ARtillery Briefs is a video series that outlines the top trends we’re tracking, including takeaways from recent reports and market forecasts. See the most recent episode below, including narrative takeaways and embedded video.

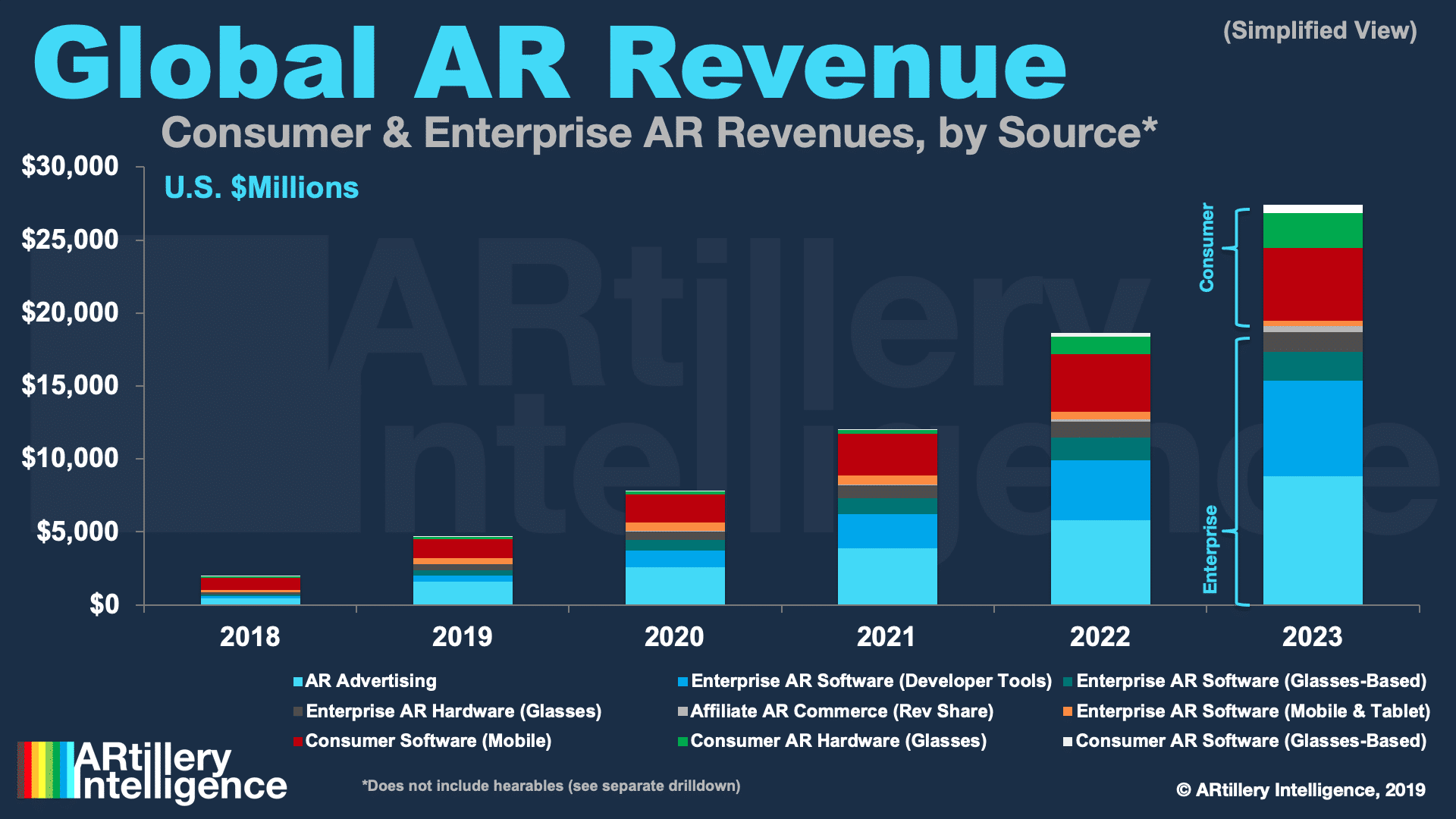

In any technology’s early stages, consumer market successes are relatively rare. That depends on your definition, but we’re talking about large-scale revenues. So a lot can be learned from early leaders. What are they doing right? How are they engaging users? How are they making money?

These are key questions in consumer AR, as there’s no standardized playbook just yet. So extracting and synthesizing early lessons is the name of the game. ARtillery Intelligence’s latest report — and Briefs episode below — does just that, continuing in Part II of the series with Niantic.

