There’s mounting evidence that social experiences lead consumer AR usage. And Snapchat, with a head start in AR lenses, in turn leads social AR. This goes for active users (key word: active), time spent and most of all, revenue.

For active users, Snapchat reported at last month’s Partner Summit that 70 percent (130 million) of its 186 million daily users activate AR lenses, and 15 billion have been viewed to date. By comparison, the other AR leader, Pokemon Go, has roughly 65 million monthly active users.

But there’s a key distinction: AR’s role in Pokemon Go isn’t primary, whereas it’s a central component of AR lenses. For Pokemon Go, AR is an element of play, the degree to which is an ongoing industry debate. AR is used an average of 2-3 minutes per Pokemon Go session.

This distinction enters the revenue picture too. People (including us) point to Pokemon Go’s $2.3 billion in cumulative in-app-purchase revenues. But all of that revenue isn’t directly attributable to AR for same reasons mentioned above. Snap’s branded AR lens revenue is conversely all AR.

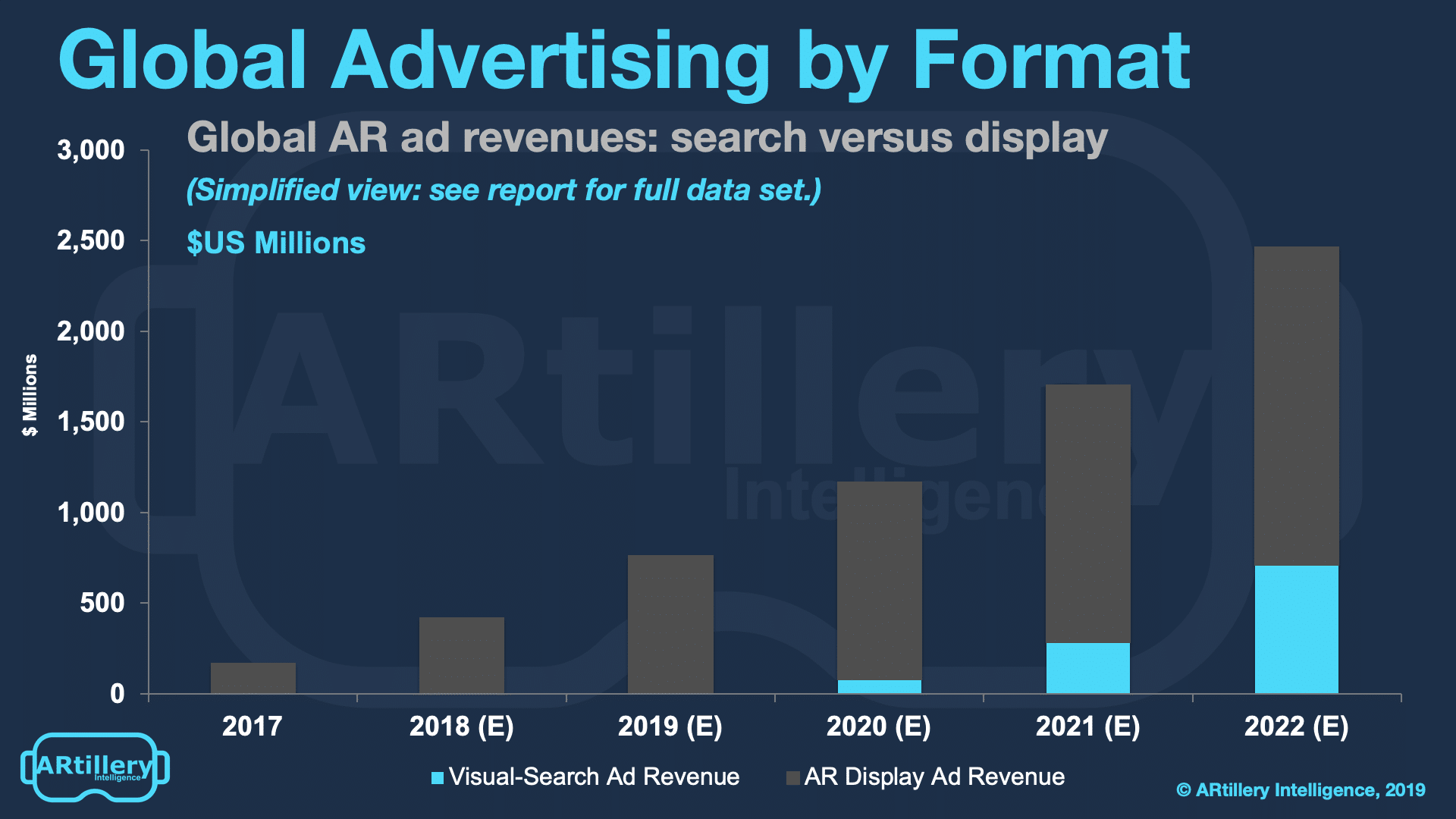

We’ve projected that Snap derived $236 million of the $408 million spent on AR advertising in 2018. That makes Snap AR’s revenue leader today if you don’t count Pokemon Go’s in-app-purchases. The total ad spend from social lenses is projected to reach $2.4 billion by 2022.

