Data Point of the Week is AR Insider’s dive into the latest spatial computing figures. It includes data points, along with narrative insights and takeaways. For an indexed collection of data and reports, subscribe to ARtillery Pro.

Pokémon Go’s business case continues to be validated. Though the tech & media press corps has shifted the spotlight to other shiny things, the app continues to see strong user engagement and revenue. After just passing $3 billion in lifetime revenue, 2019 was its biggest revenue year yet.

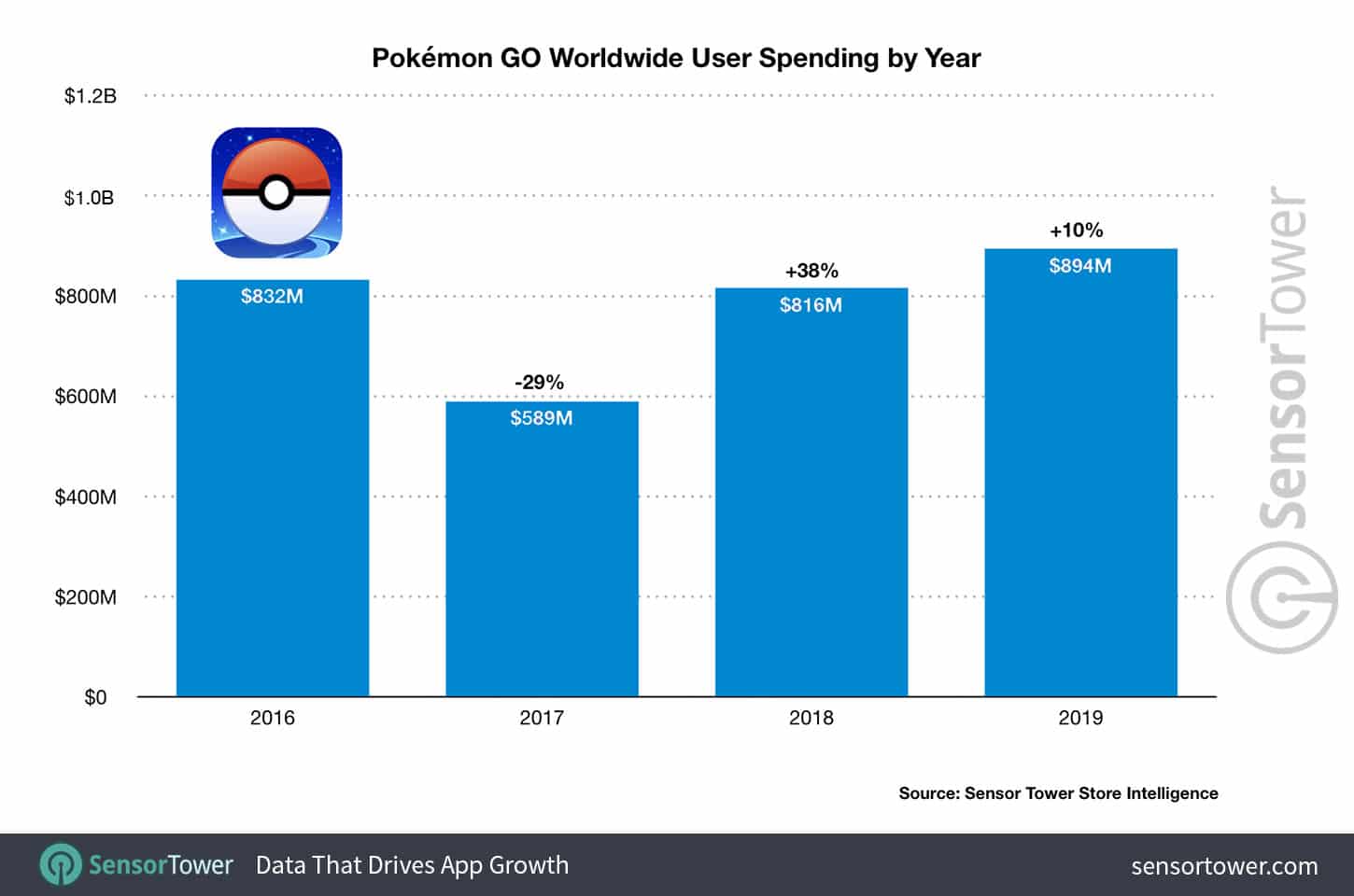

Specifically, it reached $894 million in gross player spending and 55 million downloads according to Sensor Tower Store Intelligence estimates.* This surpasses the revenue run rate we calculated in November, and more notably the $832 million the game made in its famous 2016 debut.

Here, there’s an important caveat: the 2016 blitz has a greater revenue run rate and monthly pace, given that the $832 million total happened within 6 months after the game’s June launch. But this shouldn’t take away from the 2019 accomplishment, given the rebound from a 2017 low.

2017 brought in $589 million, which then rebounded to $816 billion in 2018. With respect to 2019, it should be noted that the year contained its fourth and fifth greatest revenue months to date, including August’s $116 million and September’s $126 million. The cumulative total is $3.1 billion.

Catch them All

One reason this is all notable is that the common arc for mobile games is to lose novelty. There are a few games that have been able to counteract this natural occurrence with a combo of game updates and inherently replayable game mechanics. One exemplar here is Candy Crush.

Pokémon Go has sustained it’s momentum and player interest — including the rebound quantified above — through lots of in-game updates. That includes most notably the 2019 incorporation of Team Rocket. There’s also AR+ Mode, Snapshot and the recent Buddy Adventures update.