Just the Right Amount of AR

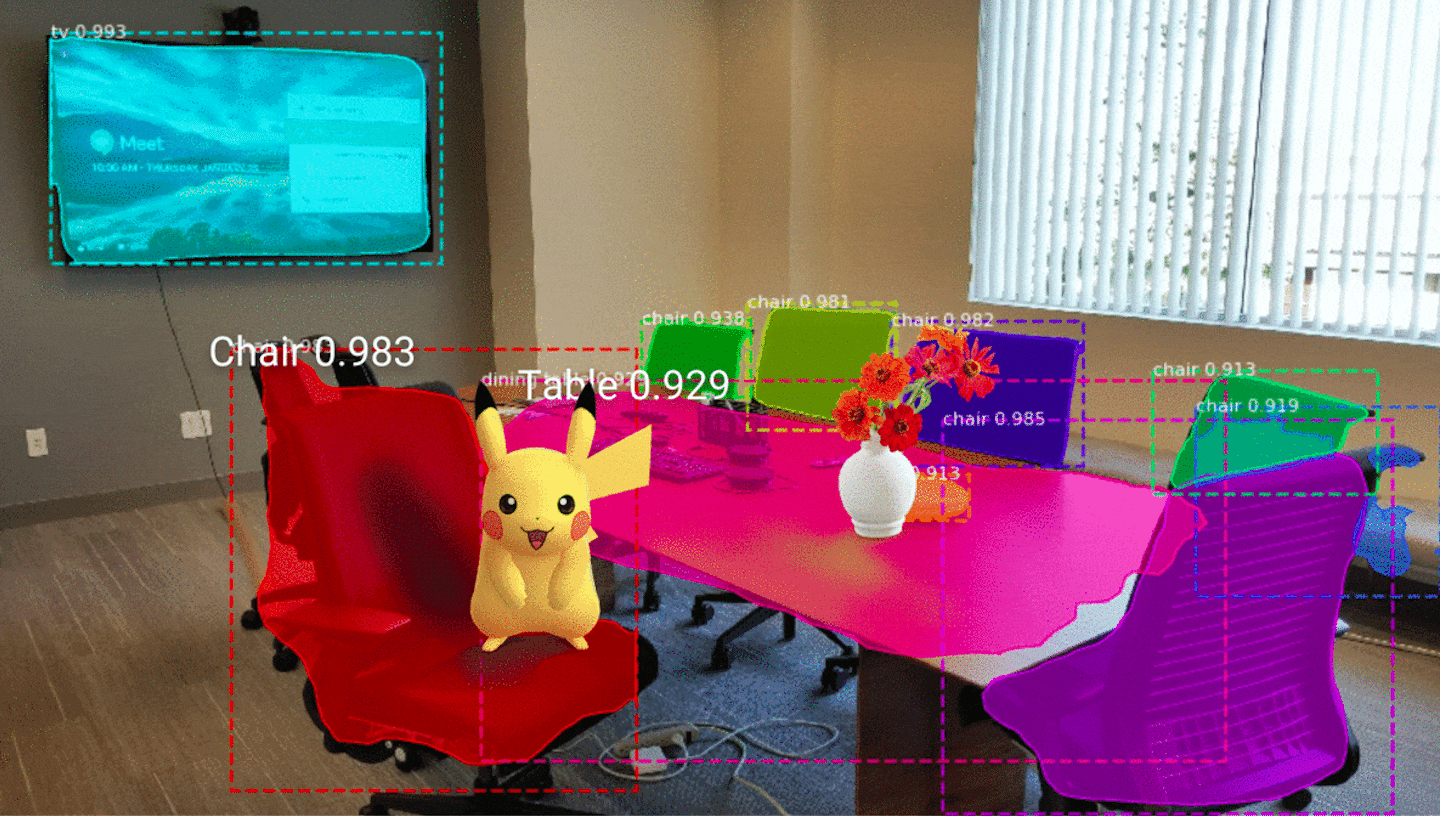

Pokémon Go has popularized AR in mainstream culture. And its credibility as an AR benchmark and strategic exemplar lies in its performance. It’s exceeded $3 billion in lifetime revenue, including its highest annual revenues to date in 2019 with $894 million in player spending.

Its achievements not only include traction and revenue, but sustainability. This is rare for mobile games, which often lose novelty and engagement over time. Pokémon Go has avoided this with a combination of game mechanics and updates like AR+ Mode, Snapshot and Buddy Adventure.

Broader success factors come down to design principles like applying AR sparingly. AR activation averages 2-3 minutes per session and usually to pose with captured Pokémon. This takes into account impracticalities of an upheld phone during long stretches of the game’s migratory play.

In other words, Niantic hasn’t overplayed it’s AR hand. It’s observed user behavior and leaned into it, resulting in features like Snapshot that apply just the right amount of AR interaction. Ultimately, AR can enhance an experience but isn’t yet a product in itself, which Niantic has taken to heart.

