ARtillery Briefs is a video series that outlines the top trends we’re tracking, including takeaways from recent reports and market forecasts. See the most recent episode below, including narrative takeaways and embedded video.

In any technology’s early stages, consumer market successes are relatively rare. That depends on your definition, but we’re talking about large-scale revenues. So a lot can be learned from early leaders. What are they doing right? How are they engaging users? How are they making money?

These are key questions in consumer AR, as there’s no standardized playbook just yet. So extracting and synthesizing early lessons is the name of the game. ARtillery Intelligence’s latest report — and Briefs episode below — does just that, starting in Part I of the series with Snapchat.

Camera Marketing

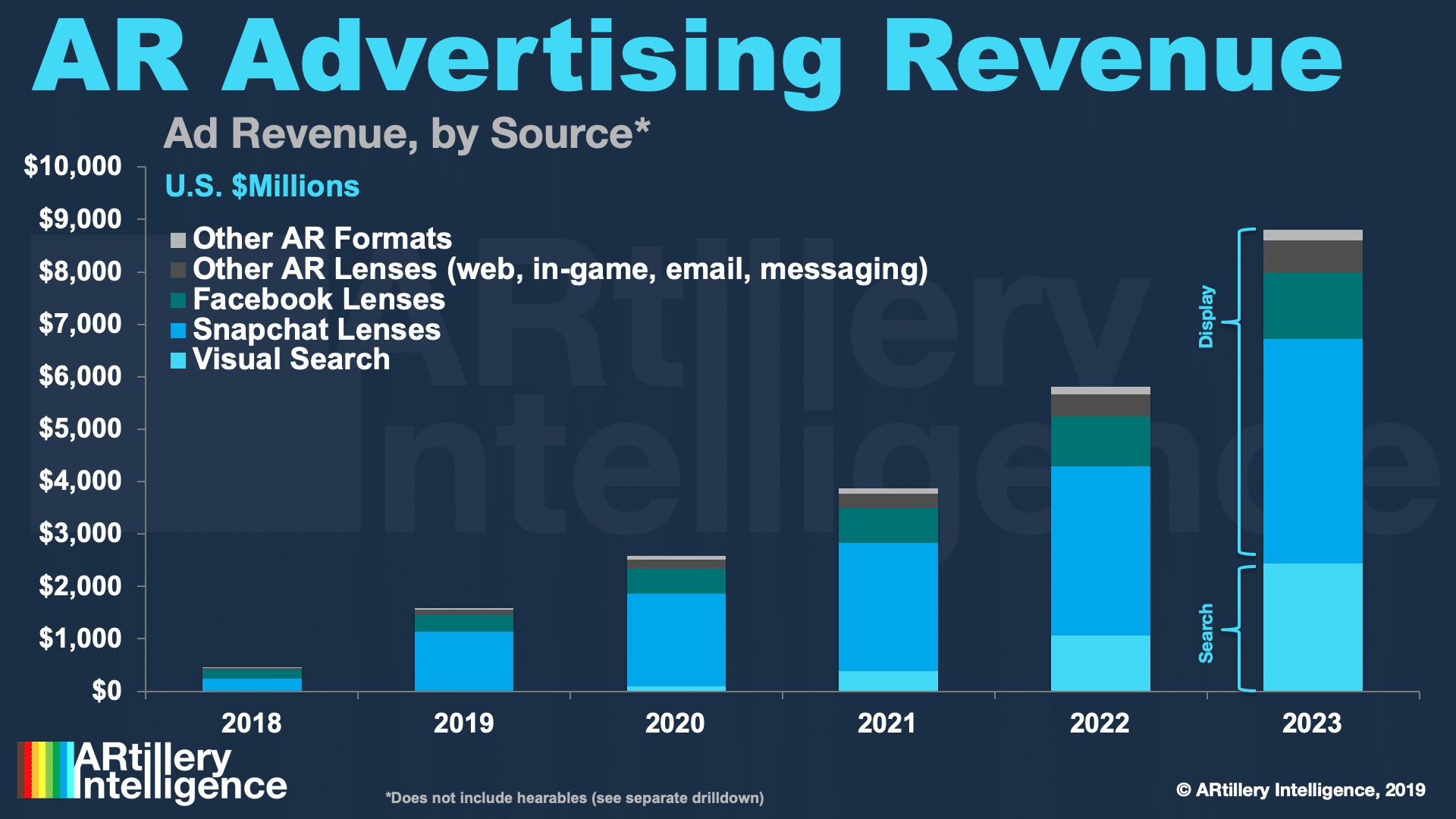

Stepping back for context, advertising has emerged as AR’s revenue leader, given brands’ growing affinity for demonstrating products in immersive ways. AR has the rare combination of “upper-funnel” reach and “lower funnel” direct-response capability from things like product try-ons.

