“Behind the Numbers” is AR Insider’s series that examines strategic takeaways from ARtillery Intelligence data. Each post drills down on one topic or chart. Subscribe for access to the full library and other knowledge-building resources.

VR continues to show early-stage characteristics, including erratic interest and investment. But how big is it, and how big will it get? AR Insider’s research arm ARtillery Intelligence has quantified the revenue position and outlook, resulting in the fourth and latest wave of its VR forecast.

Built from daily market coverage, insider interviews and 15-years of market-sizing experience, ARtillery Intelligence has constructed disciplined and independent forecasting models. The analysis is segmented into several revenue categories and the methodology can be seen here.

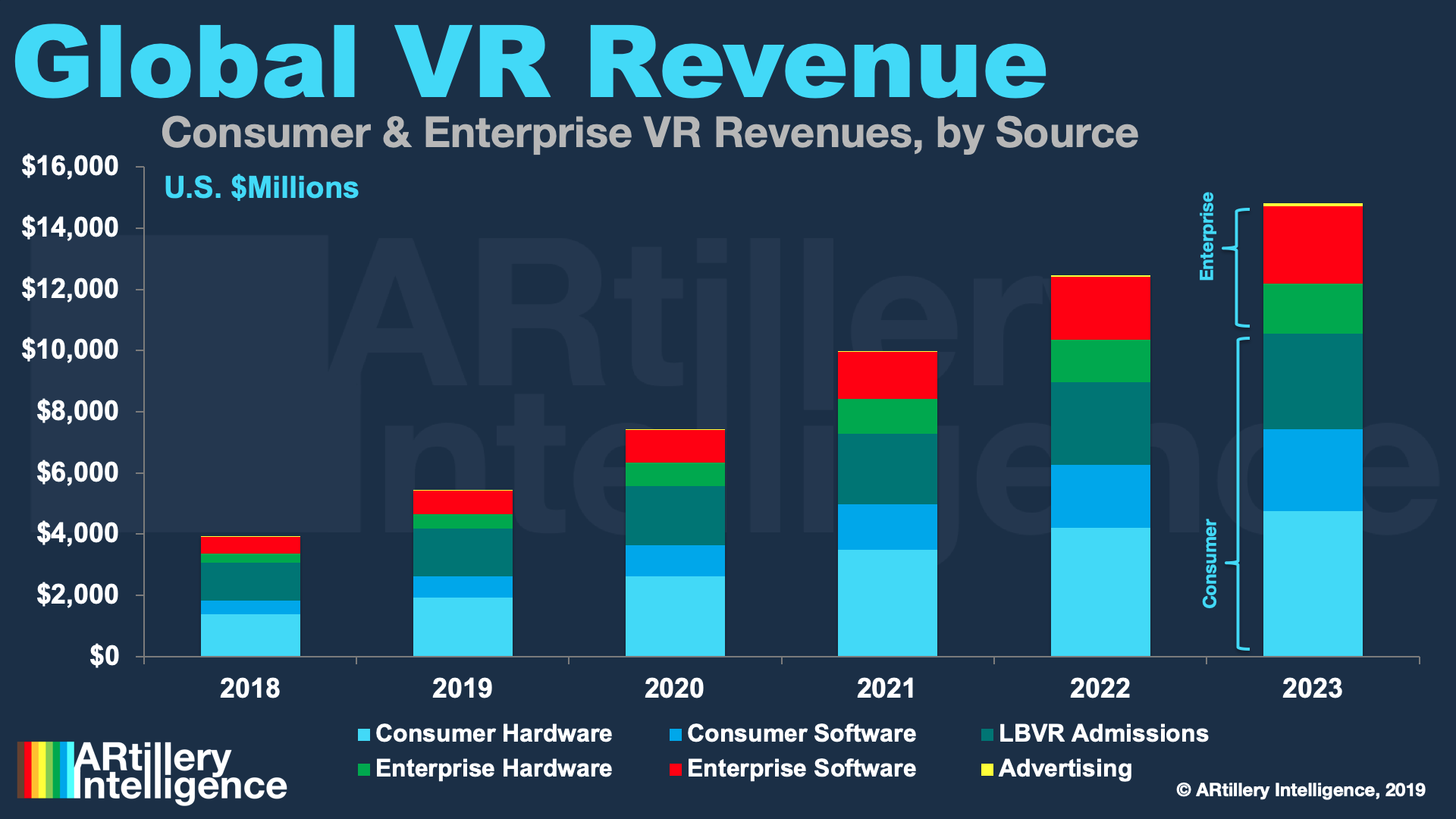

So what were the results? At a high level, the firm projects VR revenues to grow from $3.9 billion last year to $14.8 billion in 2023, a 31 percent CAGR. That includes lots of moving parts and sub-sectors including consumer, enterprise, hardware, software, advertising and LBVR.

