In honor of yesterday’s announced launch date for Oculus Quest, we’d like to revisit a key question: Will it accelerate mainstream VR adoption? Reviews are all positive, but is this VR’s “iPhone moment” as some say? (Spoiler: no).

In our 2019 predictions, we pegged Quest’s sales this year at about a quarter of a million units. This of course takes into account the expected mid-year launch. Our Oculus Go projection by comparison is 1.7 million units in 2019, given a full year runway and a lighter price tag.

Price is a big factor at this early and unproven stage of VR. ARtillery Intelligence consumer survey data with Thrive Analytics (n=1,959) indicate that demand inflects at $200 and $400. Those happen to be the all-in price points for base-models Go and Quest, respectively.

As background, Facebook’s long-game strategy compels aggressive pricing, a la loss-leader approach, to establish its platform. Early market share is the name of the game in platform wars as it attracts developers, which grow the content library to attract more users – a virtuous cycle.

Magic Number

As such, Go and Quest are dispatched to bring more people into VR. Lower price tags mean spec compromises, but it’s a deliberate tradeoff (specs for scale). TechCrunch’s Lucas Matney likens Quest to the “Nintendo Switch of VR” — trading specs for overall experience, ease and versatility.

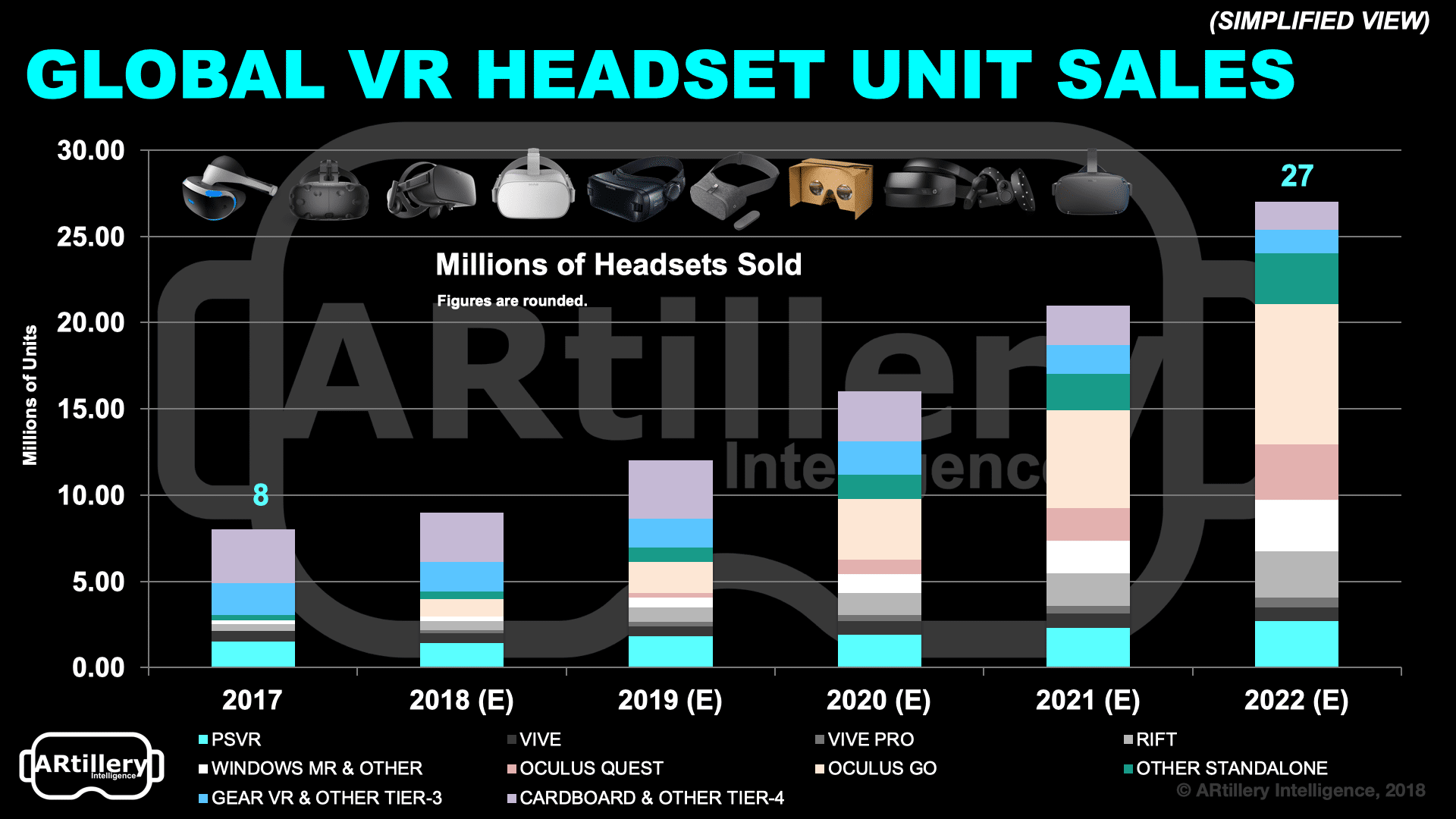

So what will the market impact be? We’ll continue to see aggressive price competition from Oculus, which will benefit consumers, accelerate adoption to some degree, and further contract the market. Go and Quest will increase their headset (unit) market share lead as charted above.

