“Trendline” is AR Insider’s series that examines trends and events in spatial computing, and their strategic implications. For an indexed library of spatial computing insights, data, reports and multimedia, subscribe to ARtillery PRO.

Discussions about AR’s market opportunity are often delineated between consumer and enterprise markets. The former can be subdivided by smartphones (near-term) and smart glasses (long-term). And the latter is subdivided between industrial and consumer-facing enterprises.

Among all these subsets, AR-industry common wisdom points to the industrial enterprise as a larger market opportunity today. That’s due to the stylistic barriers in consumer markets, especially when it comes to glasses-based AR. Bulky headgear isn’t as much of an issue for industrial work.

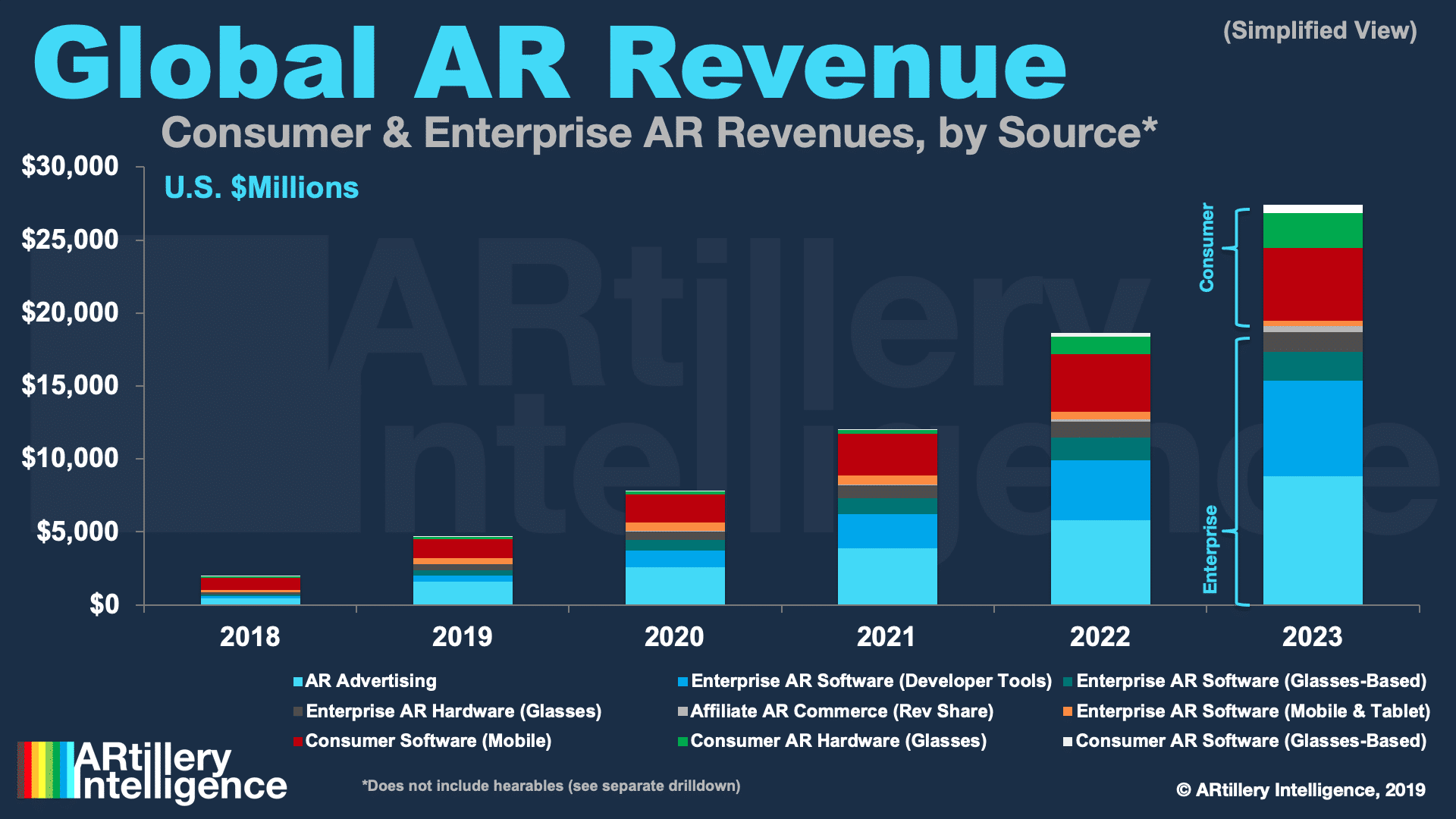

This enterprise dominance holds up for AR glasses but also AR software spending. That software is not just for industrial enterprises but consumer-facing companies that need tools to develop AR experiences for their customers. This is an enterprise AR category we call B2B2C.