Drilling Down on Consumer VR

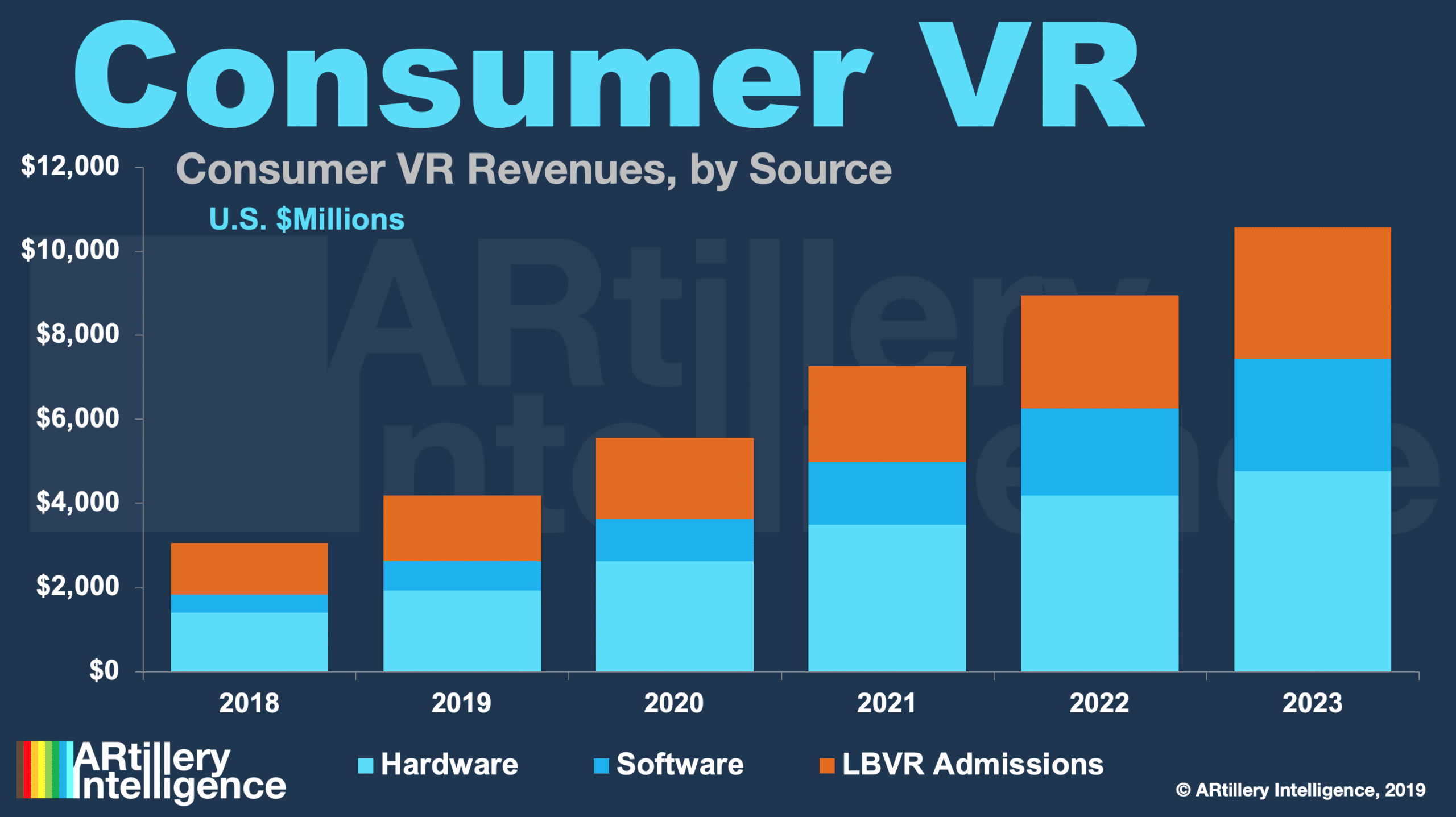

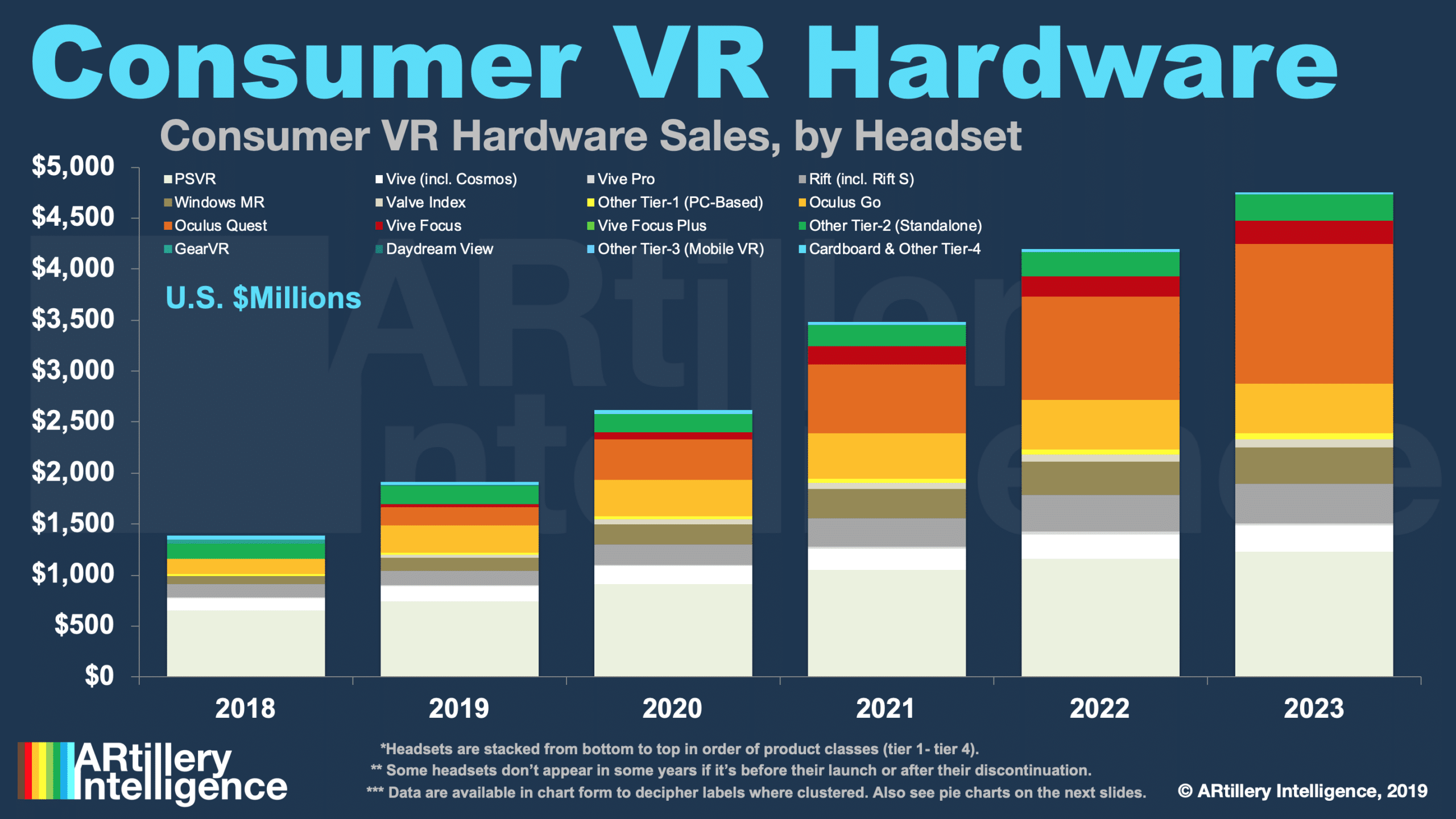

Drilling down into one of those areas, how does consumer VR revenue look? The forecast projects it to grow from $3.1 billion in 2018 to $10.6 billion in 2023. That includes things consumers pay for such as hardware (headsets) software (games, apps) and LBVR admissions.

Revenue will be hardware-dominant in early years as an installed base is established. Over time, software will gain ground with a faster refresh rate, and as a larger cumulative installed base incentivizes VR content creators to invest in long-form content, as examined last week.

To wrap some numbers around that, consumer hardware has a 35 percent share of overall VR revenues which shrinks to 32 percent by 2023. Meanwhile, consumer software has a 13 percent share of overall VR revenues in 2019, projected to grow to 18 percent by 2013.