Camera-first

All of this took a step forward at the aforementioned Partner Summit where several AR features rolled out. At a high level, new functionality addresses developers, users and advertisers. In fact, the value chain goes in that order in terms of driving AR revenue for Snap.

Starting with developers, Snap has come a long way from initially keeping AR lens design in-house. With Lens Studio, it opened up lens creation to developers and thus scaled up volume and creativity. Now it’s taking another step in giving developers ammunition to create AR lenses.

That includes creator profiles that give developers a presence to promote their work and make it discoverable. There are also new templates for popular formats such as lenses that augment hands, bodies and pets. This handles the heavy computational lifting and simplifies lens creation.

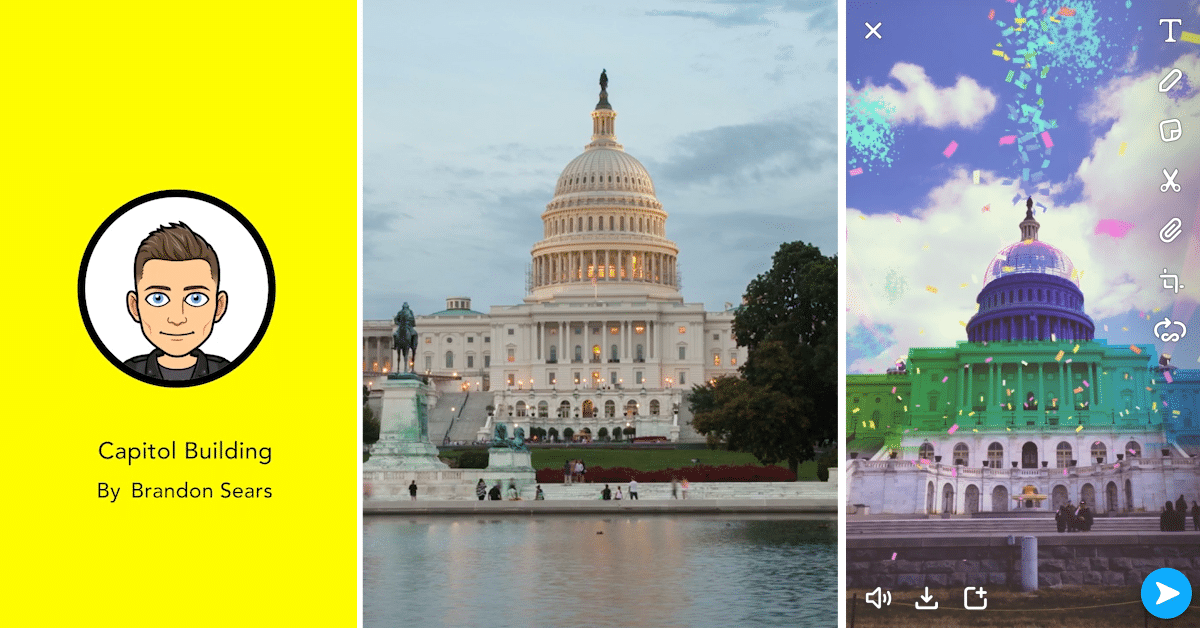

In the same spirit, “Landmarkers” templatize AR lens creation for places like the Eiffel Tower or Flatiron Building. Developers can use those templates to infuse their own creativity. Templates also mean a focused set of subjects for which they’ve nailed the AR mapping and tracking.

