“Trendline” is AR Insider’s series that examines trends and events in spatial computing, and their strategic implications. For an indexed library of spatial computing insights, data, reports and multimedia, subscribe to ARtillery PRO.

Russ Hanneman, the obnoxious angel investor in HBO’s Silicon Valley, spends most of the show trying to stay within the “Three-Comma Club.” Denoting net value in excess of $1 billion, it was once rarefied air but is now commonplace in the runaway valuations of the unicorn era.

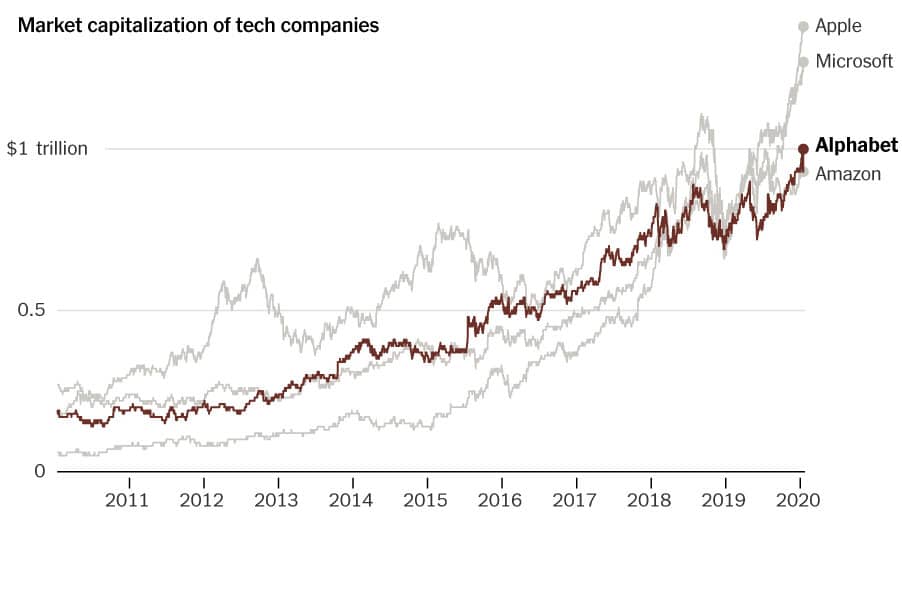

Furthermore, a new milestone has been reached: $1 Trillion valuations. Call it the four-comma club — or “quattros comas!” in Hanneman-speak. Among tech’s big five — Apple, Google, Amazon, Microsoft and Facebook — all but Facebook have crossed the mark.

Apple was first, followed by Microsoft and Amazon (which has since dipped below the mark). The latest is Alphabet which joined the four-comma club two weeks ago. Altogether the big five now account for more than 17 percent of the S&P 500, up from 11 percent in 2015.

A lot of this is due to a bull market, but it also signals the gravitational pull of these platforms. Consider that this is happening despite peak data-collection scrutiny (especially for those with ad businesses), and election-cycle rhetoric that projects the world’s problems on big tech.

Tentacles Anchored

One explanation is similar to the ongoing argument that today’s big five are too big to fail. Of course, the same was said in past tech cycles which saw incumbents get old, slow and succumb to innovator’s dilemma. Upstarts rose (including the now-giants) to dethrone them.

But the question is if it will be different this time. Some of it depends on business models, with companies like Apple faced with inherent challenges of hardware. It has to hit consecutive home runs in each replacement cycle (though cash position and supply-chain leverage help).

Software has easier capital requirements and unit economics. But that lowers barriers to entry for hungry challengers. Meanwhile, Facebook benefits from a network effect (harder to start, but then it grows exponentially) but it’s also subject to the herd mentality that killed MySpace.

In all cases, the big five are platforms with tentacles anchored in massive ecosystems. That wasn’t the case in past tech-cycles. Though we just compared Facebook to MySpace, it’s anchored itself as the web’s identity layer to avoid the fate of a social network “destination.”

Succession Plan

Why is all this important to AR? The above companies are leading the charge by investing heavily in spatial computing to own the platforms on which it runs. They’re each motivated to future proof core businesses by building specific flavors of AR that best support themselves.

