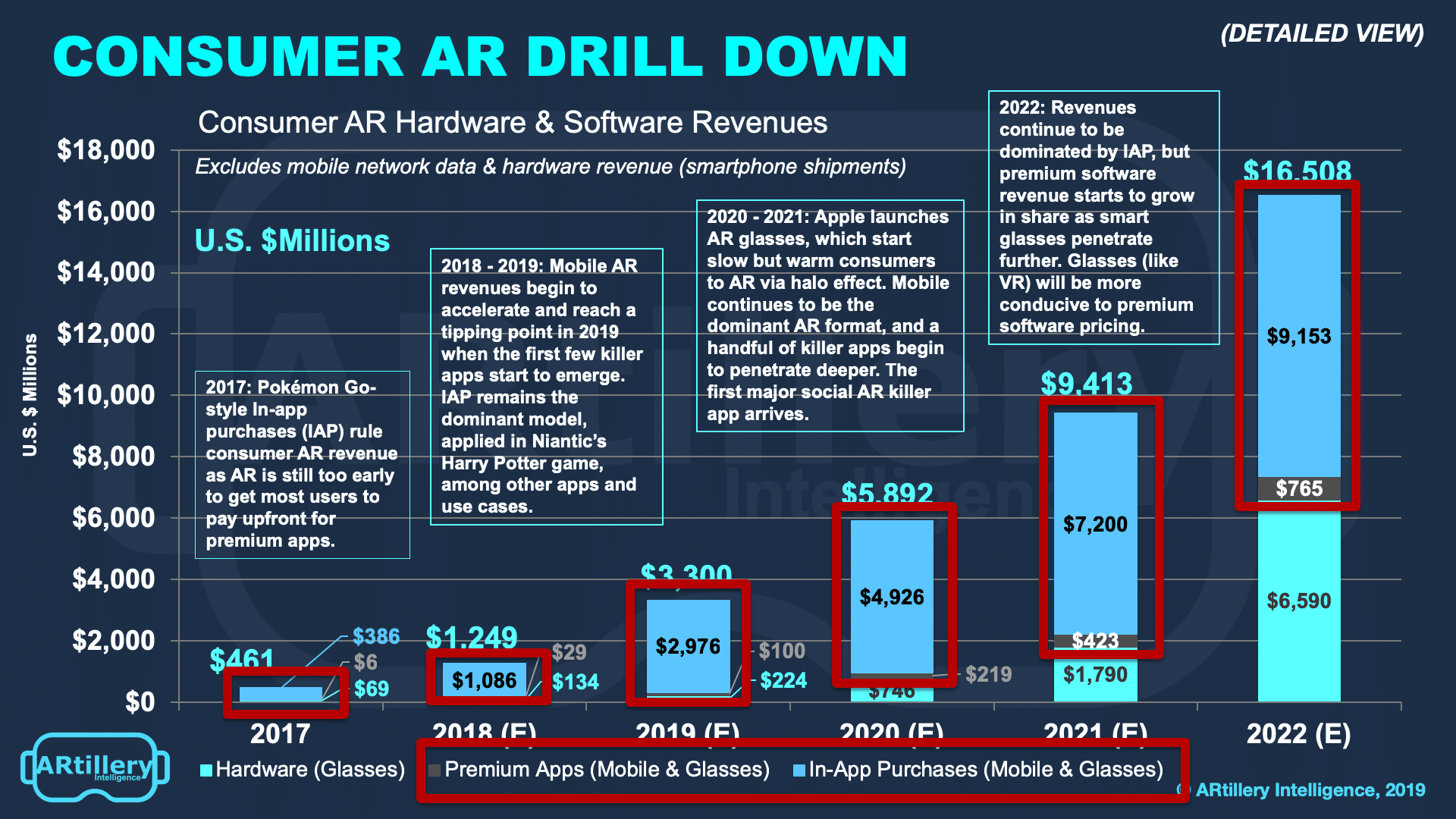

Of course there are more business models for consumer AR such as hardware sales (AR glasses). But since the name of the game today is smartphone AR, we’re highlighting the software-based models in mobile AR, and specifically those bearing fruit (revenue).