In other words, Snap has intelligently concentrated its efforts in a smaller subset of structures, thus sidestepping the AR cloud challenge of recognizing every building and street in the world. It instead focuses on high-traffic areas that will get the most bang for the machine-learning buck.

Solving Problems

Refined experiences like Landmarkers also translate to tighter AR for users… the second constituency mentioned above. For them, Snap is boosting capability beyond selfie lenses, to utilize the rear-facing camera to augment the world, and thus a greater range of use cases.

To be fair, Snapchat already had non-selfie AR such as World Lenses, Snapcode activations, song identification from Shazam (audio AR), and visual searches of products. The latter is a key step we’ve examined, to identify products in the real world through a partnership with Amazon.

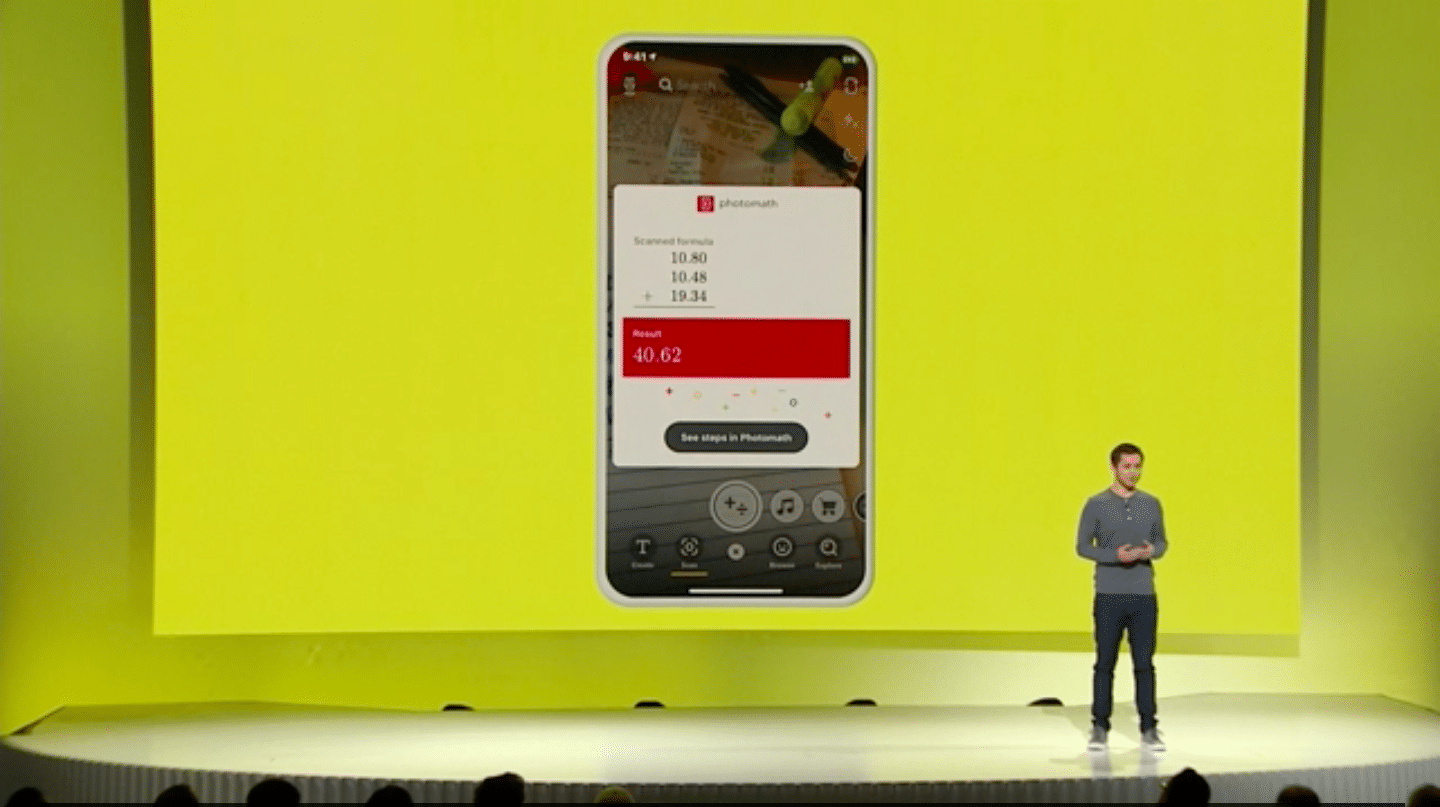

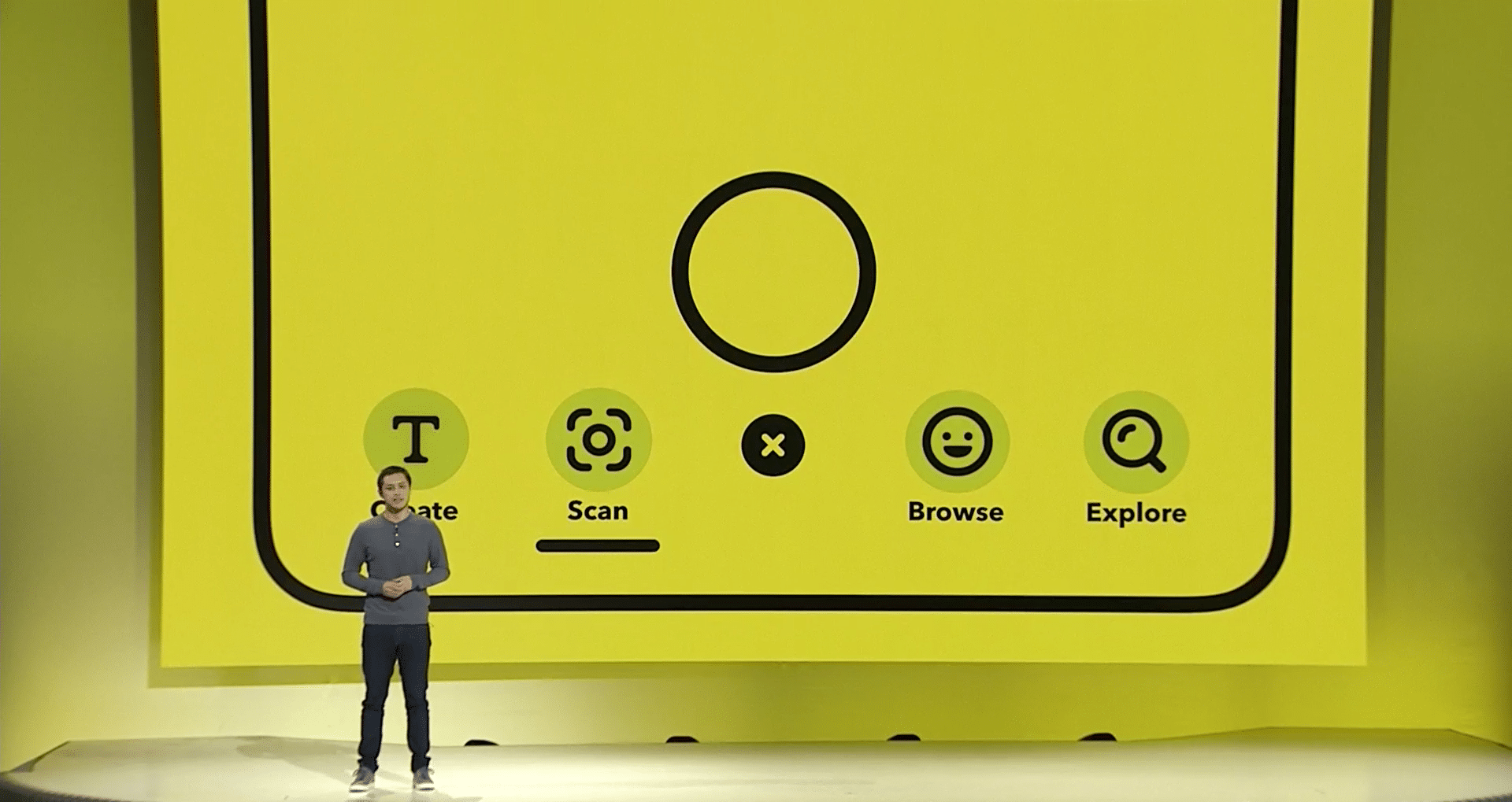

Now Snap moves to a broader range of AI-fueled AR with its Scan feature. Sort of like visual search, this uses object recognition then adds context-aware AR animations. So gifs from Giphy serendipitously animate related scenes, or math problems are scanned and solved on the fly.

The latter is perhaps the most compelling feature and combines a sort of novelty wow factor with actual utility. Snap also notably beat Google to the punch in what is a very Googley feature. Google more recently launched the Google Lens feature that adds up restaurant checks on the fly.

