![]() This post is adapted from ARtillery Intelligence’s report, AR Advertising Deep Dive, Part I: The Landscape. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

This post is adapted from ARtillery Intelligence’s report, AR Advertising Deep Dive, Part I: The Landscape. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

AR continues to evolve and take shape as an industry. Prominent sectors include industrial AR, social, gaming, and shopping. But existing alongside all of them is AR advertising. This includes paid/sponsored AR lenses that let consumers visualize products on “spaces & faces.”

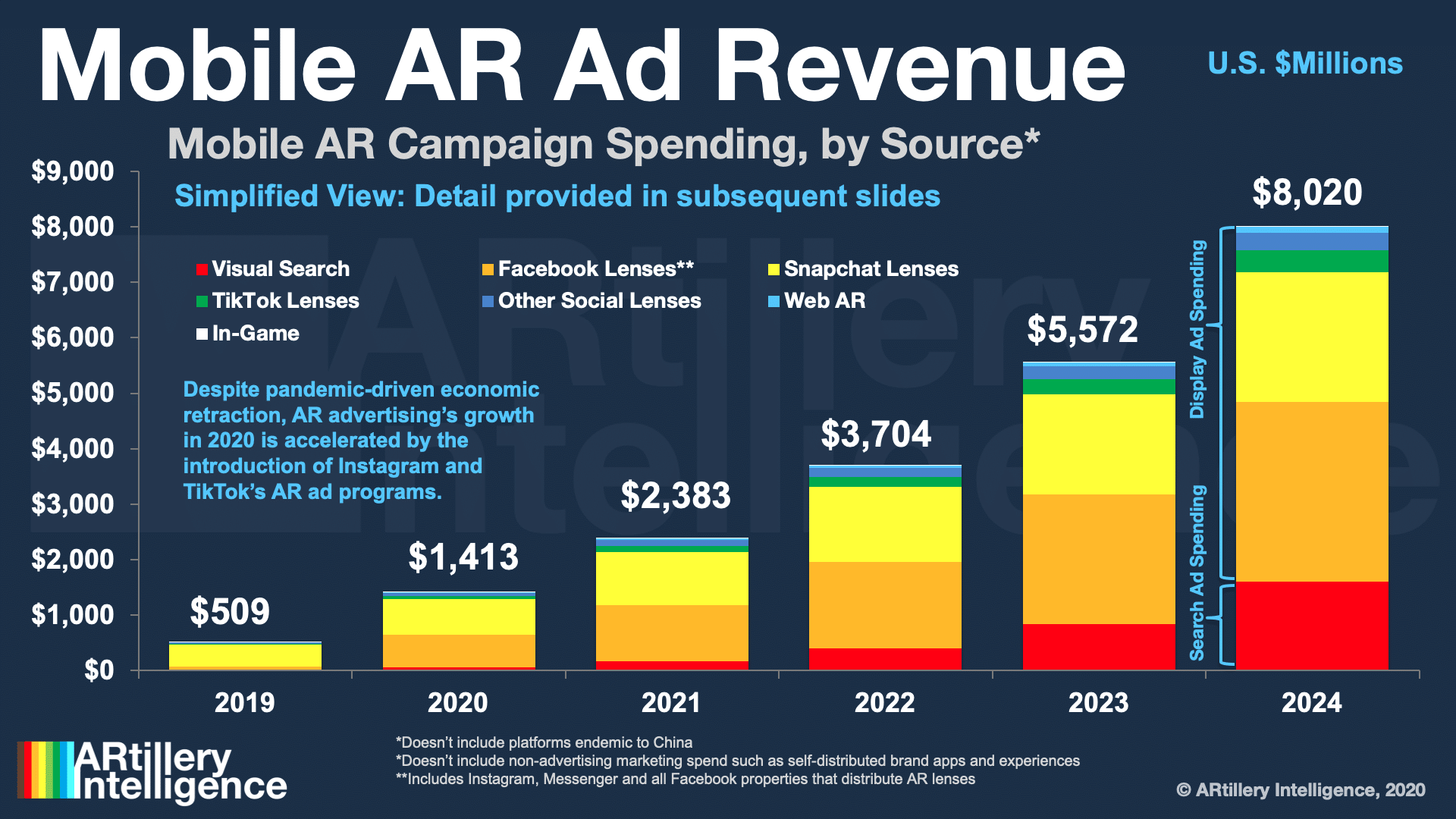

Advertising is one of the most lucrative AR subsectors, on pace to reach $1.41 billion this year and $8.02 billion by 2024. These figures measure the money spent on sponsored AR experiences with paid distribution on networks like Facebook and Snapchat.