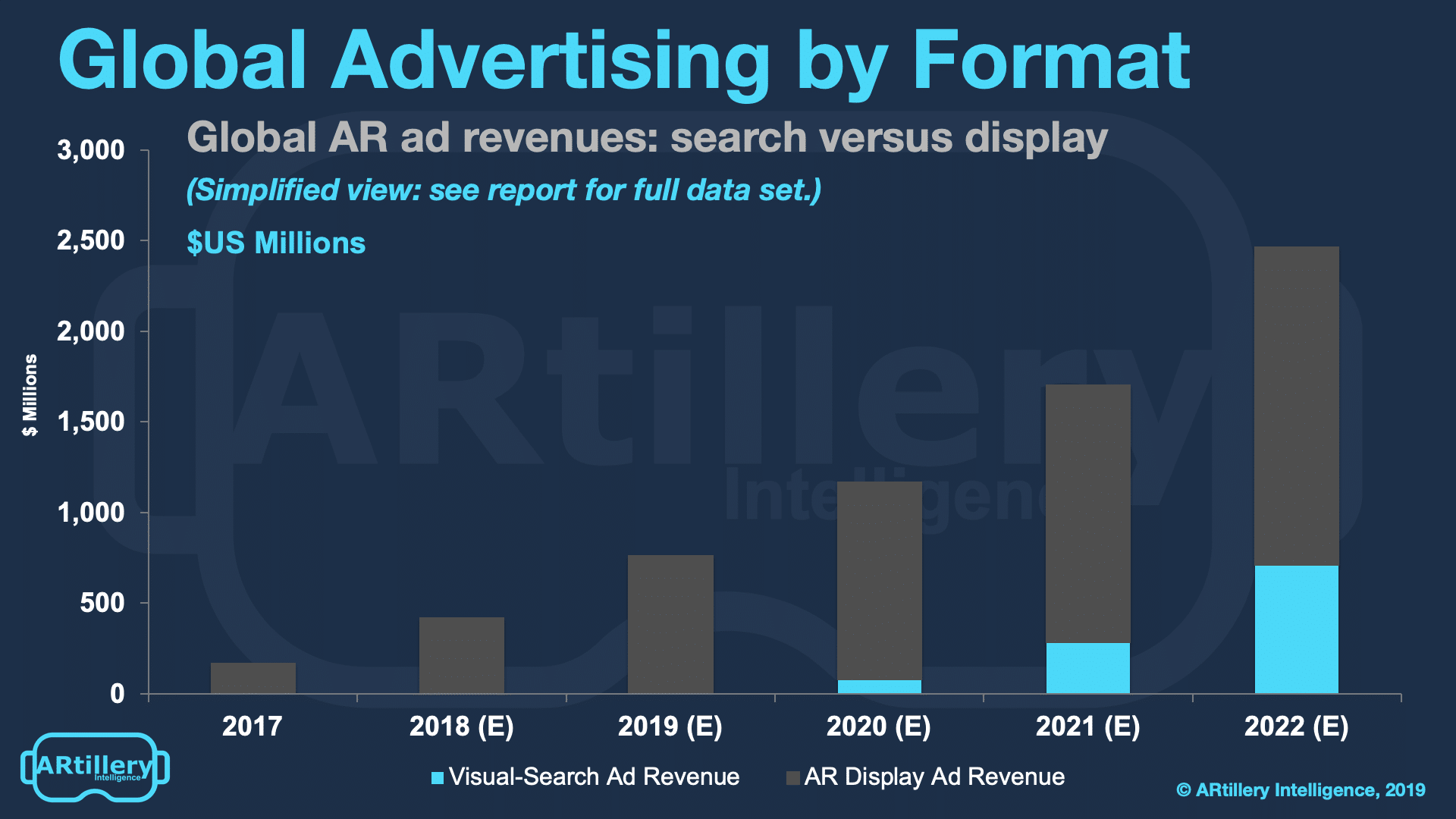

Starting with advertising, brands are really coming around to the fact that AR has inherent capabilities to demonstrate products in demonstrable ways. And it can span the consumer purchase funnel including reach-driven product/brand exposure as well as direct response.

For example, Michael Kors’ sunglasses campaign involves a Facebook News Feed ad that’s targeted based on behavior and social signals… just like any news feed ad. But it also lets you activate the front-facing camera to try on the glasses, and then buy them on the spot.

Several other campaign examples are building up and there’s lots of momentum in the brand advertising world. Seeing revenue and doubling down on it, Facebook and Snap are increasingly catering to these brands with tools to lower barriers for campaign creation and boost capability.

Based on all of this and other market tracking, ARtillery Intelligence pegs AR ad revenue at $407 million last year, growing to almost $2.5 billion by 2023. That’s mostly AR lenses per the above examples but will soon start to include the other main AR ad format: visual search.

In fact, just as the broader digital ad world is bisected by search and display advertising, AR will evolve similarly. And just like digital ad evolution, display is out of the gate first due to search’s technical complexity. But search could grow to be larger, given explicit consumer intent.

Moving on to the second business model, In-app purchases (IAP) are fitting for lots of AR experiences, especially gaming. This stems from the model’s success in mobile gaming, and its ability to maximize ARPU through the behavioral economics of micro-transactions.

But moreover, it’s fitting because AR is too early and unproven to get consumers to pay upfront for premium apps. Our survey data with Thrive Analytics clearly indicates that. And if you need any more evidence, just look at the nearly $2.5 billion in IAP that Niantic has generated.

Lastly, there’s AR-as-a-service (ARaaS). This is a much broader category, involves enabling technologies or “building blocks.” While the first model (advertising) involves brands paying and the second model (IAP) involves users paying, ARaaS serves anyone building AR products.

And what they’re paying for are tools lower friction or boost capabilities. It’s handling back-end heavy lifting or democratizing advanced AR capabilities like graphics creation or 3D rendering. These are the tool providers: the Unitys, Adobe Aeros and 8th Walls of the world.