Not so Fast

But despite that nearer-term reality, the longer-term opportunity could shift to consumers as hardware (glasses) and software (games, apps, etc.) buyers. This is based on the sheer size of the potential addressable market. In other words, there are seven billion humans on the planet.

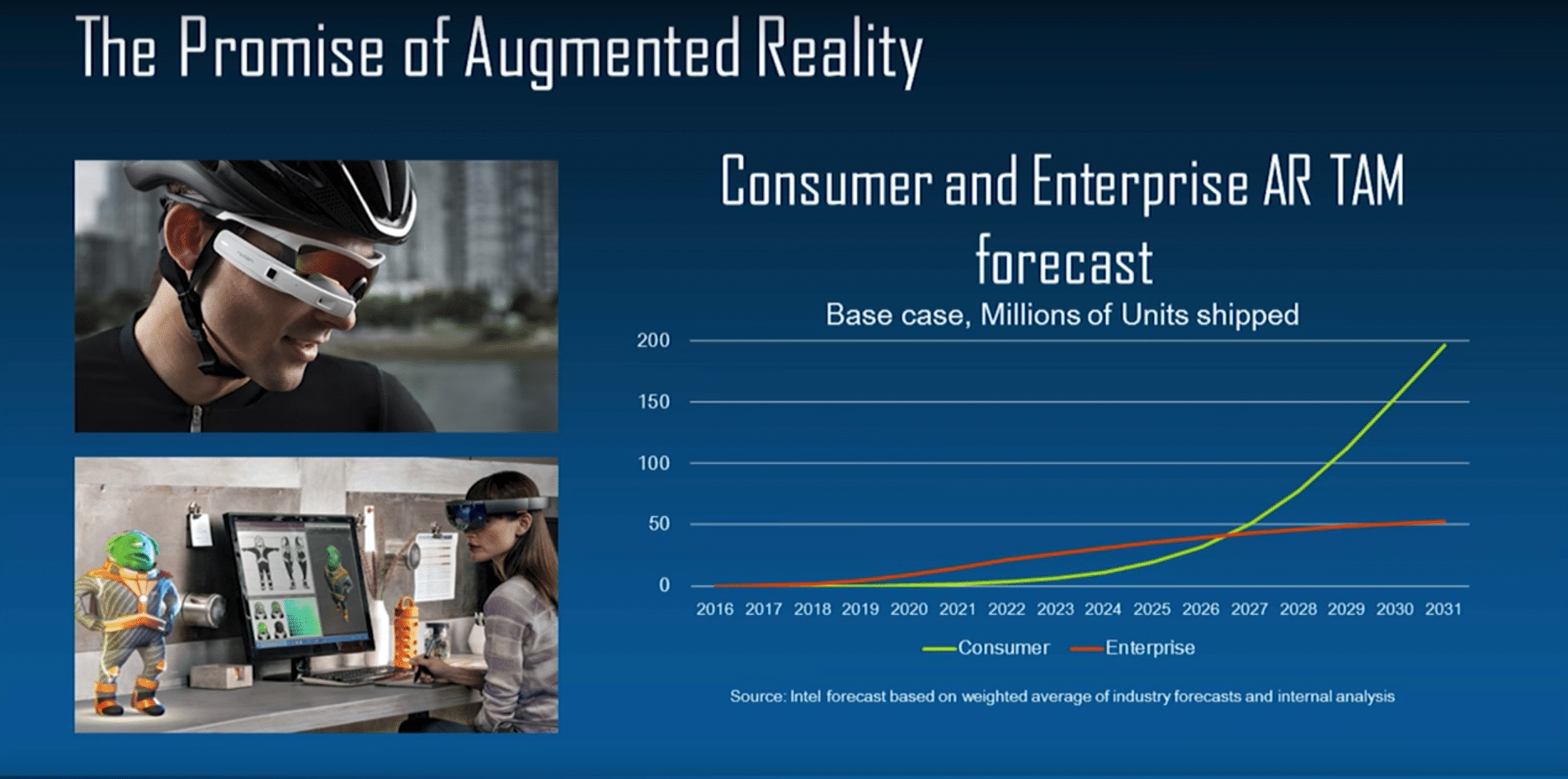

“In the long run, we know that the consumer market is going to far outpace the potential for enterprise,” said Intel’s Chris Croteau at a 2017 ARiA event. “There are a finite number of jobs on the planet and many of those jobs are being optimized and automated. So our ability to capture that market is a fixed target. But humans keep reproducing, and technology keeps spreading.”

As that unfolds, we’ll reach AR saturation in the enterprise. Because the ceiling is higher for consumer markets, they’ll keep growing as that enterprise saturation point is reached and growth matures. The question is when the consumer and enterprise adoption lines intersect.

