One striking realization about spatial computing is that we’re almost seven years into the sector’s current stage. This traces back to Facebook’s Oculus acquisition in early 2014 that kicked off the current wave of excitement… including lots of ups and downs in the intervening years.

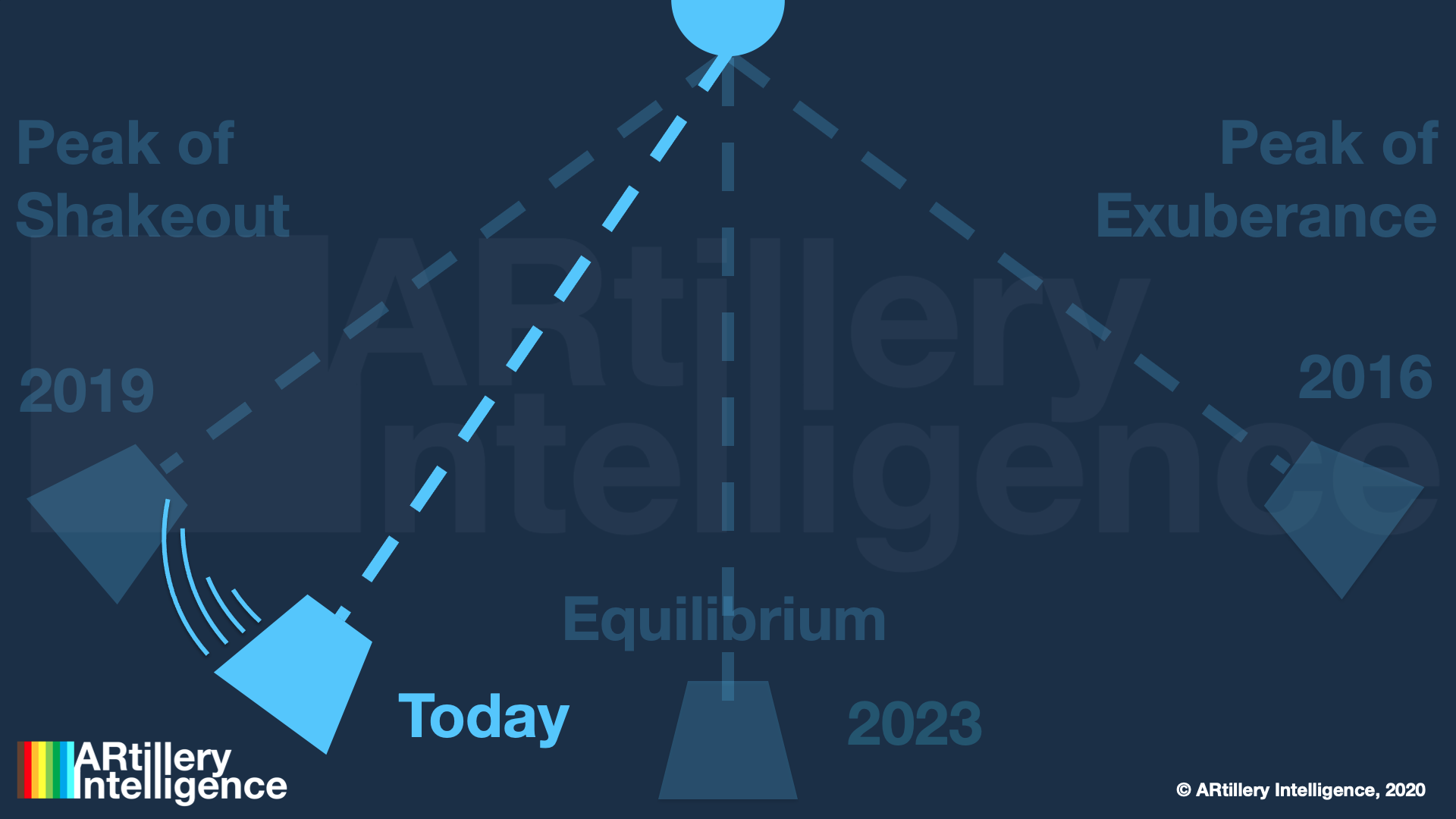

That excitement culminated in 2016 after the Oculus acquisition had time to set off a chain reaction of startup activity, tech-giant investment, and VC inflows for the “next computing platform.” But when technical and practical realities caught up with spatial computing….it began to retract.