As we’ve examined in past reports, the factors propelling this revenue growth include brand advertisers’ growing affinity for AR. Its ability to demonstrate products in immersive ways resonates with their creative sensibilities, transcending what’s possible in 2D formats.

Beyond that high-level appeal, there’s a real business case. AR ad campaigns continue to show strong performance metrics. This was the case in “normal” times and has accelerated during the Covid era when retail lockdowns compel AR’s ability to visualize products remotely.

Doubling Down

Picking up where we left off last week in defining AR advertising and its competitive landscape, it’s now time to zero in on who’s doing what… starting with Snapchat.

Snap has long labeled itself as a camera company. That designation naturally aligned with the current wave of mobile AR excitement, likely by design. But even as AR slogs through what some call the “trough of disillusionment,” Snap is doubling down on its vision for an AR future.

This involves three-levels that map to Snap’s constituents: developers, users and advertisers. A greater volume of lenses attracts users and boosts engagement rates. That growing audience attracts more lens developers which further expands the library and, in turn, attracts more users.

This virtuous cycle then achieves the ultimate goal of attracting advertisers who want to get in front of Snap’s engaged and demographically-attractive users. In fact, the emerging Generation-Z is already showing affinity for Snapchat lenses, with 40 percent reporting engagement.

Step 1: Developers

Expanding on the virtuous cycle, developers are the starting point, which Snap has begun to realize and accommodate. It’s come a long way from initially keeping AR lens design in-house. With Lens Studio, it opened up lens creation to developers, thus scaling up volume and creativity.

More than one million lenses have been created as of Snap’s partner summit, and lens creators continue to ratchet up in number. This follows Snap’s move to open the Lens Studio platform and make it increasingly accessible. Some creators can make as much as $40,000 per month.

That’s a notable flip from Snapchat’s early AR lens experiences that were limited in volume and gated by a highly curated approach (which TikTok is currently doing as we’ll examine later in this report). It has since scaled up lens development with a steady flow of tools for lens creation.

That includes creator profiles that give developers a presence to promote their work and make it discoverable. There are also new templates for popular formats such as lenses that augment hands, bodies and pets. This handles the heavy computational lifting and simplifies lens creation.

In the same spirit, Landmarkers templatize AR lens creation for high-traffic places like the U.S Capitol Building. Developers can use those templates to infuse their own creativity. Templates also mean a focused set of subjects for which Snapchat has done the technical heavy lifting.

BYO-ML

Landmarkers are also smart in that Snapchat has concentrated its efforts in a smaller subset of locations, thus sidestepping the AR cloud challenge of recognizing every building and street in the world. It instead focuses on high-traffic areas that get the most bang for the spatial-mapping buck.

More recently, it launched Local Lenses for comprehensive geo-relevant AR. Snap also recently launched its Lens Web Builder, a browser-based tool to make lens creation even easier. Users and developers alike can create lens animations in just a few steps and without design expertise.

But the most notable platform update of the past year was Snap ML. This lets developers bring their own machine learning. So those that want to play inside of Snap’s walled garden for additional traction and distribution can migrate existing software into Lens Studio.

Launch partners include Wannabe’s popular shoe try-on AR app, and Prisma’s signature artistic selfie renderings. Altogether, Snap wins from a broader slate of AR, and developers win from greater distribution. Both win from incremental users that are attracted by new lenses.

We’ll pause there and circle back in the next installment to continue the discussion of how Snap is accomodating other key constituents in the AR virtuous cycle: users and advertisers. Stay tuned for that and other excerpts on the AR advertising landscape. Check out the full report here.