![]() This post is adapted from ARtillery Intelligence’s report, AR Advertising Deep Dive, Part I: The Landscape. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

This post is adapted from ARtillery Intelligence’s report, AR Advertising Deep Dive, Part I: The Landscape. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

AR continues to evolve and take shape as an industry. Prominent sectors include industrial AR, social, gaming, and shopping. But existing alongside all of them is AR advertising. This includes paid/sponsored AR lenses that let consumers visualize products on “spaces & faces.”

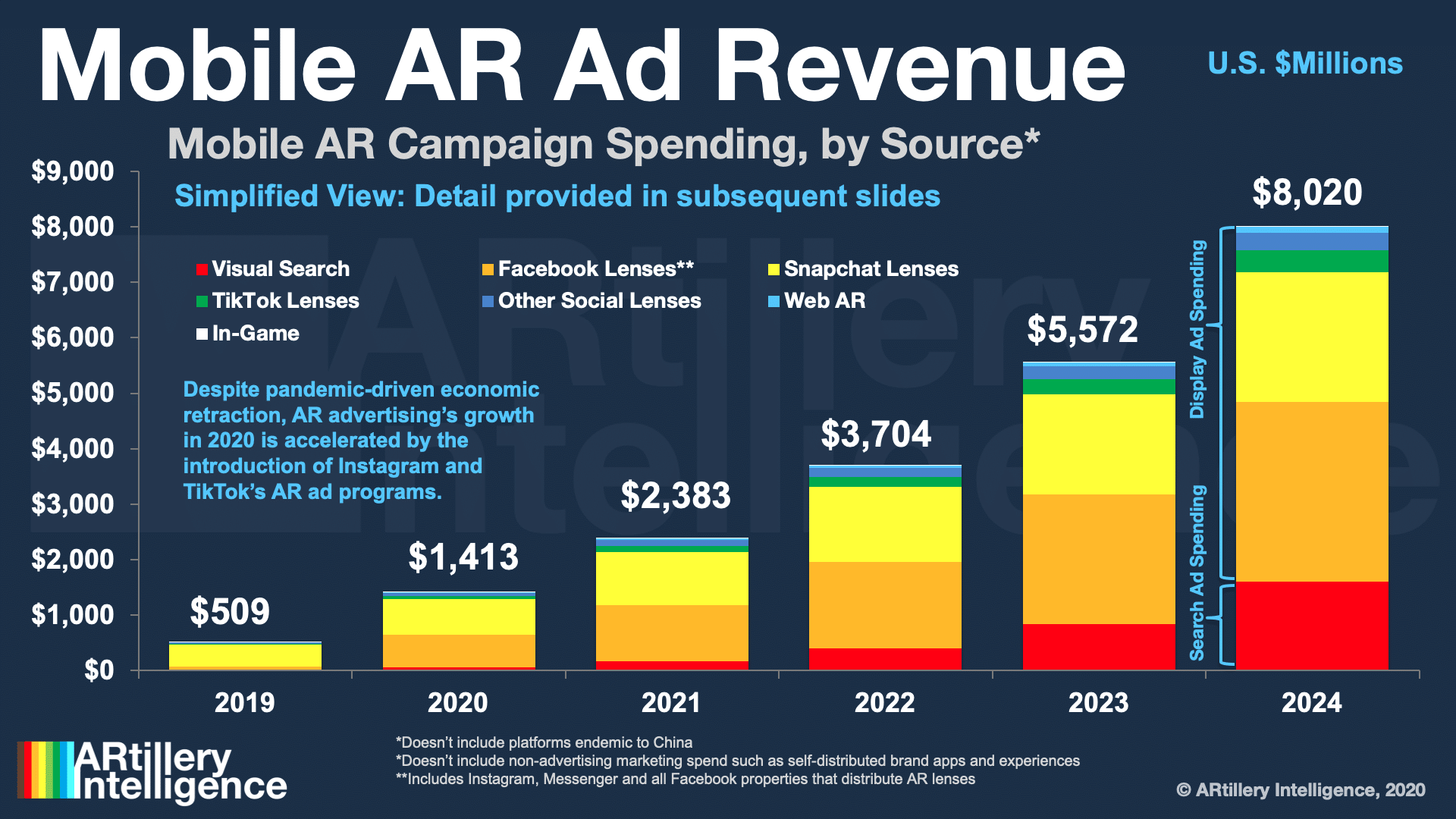

Advertising is one of the most lucrative AR subsectors, on pace to reach $1.41 billion this year and $8.02 billion by 2024. These figures measure the money spent on sponsored AR experiences with paid distribution on networks like Facebook and Snapchat.

As we’ve examined in past reports, the factors propelling this revenue growth include brand advertisers’ growing affinity for AR. Its ability to demonstrate products in immersive ways resonates with their creative sensibilities, transcending what’s possible in 2D formats.

Beyond that high-level appeal, there’s a real business case. AR ad campaigns continue to show strong performance metrics. This was the case in “normal” times and has accelerated during the COVID era, when retail lockdowns compel AR’s ability to visualize products remotely.