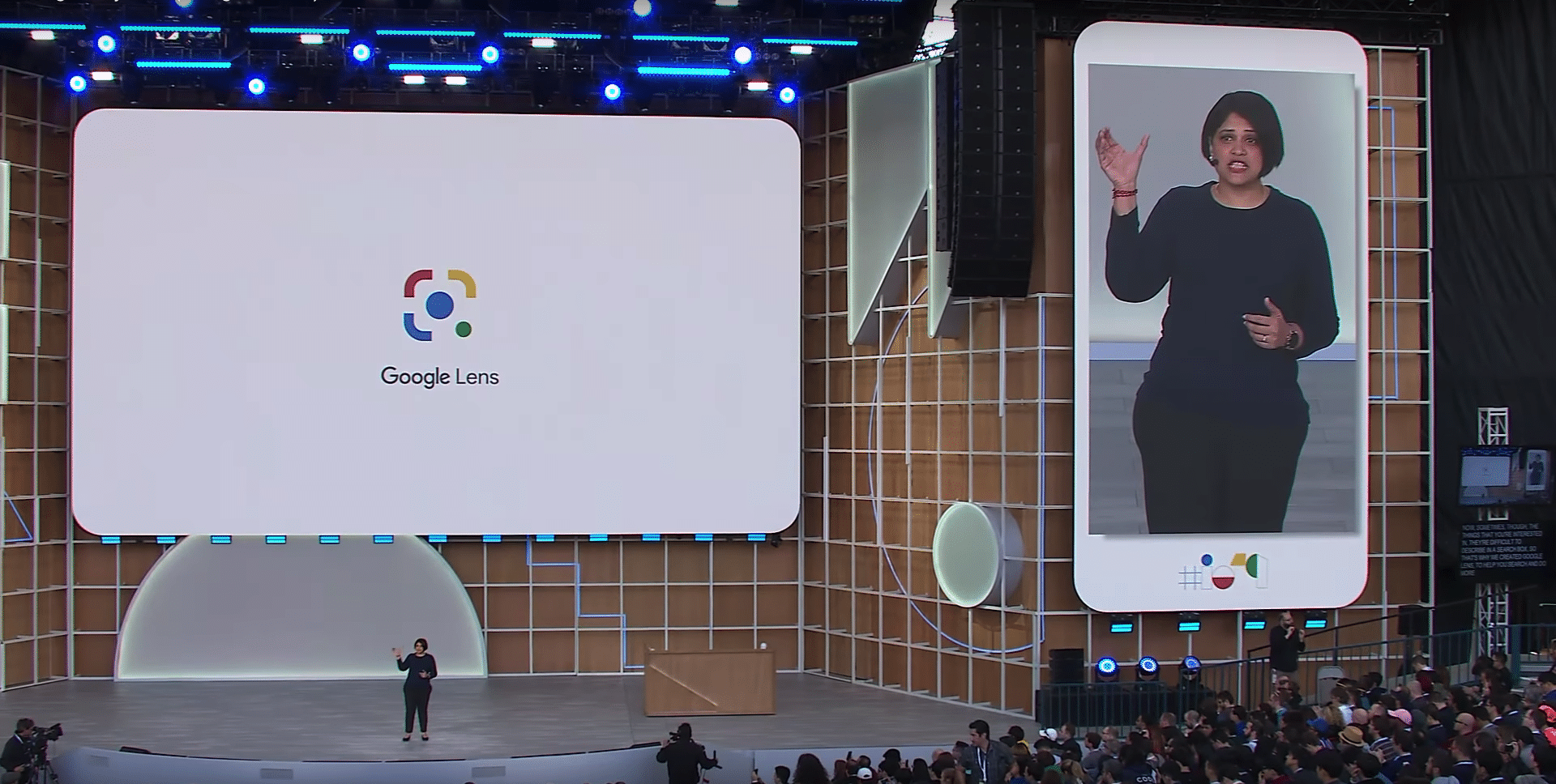

For example, Google is developing visual search as an alternate front-end modality to boost query volume. Pointing your phone at an object is often easier than typing. And it could boost ad premiums in high-intent contexts such as fashion, in-store shopping or local discovery.

Facebook meanwhile wants to be the social layer for the spatial web, just like it’s done on the 2D web. Amazon wants to boost eCommerce with product visualization; Microsoft wants to be the productivity layer in industrial visualization; and Apple wants to sell us more iThings.

The common thread is that their approaches with AR — and the spatial worlds they want to build — all trace back to their core businesses. They have many billions in revenue to protect and AR is one way to both support core businesses and succeed aging products… like the iPhone.

Moving Target

This principle is at the heart of our ongoing follow-the-money exercise. By examining the motivations of tech giants, we can triangulate their directions. And that can be valuable for startups in the sector to “skate to where the puck is going,” as they devise product road maps.

Put another way, the moves and motivations of major platform players will determine AR’s fate and have downmarket ripple effects. This is all to say watch closely for cracks in their foundations (e.g. data collection) or signs of staying power (e.g. escalating valuation).

That brings us back to the four comma club. Along with examining specific moves and investment, these macro signals like public market performance can be telling. All of the above holds strategic implications for which horse to pick in what could become big tech’s next platform wars.

Whether it’s the same cast of characters or a new big five, clues will continue to emerge to inform platform decisions. That goes for developers, industrial enterprises, brand marketers and users — and the network effects that build from all sides. As always, it will be a moving target.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image credit: HBO