![]() This post is adapted from ARtillery Intelligence’s report, AR Advertising Deep Dive, Part I: The Landscape. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

This post is adapted from ARtillery Intelligence’s report, AR Advertising Deep Dive, Part I: The Landscape. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

Picking up where we left off last week in examining Snapchat’s “virtuous cycle” — developers, advertisers and users — it’s time to tackle the last two. Starting with users, Snap is the poster child in creating AR experiences that show high engagement levels.

Snapchat notably has done this by integrating AR with an existing behavior. AR enhances the already-prevalent act of selfie sharing. It’s also expanding beyond selfie lenses to the rear-facing camera to augment the outside world, thus a greater range of use cases.

So far, these non-selfie AR activations include World Lenses, Snapcodes, Local Lenses and song identification from Shazam. Through a partnership with Amazon, it’s also moved into visual search to identify physical-world products with your mobile camera.

AR Persona

Snapchat has also moved into a broader range of AI-fueled lenses with its Scan feature. This applies object recognition, then adds context-aware AR animations to a given scene. For example, gifs from Giphy can automatically and serendipitously animate related scenes.

“Now you can scan anything, and we’ll show you the most relevant lenses. Just press and hold the screen and we’ll show contextually- relevant gifs,” said Snap’s Bobby Murphy. “If you’re trying to solve a math equation, we’ll help you do that with our partner Photomath.”

These moves extend Snap’s AR persona from lenses to more utilitarian functions. That’s evident in solving math problems and a growing list of AI-fueled use cases. As we’ve examined, utilities like search and navigation are where AR killer apps could germinate.

Meanwhile, the above moves are proving out in terms of attracting users and getting them to engage on deeper levels. Snap currently reaches 170 million active AR users, and it has reported that many of them engage lenses as often as 30 times per-day.

On-Brand AR

The above usage levels are at the heart of Snap’s AR revenues because they attract brand advertisers. Snap’s real AR revenue driver is sponsored lenses, which let brands utilize the developer tools we examined last week to craft on-brand AR lenses.

The tools to do this are included in Lens Studio. Snap essentially gives this away as a loss leader to seed AR lens creation and thus drive a small share towards paid distribution. This paid lens distribution is similar in creation and workflow to Snap’s existing ad offerings.

This is a key point, as Snap doesn’t want to create friction for brands that are considering sponsored lenses. If they can fold it into existing campaigns and social advertising playbooks, it won’t force advertiser learning curves, nor raise barriers to adoption.

That said, the economics and ad rates of sponsored lenses will continue to shift with the supply and demand dynamics of the sector. Though Snap wishes to keep things simple and congruent with other ad formats, sponsored lens pricing will deviate to some degree.

Expanding Toolbox

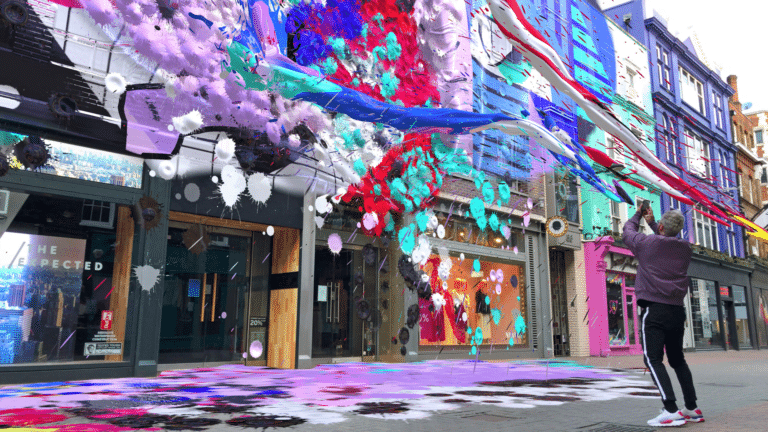

Meanwhile, capabilities continue to improve for brand advertisers, as they have access to the evolving set of tools in Lens Studio. This provides them an expanding toolbox for product animations for faces (cosmetics, etc.), and the larger canvas of the physical world.

This appeals to creative professionals at ad agencies or within the marketing departments of brand advertisers. Erstwhile stuck in confines of 2D media, they can flex creative muscles and see real results with AR-based immersive product try-ons and 3D product renderings.

One example is the NFL’s lenses for Superbowl LIII, featuring selfie animations for each team’s fans to show their support. They were viewed 303 million times, which is 3x the television viewership of the game itself. This shows AR’s potential for reach and scale.

By doing all of the above, Snap has become the AR ad revenue leader (see above). It also attributes AR to its notable stock market rebound. Beyond that, it broadly sees AR as a core part of its business as a camera company. So it will continue to triple down on it.

We’ll pause there and circle back in the next installment to continue the discussion of AR advertising players and their strategies. Next up: Facebook. Stay tuned for that and other excerpts on the AR advertising landscape. Check out the full report here.