“Now you can scan anything, and we’ll show you the most relevant Lenses. Just press and hold the screen and we’ll show contextually relevant gifs,” said Snap co-founder Bobby Murphy. “If you’re trying to solve a math equation, we’ll help you do that with our partner Photomath.”

Growing Up

These moves extend Snap’s AR persona from selfie masks to more utilitarian functions. That’s evident in solving math problems — a lighthouse feature that will lead to other creations. As we’ve examined, mundane utilities (a la Google Lens) are where AR killer apps will germinate,

And just like Google’s Lens, the magic isn’t on the front end but in the computer vision and AI to recognize objects. Snap is doing that through partners (like Photomath), but it could scale up its own AR cloud and image recognition as the machine learning improves through high-scale use.

That usage will accelerate from new lens experiences outlined above in combination with Snap’s AR-forward audience. As noted, 130 million daily active users are activating AR lenses, and 15 billion cumulative lenses have been viewed to date. No one else has that much AR engagement.

Back to visual search, it’s really just an evolution of marker-based AR, which Snap was already doing through Snapcodes. But object recognition now brings AR activation to a broader range of real-world “markers.” That includes 2D media like movie posters or magazine ads.

Though marker-based AR is often shunned in AR circles as being simplistic, we believe it will be a key factor in AR’s next era. Things like posters are not only plentiful (in ad inventory terms) but they are an adoption accelerant in expressly prompting users to scan them for AR animations.

Doubling Down

Snap has labeled itself for a while as a camera company. That designation naturally led into the current wave of mobile AR excitement, likely by design. But even as AR slogs through what some call the “trough of disillusionment,” Snap is doubling down on AR in all of the above ways.

One thing driving that is the fact that Snap is seeing real results. As noted above, it drove an estimated $236 million of $408 million in 2018 AR ad revenue. And as we’ve examined, AR lenses are beginning to attract brand advertisers by checking many of the boxes that get them excited.

That’s the endgame for all of the above. Users are engaged longer through compelling AR, thus attracting brand advertisers. Brands also now get a bigger toolbox for product animations, and ad inventory grows from faces (cosmetics, etc.), to the grander mosaic of the physical world.

So by doubling down on AR, Snap is really just following the money. To be fair, it’s less following than creating revenue where few others have. But most importantly, AR will be a key revenue diversification play to satisfy Wall Street in the near term, and Snap’s vision for the long term.

“The Snapchat camera allows people to use computing in their natural environment, the real world,” said Evan Spiegel at the Summit. “We believe that by opening the camera, we can create a computing experience that combines the superpowers of technology with the best of humanity.”

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image credit: Snap, Inc.