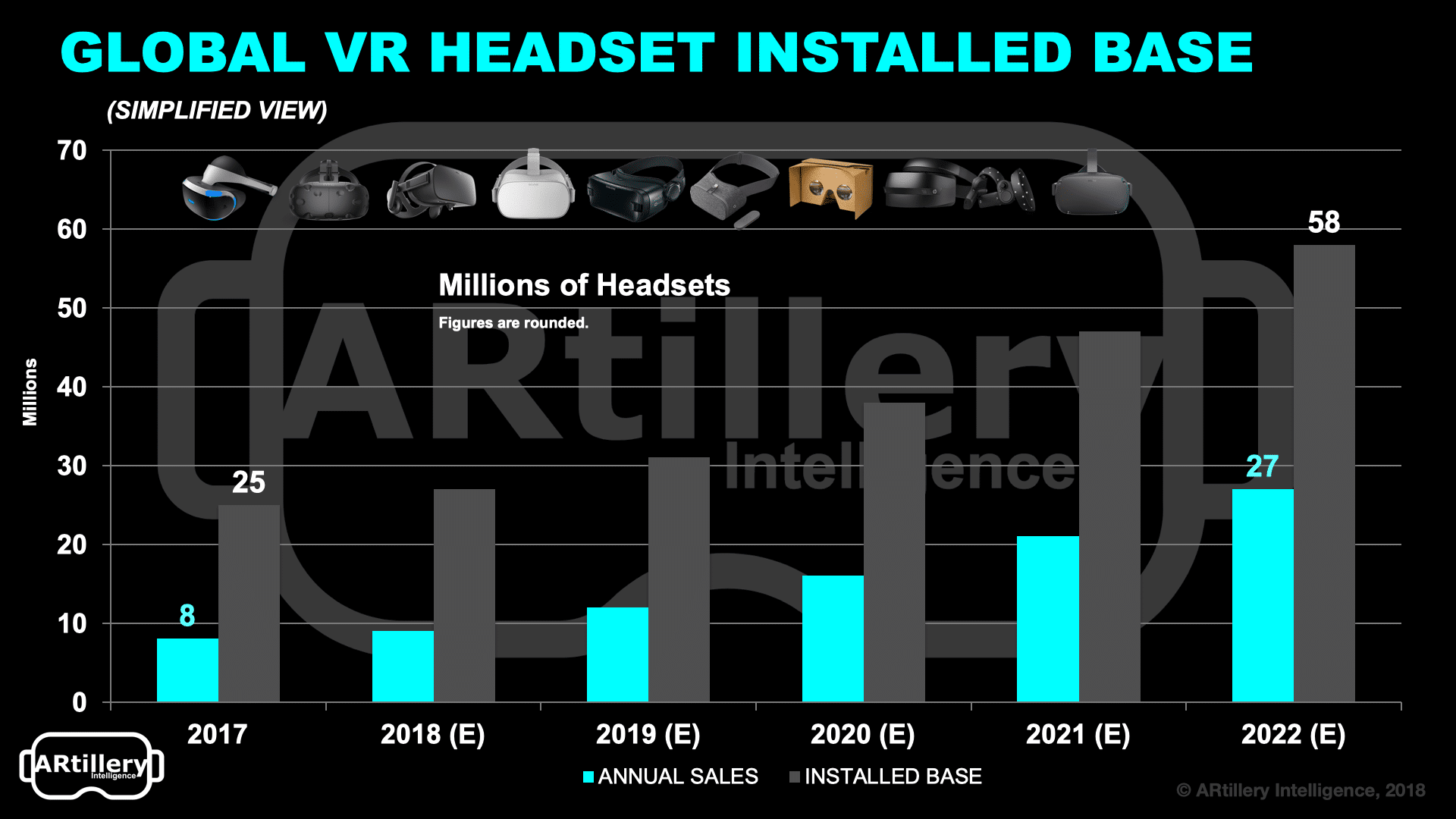

Meanwhile, VR’s overall installed base will reach 31 million in 2019, on its way to 58 million by 2022. That’s still a fragmented set of headsets but could consolidate as the VR hardware landscape matures and as Facebook/Oculus’ platform strategy — per the above — plays out.

That overall installed base won’t reach the “magic number” of 100 million units in the foreseeable future. 100 million is a historically validated milestone for hardware segments to reach a “flywheel” cycle of incentive for content creation, followed by accelerated consumer adoption.

One Good Reason

Another way to look at the 100 million figure is that there are very few products that reach ubiquity that have a price tag over $500. Your car, smartphone and flat-screen TV are on that short list but it’s an exclusive club. This is another reason price competition took over consumer VR in 2018.

The VR industry, led by Facebook, came to this sobering realization last year, and is well on its way to acceptance that VR won’t be the ubiquitous consumer product dreamed circa 2016. But that doesn’t mean it can’t grow into an opportune sub-segment of consumer entertainment.