Behavioral Economics

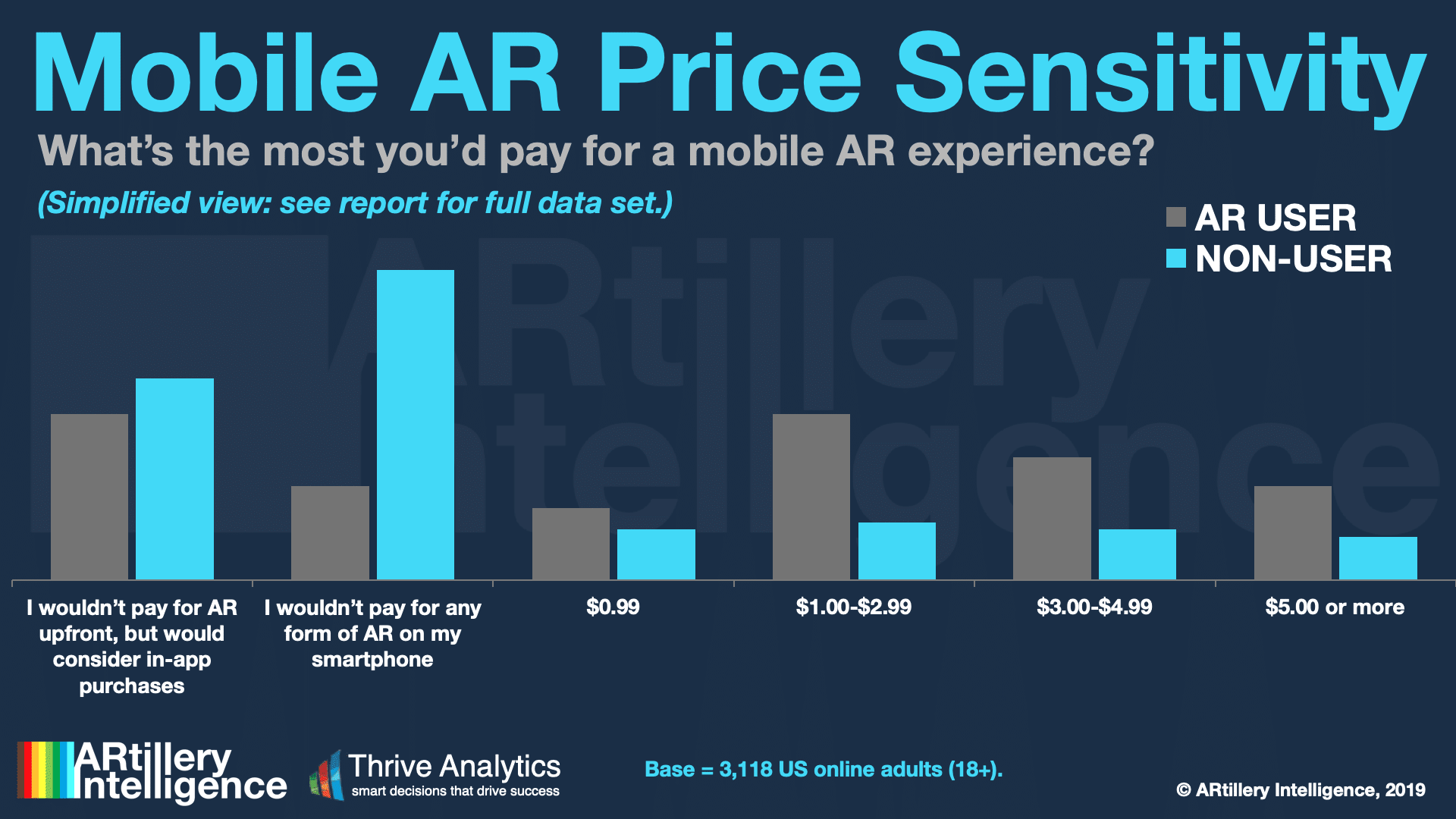

Beyond product design and game mechanics, Niantic should be examined for business model innovation. In-app purchases (IAP) comprise most of its revenues cited above. This has validated the model in AR, as the technology isn’t proven enough to compel a premium app model.

IAP also builds on the behavioral economics of microtransactions, proven in the broader gaming world. Consumers are acclimated to IAP from games like Fortnite and Candy Crush. ARtillery Intelligence consumer survey data with Thrive Analytics further validate comfort levels with IAP.

Other revenue growth will come as Niantic finds adjacent revenue streams, such as location-based sponsorship to drive measurable foot traffic to local businesses. That’s been used by large brands like McDonald’s, but Niantic recently opened it up to the long-tail SMB market to self serve.

Perhaps most notably, its Real World Platform will be another revenue stream as Niantic continues to mature and diversify. For those unfamiliar, Real World Platform is the engine behind Pokemon Go, which Niantic has decided to package up and offer to other game developers as a platform.

AR as a Service

Real World Platform could end up being be Niantic’s long-term primary business. Applying best practices, scaling capacity and architecture from Pokémon Go, it will be a valuable tool for developers. This “AR-as-a Service” play represents an opportune area of AR’s next era.

Real World Platform will also continue to evolve towards Niantic’s “planet-scale AR” ambitions. This could reach a network effect as apps built on the platform deploy far-flung users to not just use the data but feed data back (think: Waze) and strengthen its collective area-mapping.

Stepping back, Niantic’s AR scale has allowed it to experiment in all of the above ways and provide validated lessons. So it’s doing the AR industry a favor in shining a light on product and business model mysteries. That means anyone developing consumer AR should watch closely.

See more in the ARtillery Briefs episode below, and the full report, which includes data, success factors and in-depth analysis. Also check out Part III of this report which dives deep on emerging players in AR who hold lots of promise like TiltFive, 8th Wall and even Instagram as a new entrant.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.