Data Point of the Week is AR Insider’s dive into the latest spatial computing figures. It includes data points, along with narrative insights and takeaways. For an indexed collection of data and reports, subscribe to ARtillery Pro.

One of the ongoing challenges in market sizing is to piece together clues to extrapolate things like unit sales and revenues. In mature markets like smartphones, hardware players disclose figures — especially if public — but it’s a lot quieter on the early-stage front.

That’s the case with VR, which becomes an exercise in gathering hints in perpetual market-sizing mode. Sometimes there are gifts like Sony’s frequent disclosures while boasting PSVR sales. Otherwise, it’s about detective work and talking to as many industry insiders as possible.

But there are also some valuable gut checks and thought exercises along the way. For example, our September estimates for 333,000 cumulative Oculus Quests sales were based on disclosures at the OC6 conference that $20 million in games had been sold for the device.

The latest clue comes from Facebook’s Q4 earnings call in which Mark Zuckerberg boasted almost $5 million in game purchases on Christmas day. This is a narrower clue, given the one -day range, but can it help us extrapolate broader holiday device sales? Let’s pull on that string.

By the Numbers

As we’ve done with past Oculus content volume disclosures, we can extrapolate and back into hardware estimates. In this case, $5 million in content sales on Christmas day can mean a few things. Some portion of that spend is from new (gifted) Quest owners that want to get playing.

Some of that total is also existing Quest and Rift owners who were gifted or bought a game. Given the average $25 price point for Quest games, they make for nice giftable items. Let’s say for the sake of this exercise that half of game purchases are for new Quest owners.

Let’s also conservatively estimate for the sake of this exercise that new Quest owners buying content on Christmas day averaged 1.5 game purchases. That would mean half bought one game and half bought two games, with room for zero and 3-game outliers. We’d get this:

(($5,000,000*.5)/($25*1.5)) = 67,000 new Quest units

Of course, this is based on some assumed inputs. But the model is there to play with. Let’s bump up the share of game purchasers that were brand new Quest owners to 60 percent. And let’s estimate the average games per-user at 2. In that scenario, we’d get this:

(($5,000,000*.6)/($25*2)) = 60,000 units. And so on…

Panning Back

We’ll say again that this provides a limited range of sales in just one day. For broader holiday sales, we have to factor in non-Christmas gift-oriented holidays including Hanukkah. That would make Quest holiday sales greater by a multiple that correlates to population segments.

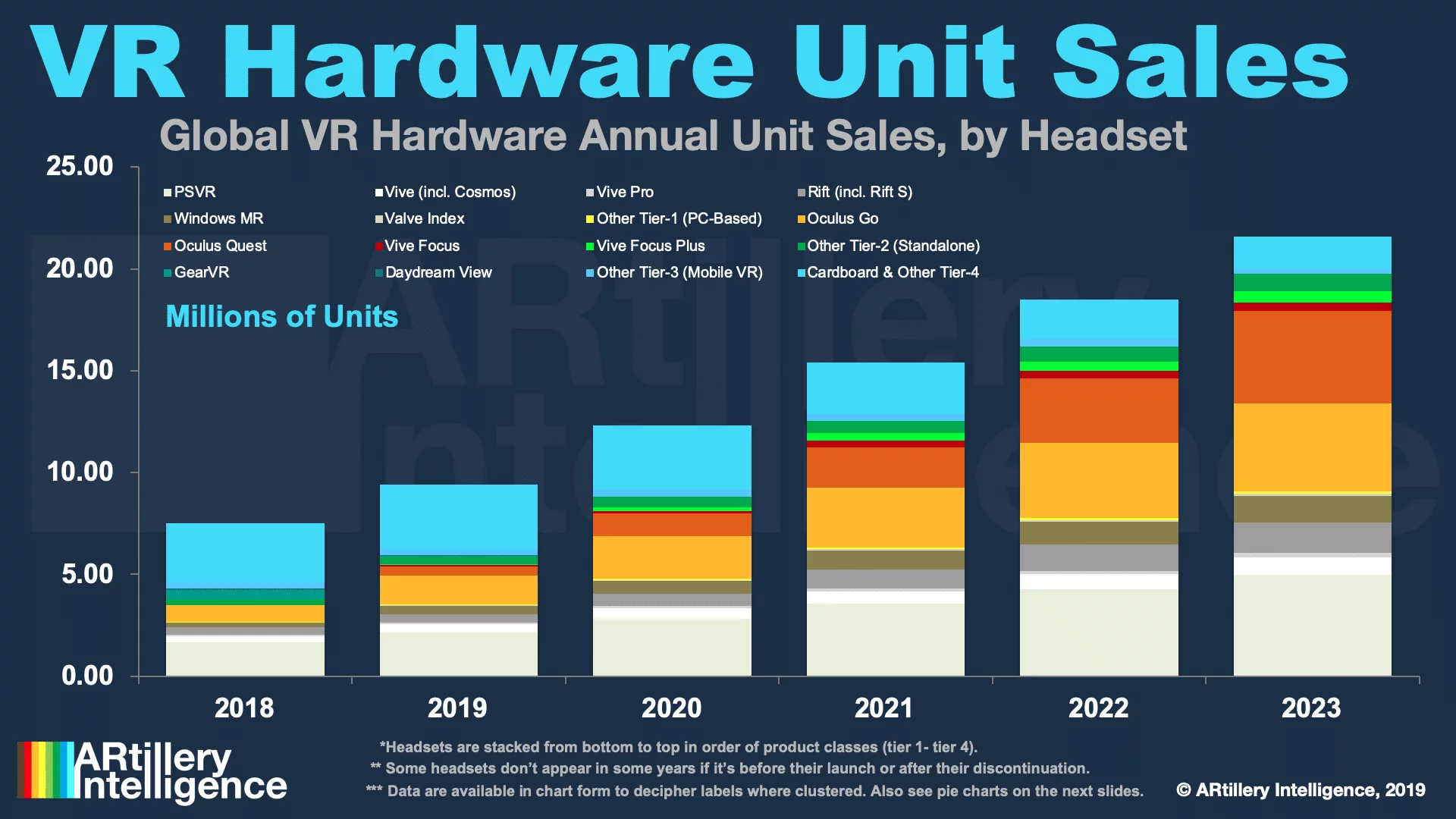

Panning back further, what does all of the above mean for Quest’s full-year 2019 unit sales? Our research arm ARtillery Intelligence estimated that figure at 470,000 in its Global VR revenue forecast. That factors in the September estimates cited above, among other things.

An expected holiday boost was one of those things, given Oculus Quest’s popularity and giftable price point for some consumer segments. That turned out to be fairly accurate, given the late 2019 supply constraints. Oculus is selling Quests as fast as it can make them.

To estimate full-year unit sales, we can start with September’s 333,000 estimate, plus October and most of November’s consistent sales pace. Adding the holiday 67,000 estimate plus some level of additional sales for non-Christmas holidays, that gets us pretty close to 470,000.

Thought Excercise

We’ll qualify the Quest holiday sales estimates with the caveat it’s a thought exercise, not an official Oculus figure. It’s also not an official figure from AR Insider or its research arm ARtillery Intelligence. It’s about extrapolating ranges for a better sense of VR market levels.

Given the challenge of market sizing without first-party data from VR hardware providers (except Sony), it’s about constantly collecting clues like this, and building smart financial models. It’s like a Sodoku board: using known quantities to logically devise unknown ones.

We’ll continue our unhealthy obsession with assembling reliable inputs and reporting back what we find. Tracking these clues is important, not just to help buttress the market-sizing of our research arm, but to impart an ongoing sense of VR traction and its strategic implications.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.