Within the popular AR advertising category of AR lenses, Snapchat is the engagement and revenue leader. It has 210 million lens users on a daily-active basis, which engage AR 30x per-day on average. And it recieved a leading share of the $1.6 billion estimated 2019 AR ad spend.

This notably exceeds Facebook’s despite its greater global reach. Snapchat achieves this through dedicated focus on AR, as it’s congruent with the core “camera company” ethos. And Snap has doubled down on AR after seeing attibutable revenue growth and stock market rebound.

That said, Instagram looms as an AR sleeping giant that could help Facebook catch up. It’s conditioned a camera-forward audience as well as product-discovery and transactional use cases, where AR could find fertile soil. And it’s just at the beginning of its AR efforts.

Comfort Advantage

Back to Snapchat, what’s it doing right? Beyond the product focus mentioned above, it also uses AR intelligently. It’s mostly applied to build on the existing and popular activity of sharing multimedia. AR layers on top of and enhances a prevalent and comfort-advantaged use case.

Snapchat has also chosen communications – via social lenses – as an AR vessel. This is important as we’ve examined, because it breeds high frequency. That compares with other AR use cases like gaming or commerce which are strong, but not necessarily all-day activities.

It’s also reducing friction for users to discover and activate AR. This goes back to its core design principle to open to the camera. This makes AR more accessible than other apps where AR is discovered or activated within a feed. It also rarely uses jargon like “AR” in user-facing ways.

If you boil all this down, there’s the common thread of what we call “training wheels.” A key success factor projected in our 2020 AR predictions, this is all about meeting users halfway with AR by making it an additive component of the things they’re already comfortable with.

Doubling Down

Beyond these tactical factors, there’s an underlying driver for Snapchat to invest in AR. This goes back to our ongoing exercise of “following the money” to extrapolate tech giants’ AR moves and motivations. Snap sees real financial results from AR, as mentioned, and is doubling down.