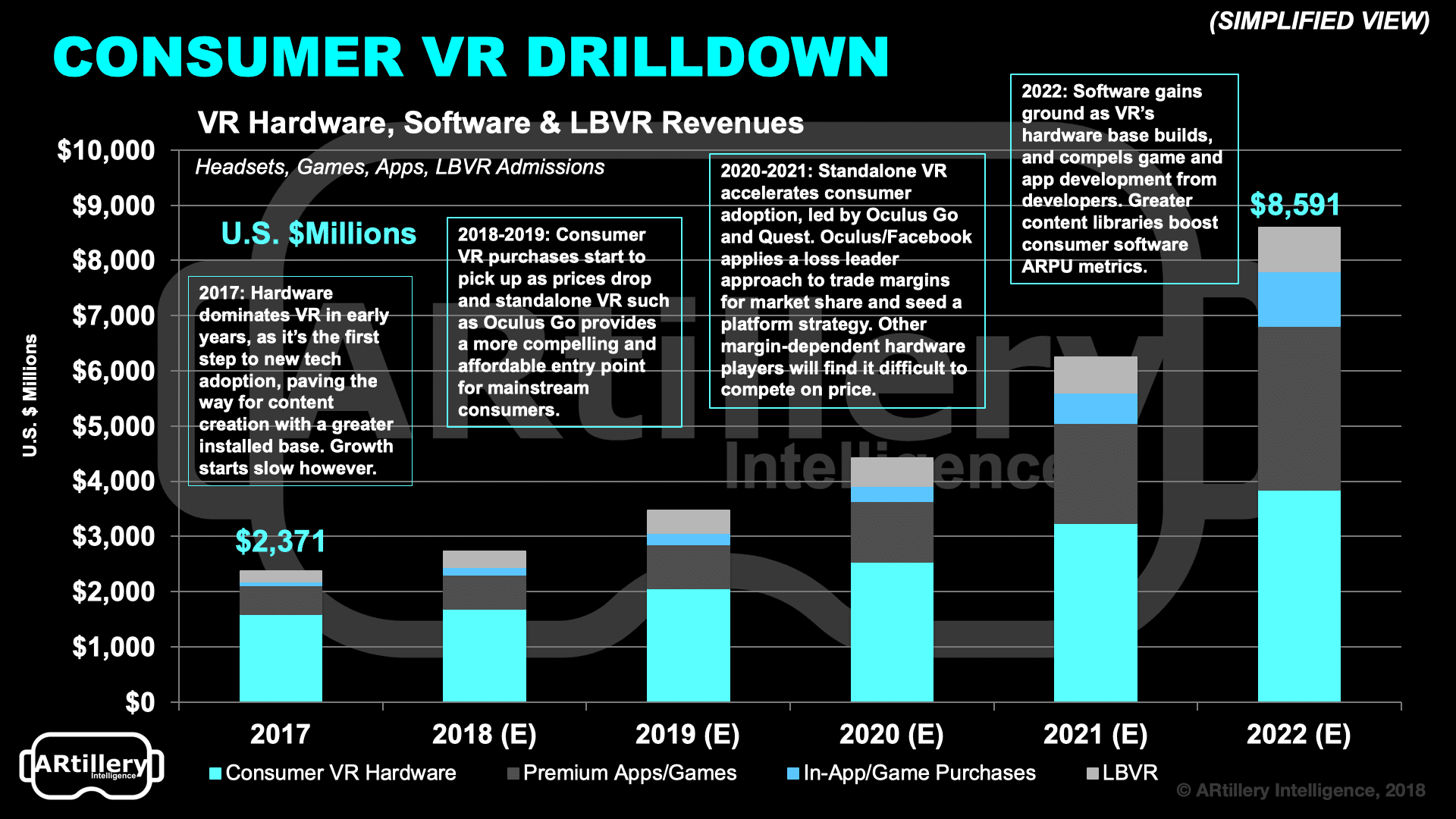

Specifically, we project consumer VR to grow to $3.5 billion next year and $8.6 billion by 2022. That’s led by hardware in the near term, with software’s share increasing as it builds on a larger installed base, and as refresh rates (or game purchases) outpace hardware replacement cycles.

For anything greater than that, VR needs a more compelling reason to buy, or a killer app. We’re with Charlie Fink: outside of VR circles, there’s not really one solid answer to the question of why one should buy VR. There are lots of little answers, but that’s not going to cut it for regular folks.

Quest Love

Speaking reasons to buy a headset, a related question is what will Oculus Quest’s content library look like? If it’s to be the adoption accelerant that many say it will be, content will be key per Fink’s assertion. This is underscored by the fact that it will be a closed system, compared to Rift.

We already have a glimpse, with 50 titles announced for Quest’s launch. And there are clues to where the content library could go. Working backward from the device’s specs — similar to that of an Android phone — Quest experiences could follow the current path of mobile games.

This can be linked to the revenue-driven optimization of games like Fortnite for smartphones. Ars Technica’s Sam Machkovech points out that this leads to lots of 3D experiences on devices with Snapdragon 835… the same system on a chip (SOC) that will power Oculus Quest.

“It’s designed to be portable to manage heat and 3D power,” he said. “People have been making 3D games on Android and they’re getting better. You can take popular games — Pub G, Fortnight, Asphalt Nine — and play them on this exact SOC and get good 3D performance.”

Frame of Reference

Other things that will translate best to Quest include 6DOF experiences within relatively limited spaces that people set up with the indoor-only Insight tracking system. That correlates to untethered, though still room-scale, range of motion like Beat Saber which is a launch title.

There will be successful ports, but native Quest titles will grow as its installed base attracts developers. Those will eschew Rift-like photorealistic and textured graphics for processing-friendly polygon counts (think: Superhot) or cartoonish fodder — again a Nintendo-like approach.

“I think you’re going to see painting and sculpting apps like Tilt Brush. You’re going to see world exploration like Google Earth, and fun toy games like Job Simulator,” posed Machkovech “[These] have certain compromises so that they’ll run on weaker computers.”

But in the end, these price-driven spec compromises may be moot for most users. If Quest fulfills its goal to bring new users into VR, they won’t be slighted by “lesser” specs, for which they have no frame of reference. So it will once again come down to price, content and marketing.

In that sense, Quest is exactly what VR needs right now. It will put a dent in mainstream adoption and has already sold out its first three days of inventory. But device quality aside, larger forces and market factors indicate that we could be waiting longer for the industry’s iPhone moment.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image credit: Facebook/Oculus