This category’s breadth also stretches to studios and creative agencies. These are prevalent in the world of media, and have already populated the VR gaming and entertainment spheres. Next we’ll see them bloom in AR, following the lead of AR studios like Happy Giant.

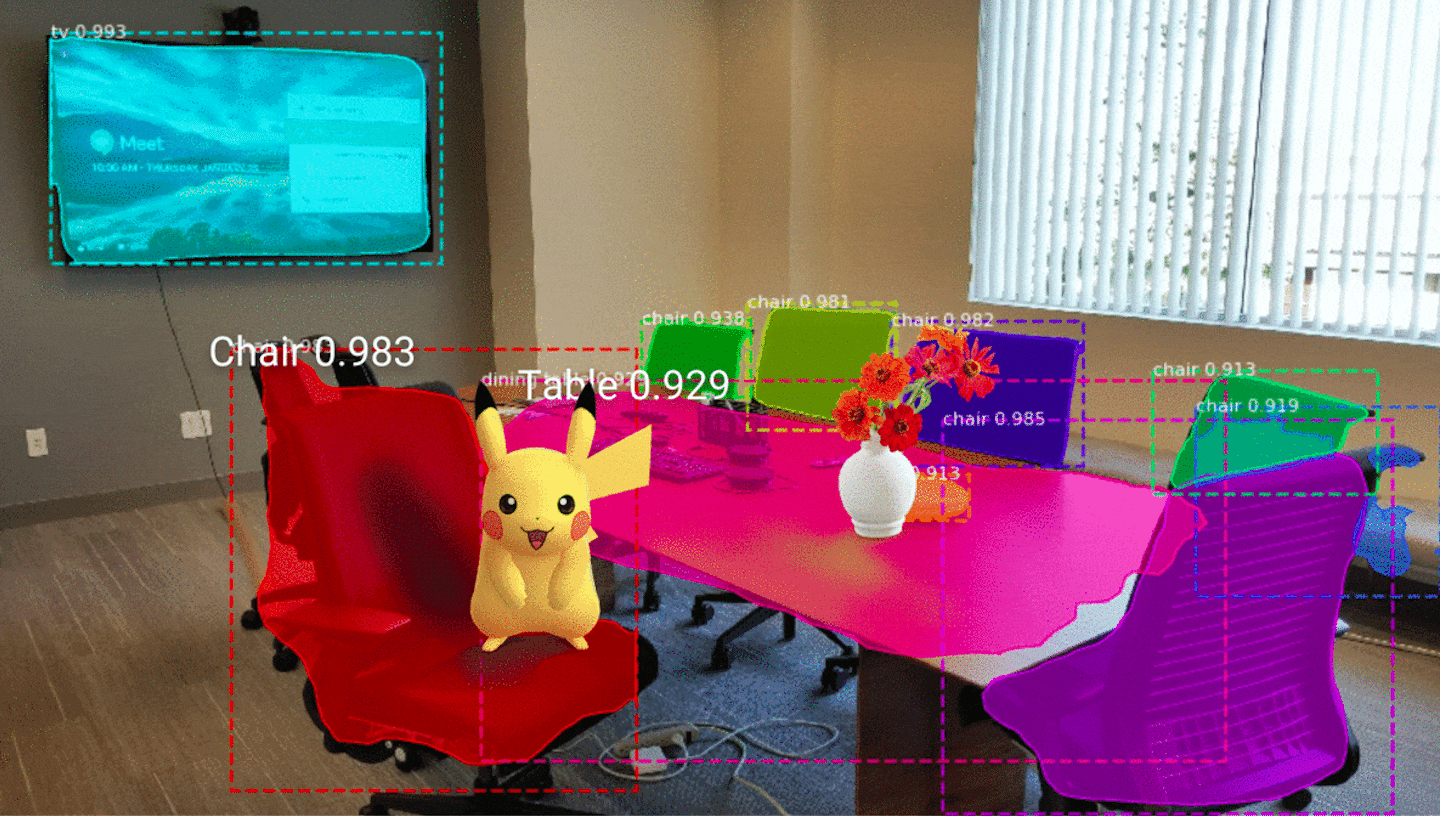

But the best example of ARaaS may be Niantic’s Real World Platform. It developed to serve the company’s own needs. That’s everything from scaling capacity for surges in use, to a geospatial engine that determines where Pokemon hatch. Now it’s spinning it out as a developer platform.

As a side note, this follows the path of one of the most successful tech products in the last decade: AWS. It similarly spawned as an internal tool to handle Amazon’s massive operational scale. Then it realized that the rest of the world needs the same variable compute capacity.

The underlying theme is that history repeats. Much of the above trends follow historical tech patterns — everything from the search/display ad interplay to the “picks & shovels” opportunity for AR-as-a-service. Of course, there will also be a fair amount of surprises and new dynamics.

This ecosystem will evolve quickly and be joined by several other business models. Just like the mobile revolution, native AR products and business models will pop up that no one saw coming, such as Foursquare, Waze and Uber. The question is when will AR get its first Uber?

See the full presentation below for more color.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.