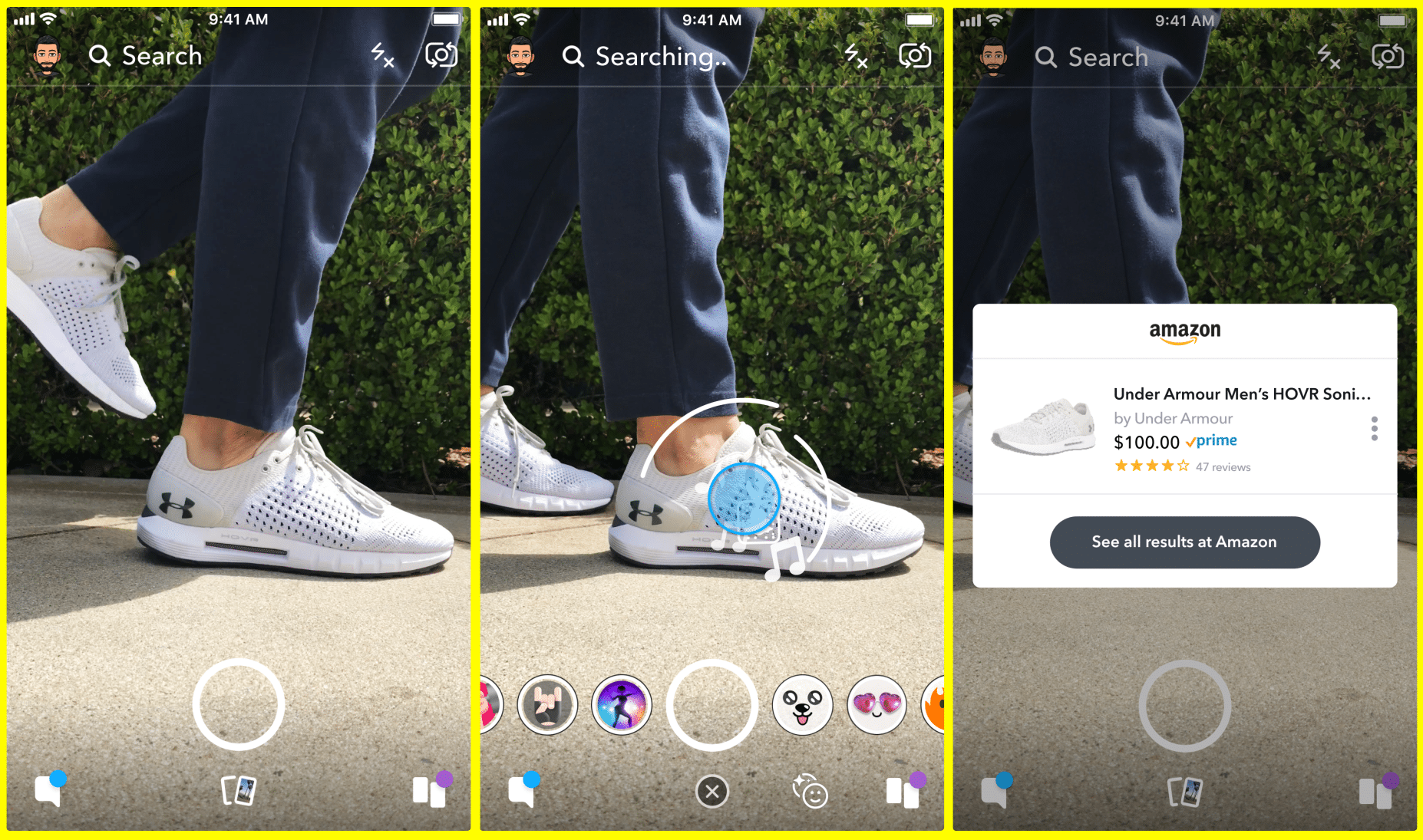

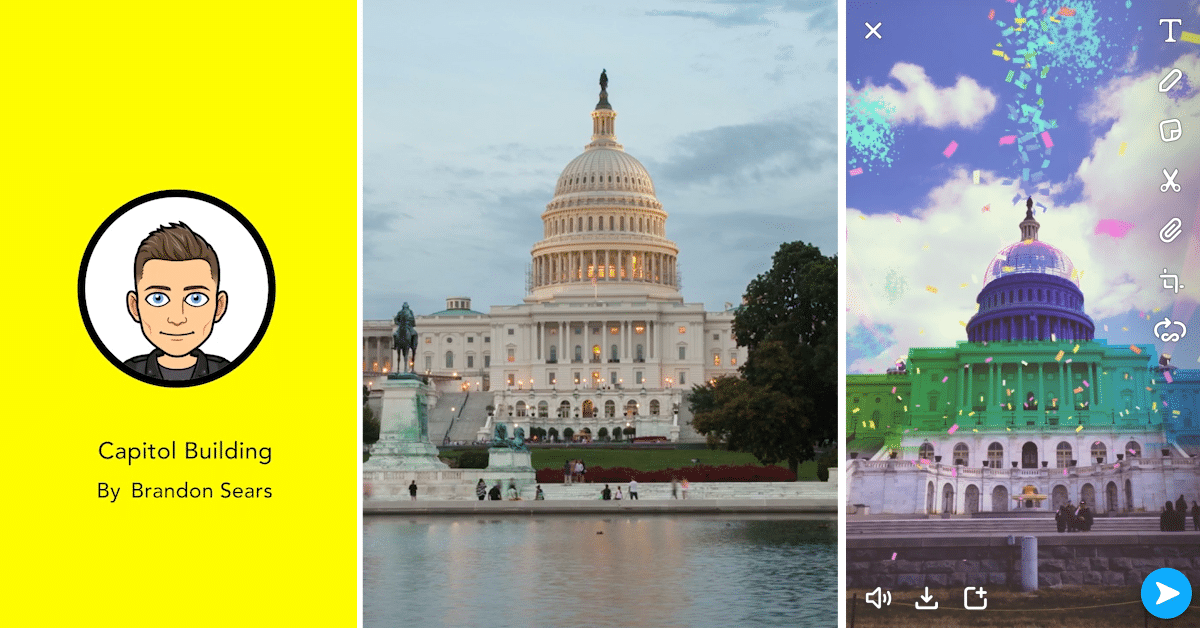

That includes expanding beyond selfie lenses with rear-facing camera activations to augment the world, such as Landmarkers. It’s also utilizing computer vision for AR utilities like solving math problems on the fly, or identifying style items with the camera, in partnership with Amazon.

All of this flows into tools for Lens Studio developers. By boosting that toolset, Snap grew the developer community 40 in Q3. It recognizes that stimulating the supply side and incentivizing developers will drive lens demand which in turn incentivizes more developers — a virtuous cycle.

Overall, Snapchat’s AR scale has allowed it to experiment in ways that provide validated lessons. So it’s doing the AR industry a favor in shining a light on these product and business model mysteries. That’s something that anyone developing consumer AR products should watch closely.

See more in the ARtillery Briefs episode below, and the full report, which includes data, success factors and case studies. And stay tuned for Part II of this report which dives deep on Niantic.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.