Intel believes that intersection will happen for AR glasses around 2026, per the below graph. This point of intersection is of course purely speculative — as is any prediction that far out — but it’s conceptually important. With all else equal, consumer markets are bigger for AR hardware.

Moving Target

The Intel construct above is specifically about AR glasses. If we pan back to all AR technology that we track, there are other categories that may have different intersecting trendlines for consumer and enterprise spending. Software for example could be enterprise-dominant for longer.

That’s because consumer AR software is gated by hardware penetration, whereas enterprise AR software spending isn’t. In other words, consumer AR software sales (games & apps) correlate to installed hardware base, but enterprise software is much broader, such as SaaS developer tools.

Today, that consumer AR software spend is tied more to smartphone-based AR, and takes form mostly through in-app purchases for mobile games like Pokémon Go. But over time, the consumer AR software spend will also build on the installed base of consumer-grade smartglasses.

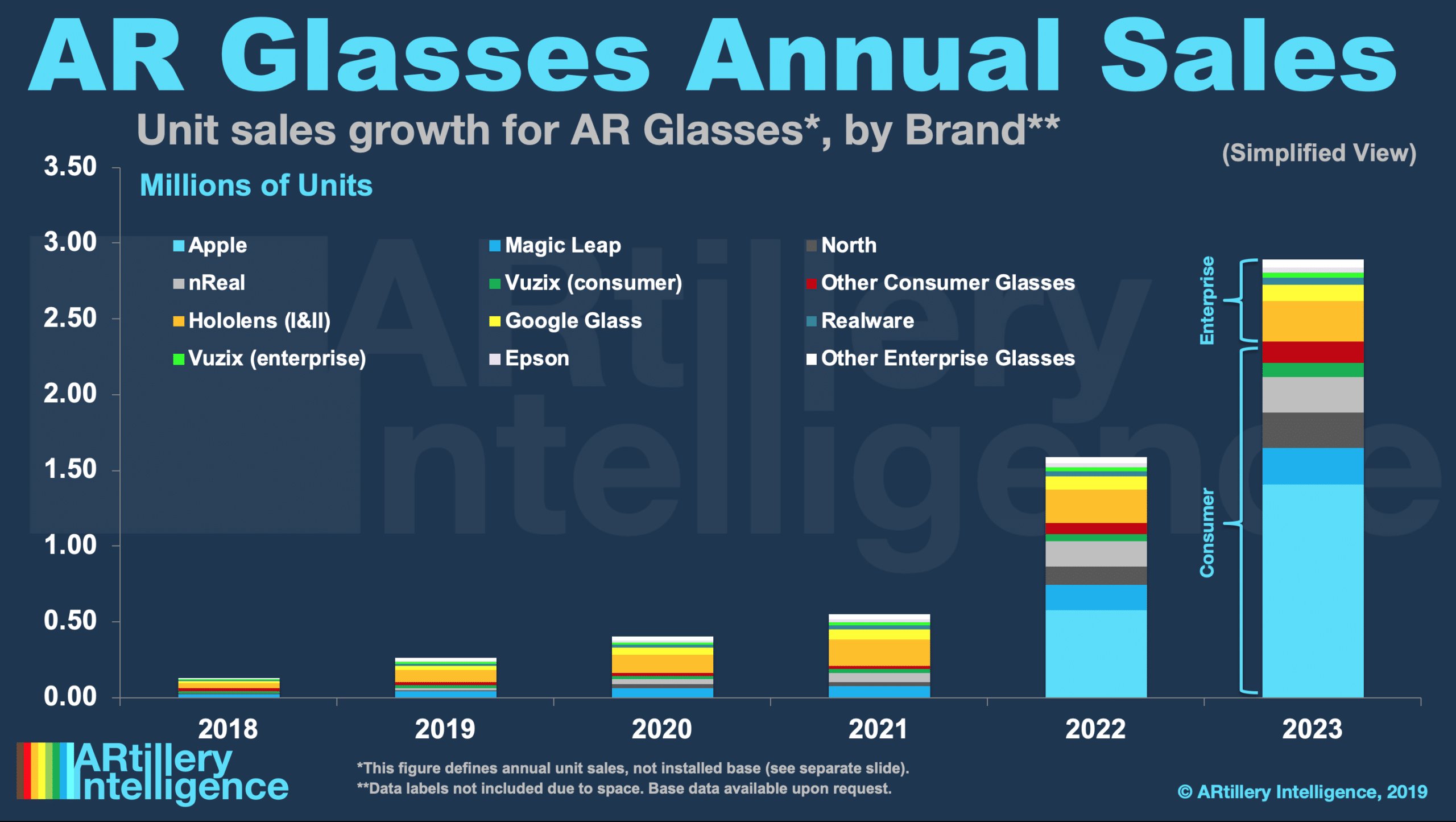

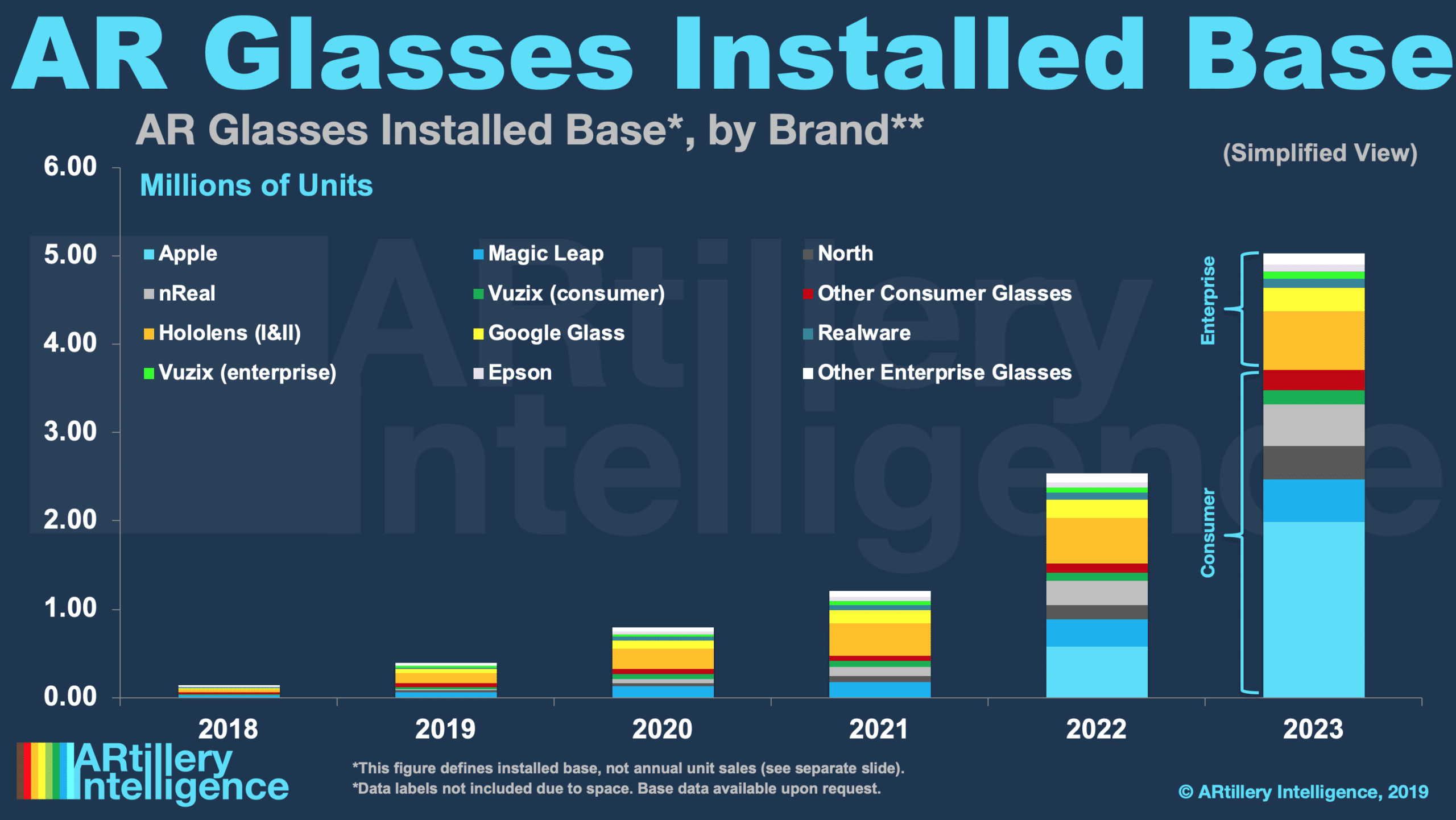

The question is when? Projections from our research arm, ARtillery Intelligence, peg the consumer AR glasses inflection in 2022 (based largely on Apple). The pace could be quick but will grow from a small base of a few million units. For perspective, there are three billion global smartphones.

Like much of the above, that’s speculative. Signals that inform projections include the halo effect and acceleration that Apple’s rumored AR glasses could ignite. It will take a while to approach mainstream penetration (100 million units), instead reaching single-digit millions by 2023.

That incudes annual sales and installed base, which are different (see charts above). Enterprise will dominate AR glasses sales until 2022 but that could flip, depending on the size and timing of Apple’s consumer AR splash. It will be moving target that we’ll watch closely.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image credit: Magic Leap