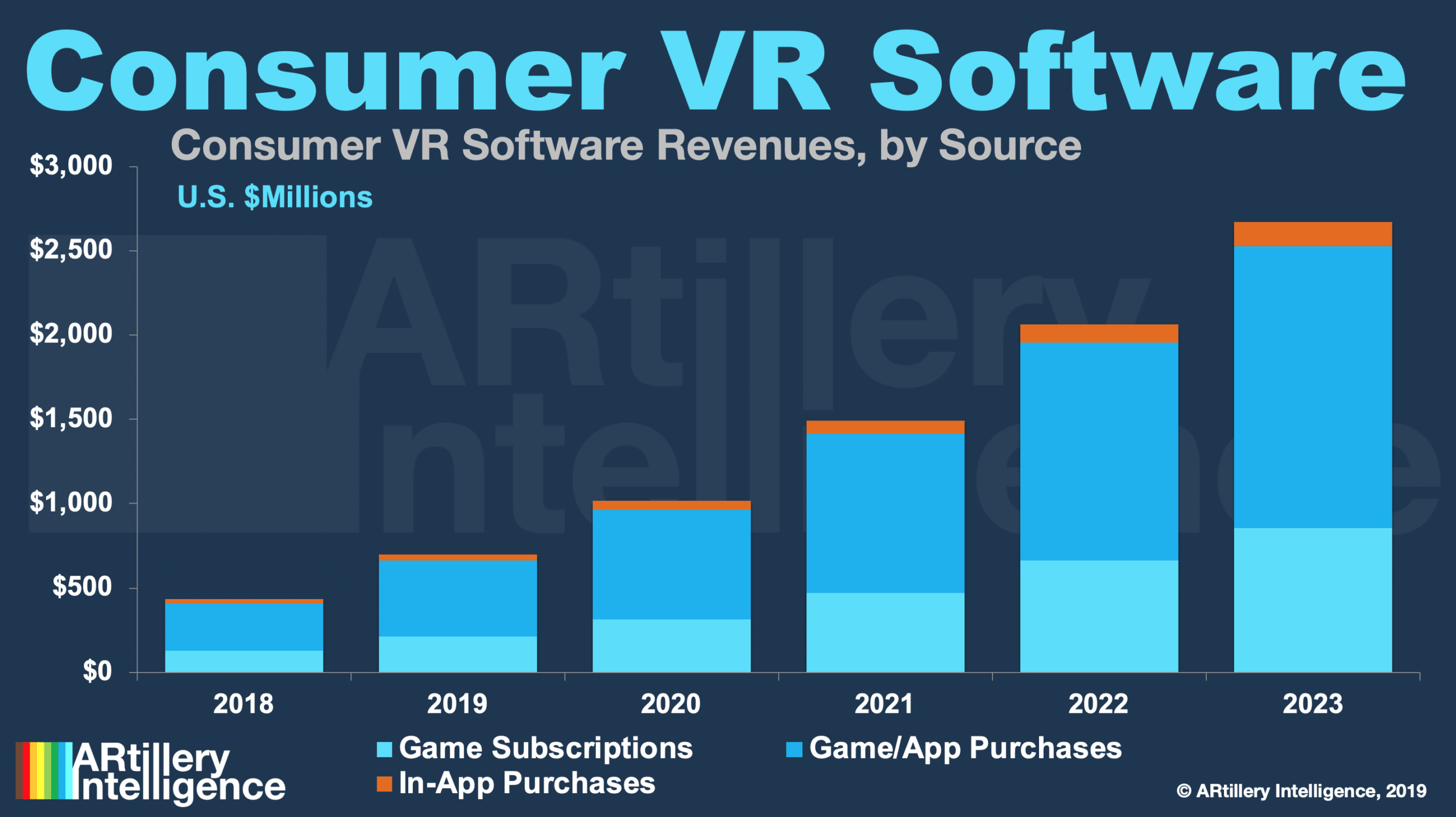

This growth in software’s share of spending will result in more robust VR content libraries, more users, and greater software spending per user (ARPU). Premium apps will dominate software revenues (just like in console gaming) but in-app purchases will gain revenue share over time.