Beyond play dynamics, this validates Pokémon Go’s in-app purchases (IAP) revenue model. It’s inherited from the broader mobile gaming world, where it approaches $70 billion in annual revenue on the behavioral economics of microtransactions (all that money you spend on Candy Crush).

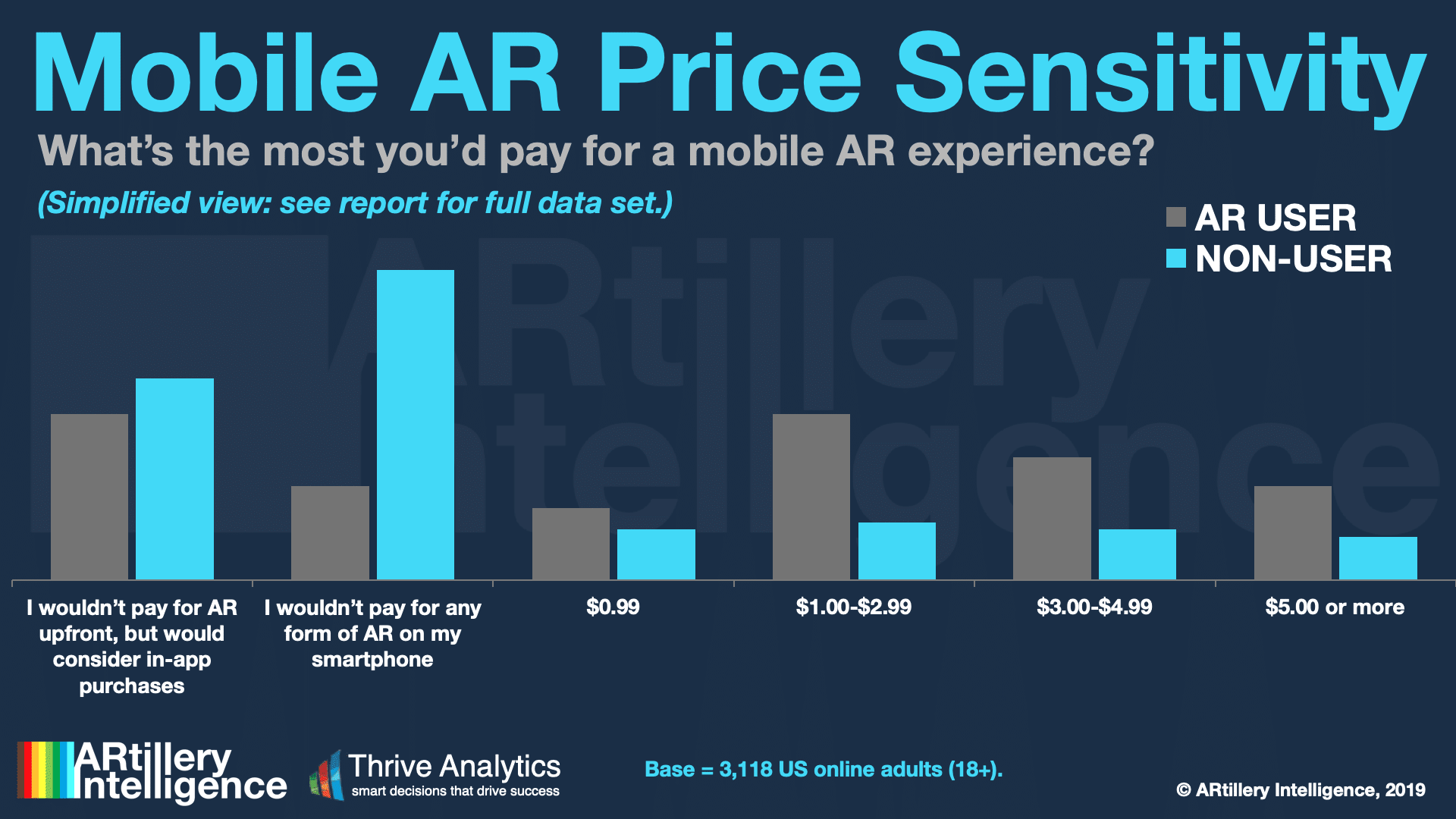

Not only is IAP validated in mobile gaming but it’s fitting to AR’s early stage when users hesitate to pay upfront for premium apps. Beyond revenues, IAP is supported by consumer survey data from our research arm ARtillery Intelligence, and recent report on top AR business models.

The Graying of Pikachu

The question remains how the above pace will sustain. Growth rates naturally diminish as revenue escalates and period-over-period growth is calculated from a larger denominator. This compels revenue diversification or adjacent products that boost variable revenue against fixed cost.

This is precisely what Niantic recently did by expanding the capacity of its secondary revenue stream for in-game brand sponsorship. Previously available to multi-location brands like McDonald’s and Starbucks, it will now tap into the long-tail SMB marketplace.

The question is if this will help sustain growth rates as the core IAP revenue stream matures. Niantic can also grow IAP through other means like geographic expansion. The U.S. currently leads in revenue ($335 million) followed by Japan ($286 million) and Germany ($54 million).

This will be worth watching, as early industry leaders like Niantic do the industry a favor through the large-scale deployment. That can uncover key market dynamics and demand signals which is valuable intelligence in early stages of any consumer technology. We’ll be tracking it closely.

*Sensor Tower’s Store Intelligence figures are extrapolated third party data based on consumer behavior in its network, rather than first-party data from Niantic. The data are still reliable as Sensor Tower’s network reach, and consistent methodology over time enable longitudinal analysis.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header Image Credit: Sensor Tower