Like past tech revolutions – most memorably, the dot com boom/bust – spatial computing has followed a common pattern. Irrational exuberance is followed by retraction, market correction, and scorched earth. But then a reborn industry sprouts from those ashes and grows at a realistic pace.

That’s where we now sit in spatial computing’s lifecycle. It’s not the revolutionary platform shift touted circa-2016. And it’s not a silver bullet for everything we do in life and work as once hyped. But it will be transformative in narrower ways, and within a targeted set of use cases and verticals.

This is the topic of ARtillery’s recent report, Spatial Computing: 2020 Lessons, 2021 Outlook. Key questions include, what did we learn in the past year? What are projections for the coming year? And where does spatial computing — and its many subsegments — sit in its lifecycle?

Stepping Stone

Picking up where we left off in the last installment in this series, there’s ample transformation and evolution underway in spatial computing. This most notably includes subsegments like enterprise productivity, brand marketing, gaming, and the potential for utilities such as visual search.

Many of these developing areas owe their success to piggybacking on smartphone ubiquity. Of the 3.46 billion global smartphones today, 3.03 billion are compatible with at least one form of AR, including rudimentary web AR. And an estimated 598 million devices are AR active.

This ubiquity is not only a pathway to scale, but could represent AR’s scaffolding. The AR cloud will continue to be the model for location-anchored data that empowers AR devices to activate meaningful graphics. And such efforts will crowdsource spatial mapping to the mobile masses.

But mobile AR’s job doesn’t end there. One key role will be to acclimate the world to AR so that its fully actualized form – head-worn AR – has a softer landing. That includes consumer acclimation, as well as developers getting conditioned to think spatially by building mobile AR experiences.

Another accelerant in that conditioning process will be wearables, as they acclimate consumers to body-worn sensors. The device class continues to inflect as companies like Apple lean in as a means to future-proof a hardware business that’s overly reliant on a maturing iPhone.

Speaking of Apple, several clues emerged about its rumored AR glasses last year, which could accelerate AR through a classic Apple “halo effect.” But it won’t be the graphics-heavy AR that we often envision – instead taking a more elegant “lite AR” approach to enhancing human vision.

2021 Predictions: AR Glasses Evolutionary, Not Revolutionary

The Covid Era

All of the above covers consumer-based endpoints, but what about enterprise? Indeed, this is where ample AR traction has been evident, given its ability to guide industrial (assembly, maintenance) and corporate work (design collaboration) using line-of-sight annotations.

And what about VR? It continues to grow gradually, accelerated by Facebook’s investment in high-quality, low-cost hardware such as Quest 2. The device is showing early signs of heavy demand, while Facebook amps up its supply-chain in a world still reeling from a pandemic.

Speaking of which, the elephant in the room in all of the above is Covid-19. Like in several industries, it has affected AR & VR unevenly. For example, AR lenses align with demand signals of the shelter-in-place masses. This includes entertainment, communication, and remote shopping.

Conversely, anything hardware-based – including AR and VR glasses – have been impacted by global supply-chain impediments. But counterbalancing that to a certain degree is the technology’s alignment with remote work, such as AR’s remote assistance and VR’s immersive presence.

The long-run result could be a net positive. This will happen as supply-chain shortages cause pent-up demand, which can already be seen. And Covid-pressured enterprise adoption could expose AR and VR, instilling permanent habits in the post-Covid era of semi-remote work.

All of the above is what we learned in a volatile 2020. The rest of this report will drill down on each of these areas, and we’ll circle back here on a semi-weekly basis with more excerpts. 2021 will continue to be a transformative time for the world, and for spatial computing as it finds its footing.