Demand Inflections

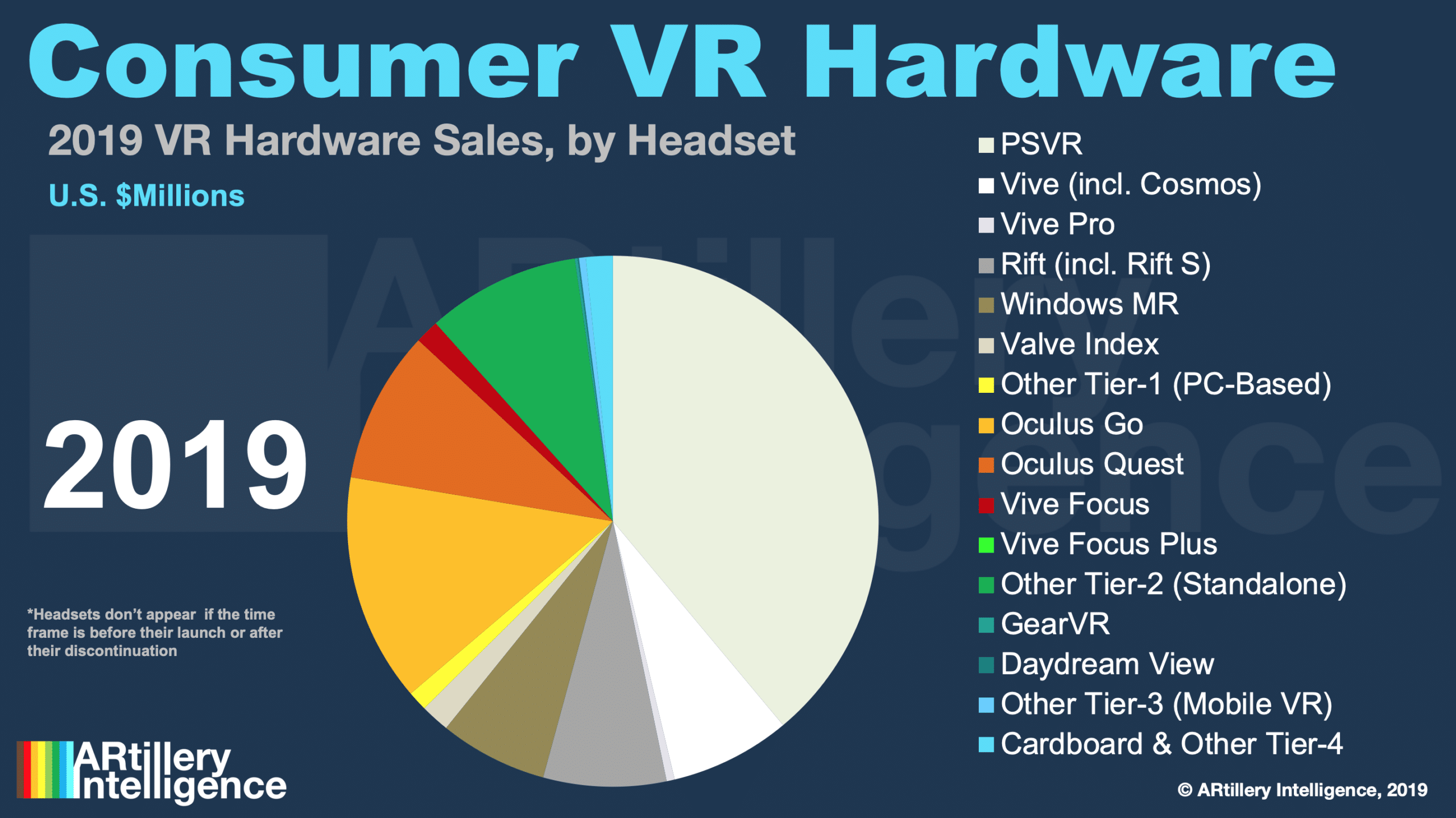

As for consumer hardware leaders, PlayStation VR (PSVR) continues to lead the pack. It’s momentum is fueled by price and installed base of 100+ million PlayStation 4 consoles. But its share will start to diminish, given the rise of standalone VR, most notably Oculus Quest.

