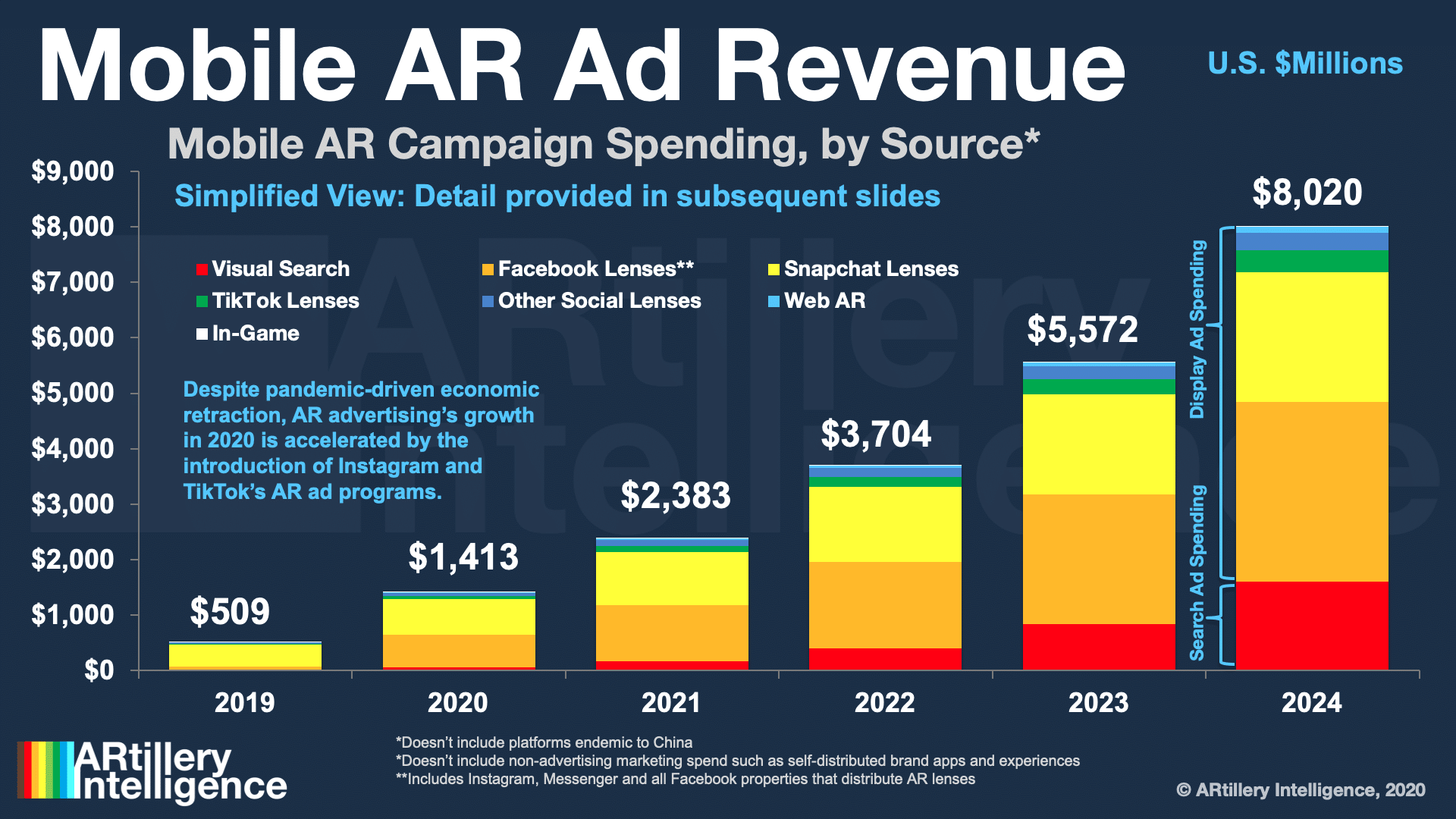

AR continues to face adoption headwinds, but one bright spot is advertising. As explored in AR Advertising Deep Dive, Part I: The Landscape, revenue could reach $8 billion by 2024. Continuing with Part II of the report, we “show rather than tell” with AR ad campaign case studies.

Before getting into our next case study, what’s driving these campaigns? For one, AR lets brands demonstrate products in 3D, which appeals to creative sensibilities erstwhile confined to tiny mobile banners. More importantly, high-performing AR ad campaigns validate a business case.

But another factor could be a key accelerant: Self-motivated investment from tech giants to build the tools that enable and stimulate AR ad creation. We’re seeing that as Snap continues to double down on AR; and as Facebook does similar — now including the AR sleeping giant, Instagram.

Incubating AR

But could greater impact come from the biggest ad giant of all: Google? It’s been pushing various flavors of AR to future proof its core search business. That includes visual search to contextualize items you point your phone at, and AR-infused search results for 3D visualization.

We’ve spent ample time talking about the former, and less with the latter. But the concept of 3D/AR models populating search results took a step forward with Google’s Swirl rollout. Available previously on a limited basis, it’s now available globally to Display and Video 360 advertisers.

For those unfamiliar, Swirl is an interactive 3D ad format that lets consumers see, zoom and spin 3D models in search results or web pages. That happens on your screen or overlaid in your space with camera activation. Offering both options means AR can “ease in” as a shopping modality.

Speaking of lowering friction, Swirl’s virtues manifest on the brand side too. By standardizing a 3D format and giving it distribution scale through search, Swirl could stimulate adoption from brands — otherwise faced with a fragmented set of tools to offer (and get analytics from) 3D advertising.

Deep Impact

As part of Swirl’s global launch, Google revealed a few proof points on its performance from early partners and beta participants. One thing to note from the below list is the versatility in product categories that Swirl can accommodate. This speaks to the magnitude of its potential impact.

— Purina ONE’s Swirl ad let users virtually play fetch with a 3D dog, meant to evoke the vibrance of a healthy pet (see above). It achieved a 6x engagement delta over 2D benchmarks.

— Nissan’s Swirl ad let users control a virtual car and see features like lane-assist (see above). It achieved an 8x engagement delta over rich media benchmarks in the auto vertical.

— Adidas’ Swirl ad let users zoom and spin its Ultra Boost 2019 shoe (see below). It achieved a 4x engagement delta over rich media benchmark, 11 second dwell times and a 2.8x ROI.

— Belvedere Vodka’s Swirl ad let users simulate the experience of adding products to a gift bag (see below). It achieved 6.5x brand-favorability and 4.9x purchase-intent over benchmarks.

Evolutionary Path

All of the above represents an ongoing evolution of the search engine results page (SERP), from “10 blue links.” That includes the 2010’s “universal search” trend (video, images, etc.) on to the knowledge graph — those panels at the top of search results that answer your questions directly.

3D models are the next logical step in that evolution. They’re also a way for Google to continue growing search revenue — which gets harder to do over time, as percentage growth is calculated from a larger base. That’s one of the motivations for Swirl, along with long-term future-proofing.

The AR advertising sector will benefit as a byproduct. Given Google’s scale, 3D models in search could acclimate and get consumers hooked on immersive online shopping. That will motivate brands to invest, which in turn stimulates AR advertising startups to feed that demand.

That cycle starts with Google building the tools. Meanwhile, the Covid era has boosted all-things-eCommerce, especially those that compensate for the lack of touching/feeling products. This means Google Swirl could angle for a key role in retail’s post-Covid “touchless” era.