Ace Up Its Sleeve

Picking up where we left off last week in defining Facebook’s AR platform play and developing ad business, it’s time to zero in on its the Ace up its sleeve: Instagram. Its 500 million daily active users and camera-centric use case are more aligned with AR than other Facebook properties.

These are all reasons why Facebook launched its Spark AR developer platform on Instagram. Following its launch last August, we’ve seen steady feature updates such as the recent addition of filters that interact with music or animate previously-published Instagram photos.

That will continue to grow and follow the same progression we’ve seen on Facebook’s other properties. This entails a period of user acclimation, community lens creation, followed by monetization. The latter is where brands create and distribute lenses at meaningful scale.

Facebook is motivated to make all of this happen because it continues to run low on ad inventory on the flagship News Feed. Because that’s its core product which it doesn’t want to oversaturate with ads, it’s looking to untapped ad inventory in places like Messenger and Instagram.

Besides financial motivation, Facebook knows AR “fits” on Instagram and it wouldn’t force an unnatural union. Not only does it fit from a user perspective, but with Instagram’s appeal as a promotional vehicle. It has cultivated a natural shopping and product-discovery use case.

Shoppable AR

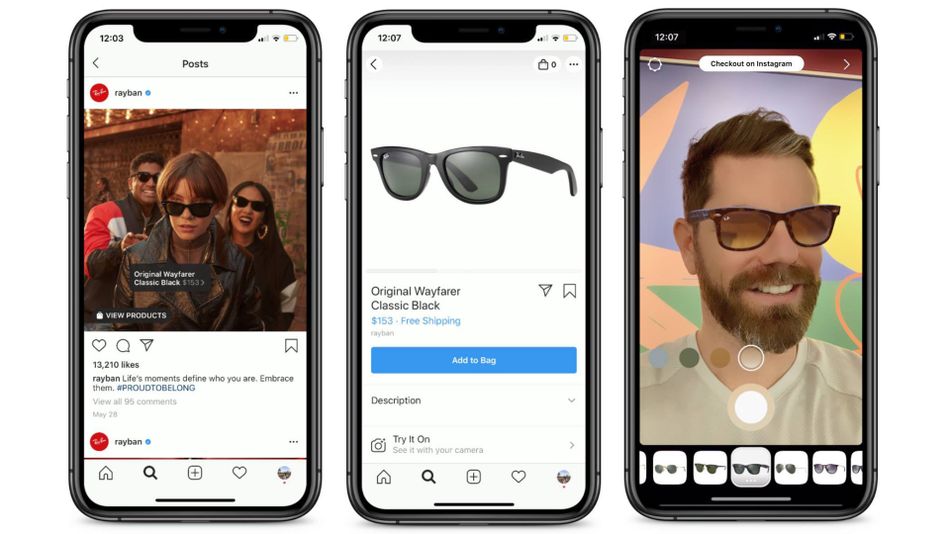

One promising outcome for AR on Instagram is shoppable lenses to transact right on the spot. We predicted this in 2018 when it was clear that AR was coming to Instagram. That put AR on a convergence path with Instagram’s ongoing transformation into a shopping experience.

This has since unfolded as Instagram works with fashion retailers to integrate AR product try-ons as part of the in-app transaction features they already utilize. These integrations are logical, as Instagram has become a place for consumers to discover products and transact.

AR will now join that shopping flow to make products more demonstrable, pursuant to boosting sales. This continues to be validated by Snapchat and others. For example, Facebook itself has reported that AR-based cosmetics try-ons have boosted conversion rates by 28 percent.

Altogether, Facebook has several tracks for spatial computing, which will eventually converge. It has primary VR ambitions to connect the world in more immersive ways (and monetization therein). It’s also working towards AR glasses, “Live Maps” and lots of other spatial research.

Mobile AR lenses are the least sexy of this lot. But they’re key step to get users and developers acclimated to a spatial UX. That will prime the next era of interfaces Facebook is aiming for. Meanwhile, mobile AR — potentially fueled by Instagram — generates real revenue today.

Scale of Influence

Another component of Instagram that could create fertile soil for AR advertising is its influencer framework. But rather than rely on a relatively small batch of high-influence celebrities, AR can decentralize that sphere of influence by creating micro-influencers throughout the social graph.

This brings in what 8th Wall VP of Product Tom Emrich calls incarnations. The principle stems from ever-popular selfie lenses by allowing consumers to wear (or be) a given product through branded accouterments. In this case, brands can empower anyone as an ambassador.

Puma’s “Pumans” campaign did this by letting users pose with a Puma mask and share with friends. Its viral appeal jumpstarted a network effect as people acted as micro-influencers within their social graphs. AR has a unique ability to amplify and optimize that shareability.

“They inspired their followers to use the filter themselves by sharing the link when they showed off the filter in their stories,” said Emrich. “This in turn created a population of ‘Pumans’ who would then market the filter to their followers and so on. The scale of influence where the use of filters creates other users of the filter is something unique to AR. That’s because the asset that your influencer is marketing is a digital one that can be shared and used throughout the network, rather than a physical product that’s captured and shared on one influencer’s feed, relying on likes and comments.”

We’ll pause there and circle back in the next installment to continue the discussion of AR advertising players and formats. Next up: web AR. Meanwhile, check out the full report here.