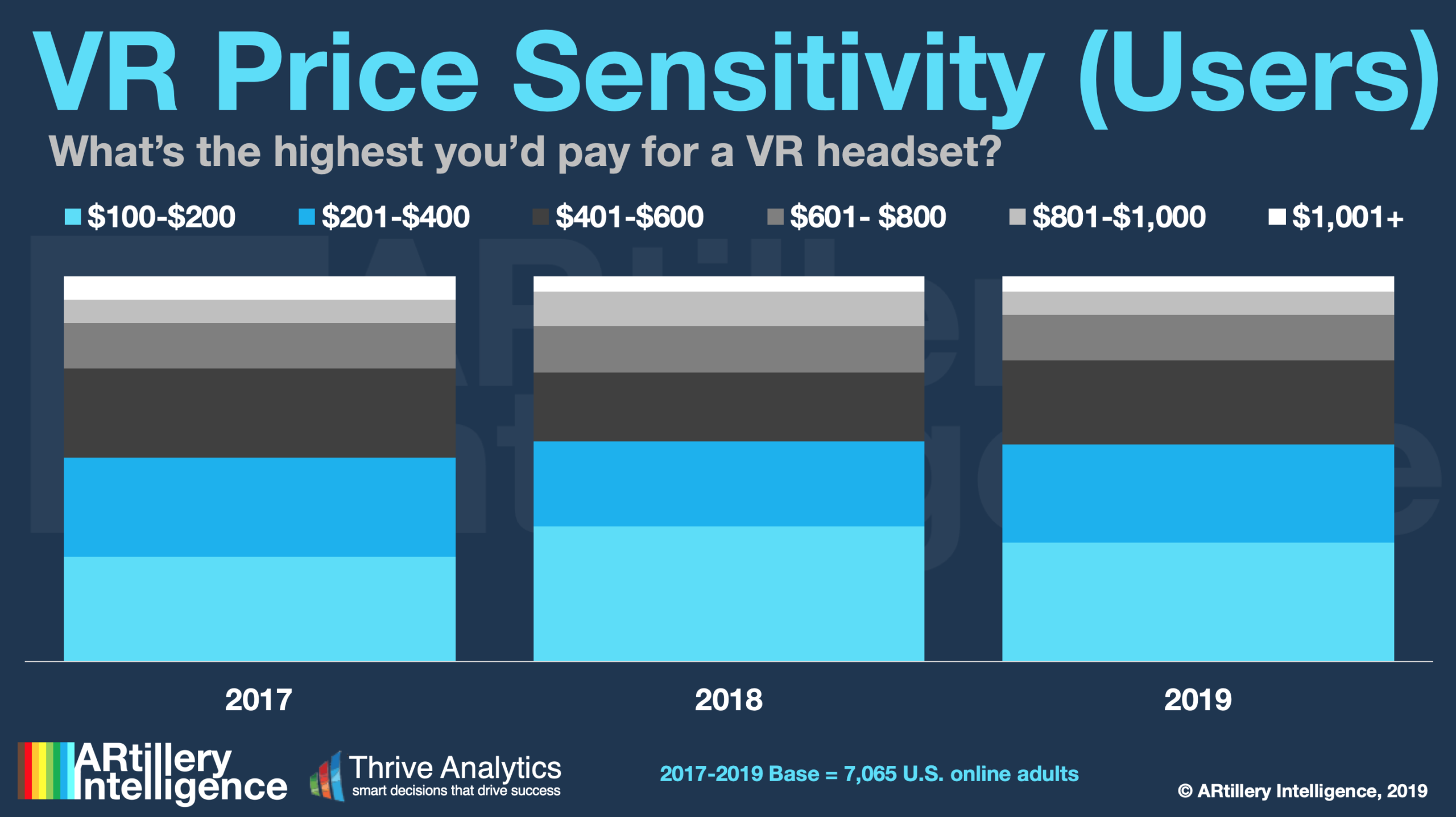

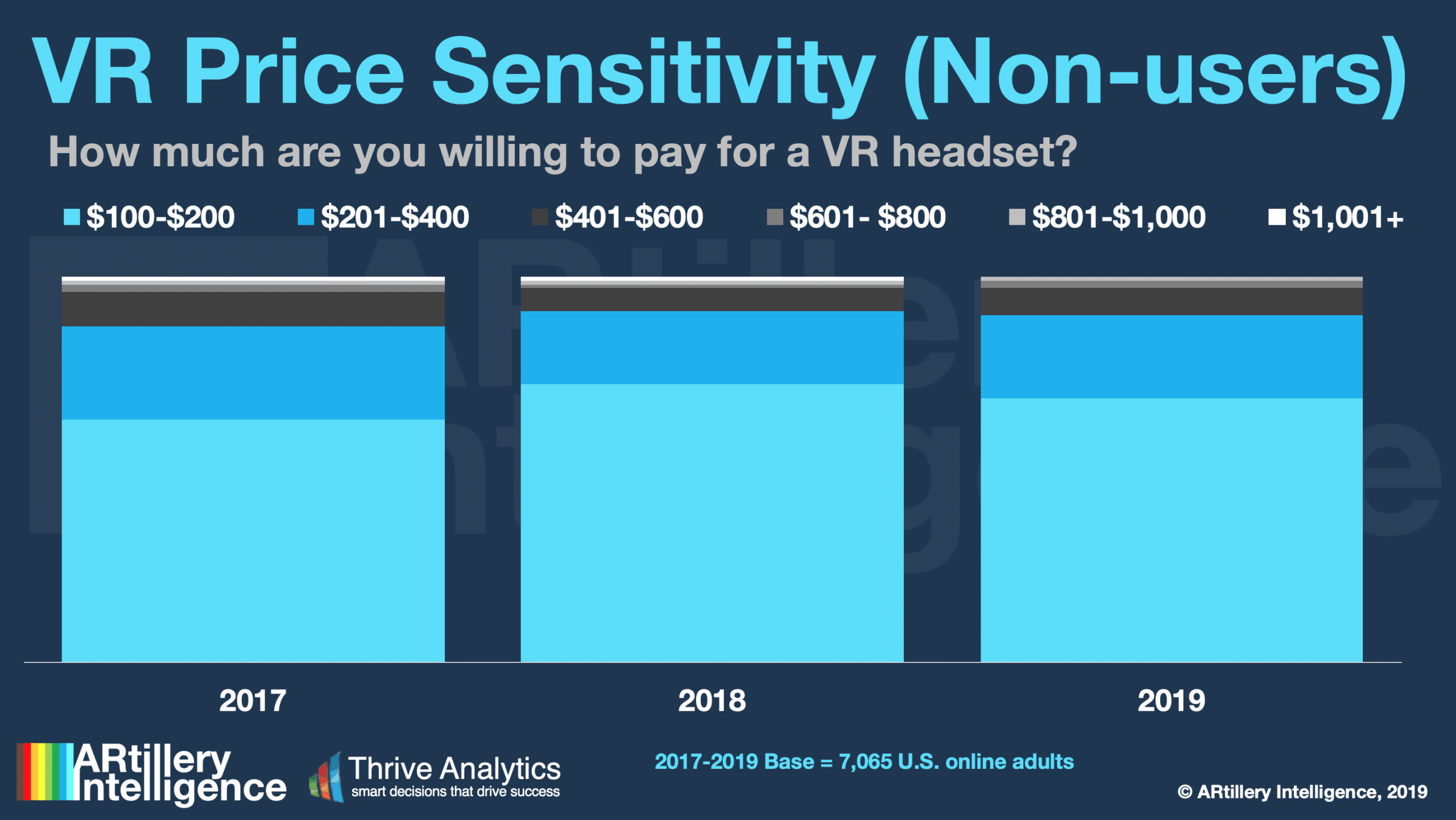

In fact, the greatest share gains in this five-year outlook will be with standalone headsets such as Oculus Go and Quest. These happen to be at the price points — $199 and $399 respectively — where demand inflects according to ARtillery’s consumer survey data with Thrive Analytics.

In the near term, several signals from Oculus Quest inform ARtillery’s projections that it will reach 470,000 units and $202 million in revenue in 2019. That will be partly fueled by its initial Q2 launch blitz, and Q4 holiday season. The device is currently sold out on Amazon.

Price competition among headset manufacturers will correspondingly accelerate consumer adoption in the aggregate. Oculus in particular has the advantage of Facebook-backing in order to apply loss-leader pricing to strategically prioritize market share over margins.

That will give it a strong competitive position versus players that are dependent on nearer-term hardware revenue. That mostly applies to the mass market: other headsets will develop strong (albeit narrower) higher-end use cases for enthusiasts, such as Valve Index and VIVE PRO.

Lastly, location-based VR (LBVR) admissions are the second largest consumer VR revenue source, though that will recede over time. Currently at 32 percent of VR revenues, they will have 21 percent by 2023, as barriers to VR ownership lower (e.g. cost, cultural acceptance).

Cautiously Optimistic

Panning back, ARtillery Intelligence’s position on VR revenue growth is best characterized as cautiously optimistic. Scale will come, but slower than many industry proponents have thought, due mostly to the pace of adoption and other signals ARtillery Intelligence tracks.

In fact, you may notice that VR revenue projections in outer years are lower than other figures you may have seen. They’re also lower than ARtillery’s past estimates, as it adjusts to market signals. This is common in industry forecasting, as market watchers course-correct to market variables.

Stay tuned for more forecast tidbits and insights over the coming weeks. Meanwhile, find out more about the report methodology/inclusions or access the entire thing here. There will be lots to unpack as the VR market unfolds with a combination of expected and unexpected outcomes.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.