One of the common rallying cries of the AR industry is that the technology’s use in ubiquitous smartphones makes it a strong forbear to AR’s eventual manifestation in glasses form. We stand behind that concept, given that mobile AR conditions consumers to spatial experiences.

But another device class could have an equal or greater impact towards that same end: wearables. The thought is that devices like Apple Watch and AirPods condition consumers to wear sensors on their bodies, and thus acclimate to the cultural shift that will be required for AR glasses.

These dynamics and their impact on the AR industry’s growth are the focus of the latest report from AR Insider’s research arm, ARtillery Intelligence. They’re also the focus of the latest episode of ARtillery Briefs, which you can see in full below along with narrative takeaways.

Classic Apple

The above factors are amplified as wearables continue to be one of the fastest-growing consumer tech segments. That includes smartwatches and “hearables” such as Apple AirPods and its equivalents. They’re even performing well during a pandemic, though sales are down slightly.

Beyond consumer demand, tech giants are embracing wearables as they align with road maps and growth strategies. The poster child is Apple, which is motivated toward wearables as a revenue diversification play in the face of falling iPhone sales as the smartphone market matures.

To quantify that, Apple’s year-over-year wearables growth is almost to the point of offsetting iPhone sales declines. Wearables also represent a long-term strategy to future-proof Apple’s multi-device ecosystem approach, consisting of Watch, AirPods and (soon) smart glasses.

Apple is hoping that this device-constellation approach will collectively achieve a holistic sensory augmentation where the whole is greater than the sum of its parts. It’s also hoping this approach motivates consumers to own several devices — an ARPU-boosting move that’s classic Apple.

Trojan Horse

Google is meanwhile motivated toward wearables to maintain direct touchpoints to consumers. This was the same strategy that drove Google’s investments in the Android OS years ago. Just like with mobile devices, Google can position itself closer to users as a “Trojan horse” for search.

Amazon is motivated for similar reasons — a direct consumer touchpoint as a Trojan horse for its core business, which of course is eCommerce. The same thing drives its smart-speakers and Internet-of-things devices — the endgame being more frequent and larger eCommerce baskets.

Going down the list, Microsoft is motivated to drive and future proof its core product: enterprise productivity. That includes its Surface Buds which create deeper integrations to Office products such as language translation, or controlling slide presentations through voice commands.

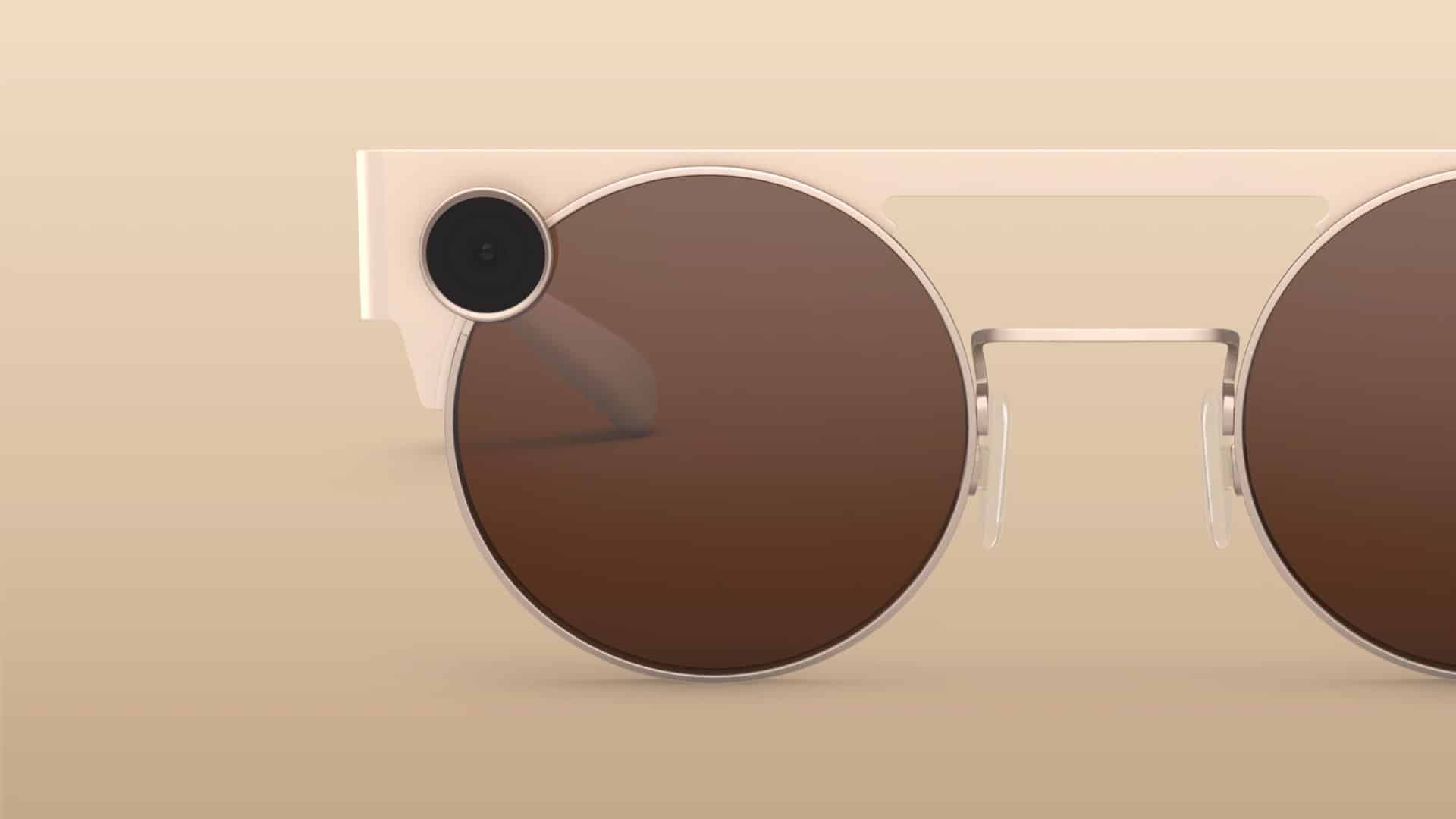

Then there’s Facebook, where wearables support AR glasses ambitions. Its project Aria is doing just that by feeling out AR glasses’ social dynamics. Speaking of which, Snapchat is doing similar with Spectacles by testing the social waters to gain UX insights for its eventual AR glasses.

Softer Landing

That just scratches the surface and you can see more in the full report and the video below. In closing, the main takeaway is that wearables’ traction could give consumer AR glasses a softer landing. Given the cultural shift required for widescale acceptance, they could certainly use it.

And beyond acclimating the world to AR’s future, wearables in some ways already are AR. More accurately, the branch of wearables known as hearables represents AR’s lesser-known cousin, Audio AR. This involves spatially-aware and intelligent audio prompts about one’s environment.

It’s also worth noting that Covid-era lockdowns have created supply chain impediments. But the wearables sector has been resilient. Moreover, Covid-era impact will mostly be felt in the near term and wearables will be back on track by mid-2021 to continue paving the way for AR Glasses.