Data Dive is AR Insider’s weekly dive into select spatial computing figures. Running Mondays, it includes data points and strategic takeaways. For an indexed library of data, reports, and multimedia, subscribe to ARtillery Pro.

Data Dive is AR Insider’s weekly dive into select spatial computing figures. Running Mondays, it includes data points and strategic takeaways. For an indexed library of data, reports, and multimedia, subscribe to ARtillery Pro.

Socially-distributed lenses and filters are the leading form of consumer-based AR in terms of active use. A close second is location-based gaming, thanks to Pokémon Go, whose users engage with AR 2-3 minutes per session and with more AR game elements rolling out all the time.

For social lenses, we’ve based much of our analysis on the active use of the AR lens leader Snapchat. It has 163 million daily active lens users, some of whom engage 30 times per-day. Snap has also announced that it has surpassed one million lenses created.

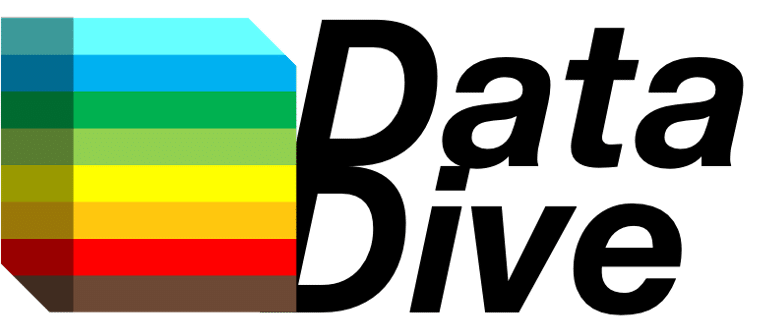

But if we segment Generation Z (born ’96-’10), engagement and demand signals appear to index higher. As we examined recently, 56 percent of Generation Z use social apps — with Snapchat currently in the lead — while 40 percent specifically use AR lenses to do so.

Coming of Age

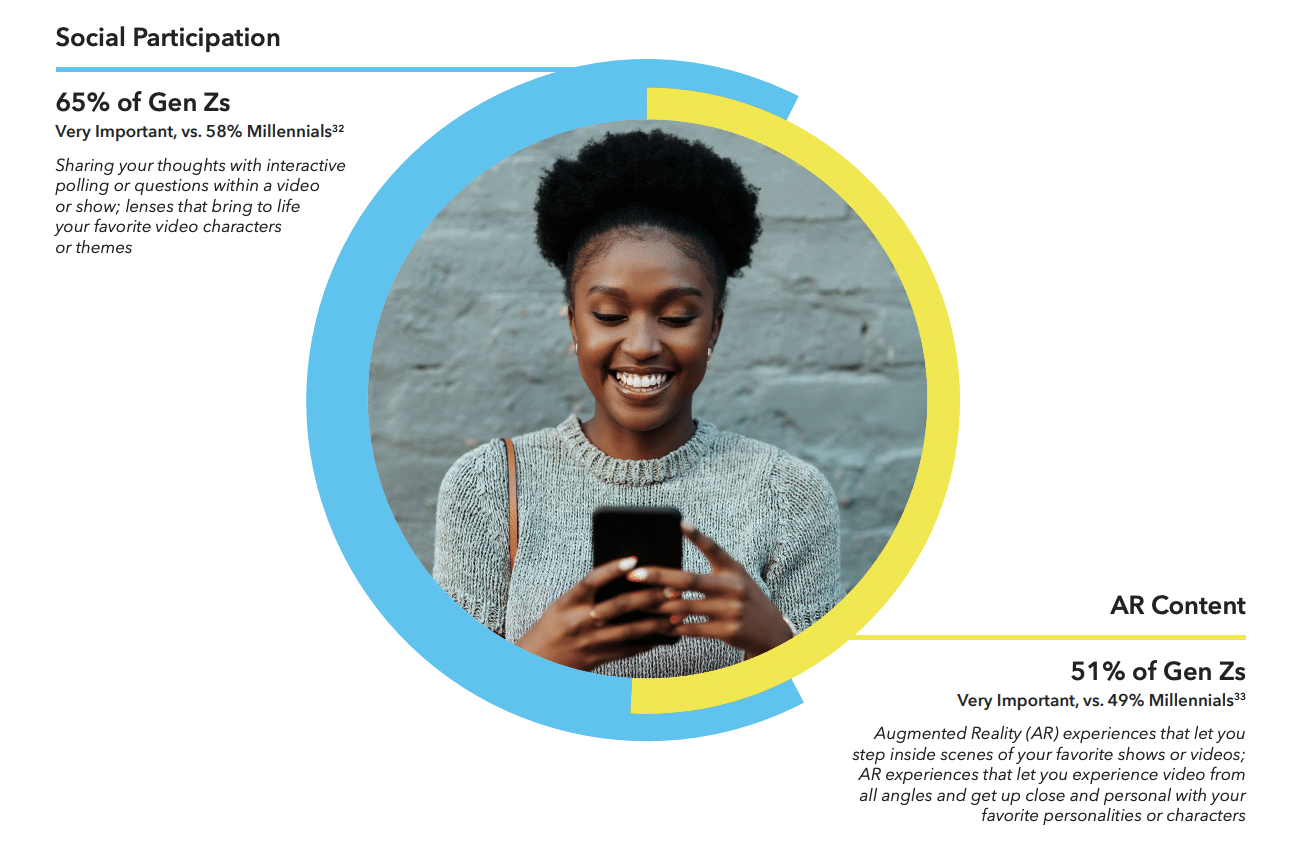

Joining that data are newer findings from a National Research Group (NRG) study. 51 percent of Gen-Z respondents (and 50 percent of millennials) identify AR as “very important” for entertainment and social connections. See the survey wording in the graphic below.

This aligns with data from Pew Research, showing that Gen-Z leans towards Snapchat and away from Facebook, at least in terms of usage frequency. But in fairness to Facebook, it’s no slouch for execution, investment and long-term vision in AR and the full spatial spectrum.

Either way, Gen-Z affinity for AR bodes well for all players. Examining today’s usage is one thing, but segmenting by generation can be a leading indicator of AR’s future demand. This will unfold as Gen-Z — like millennials — systematically phase into the adult consumer population.

Of course, anything can change through a generation’s shifting behavior. But digital-native orientation and a deep-rooted proclivity for sharing media puts AR lenses in a good position for sustainability. That could involve lenses’ current attributes or the ways they’ll evolve over time.

Commercial Viability

Usage and engagement are one thing. The rubber meets the road in turning that engagement into monetization. Snap has proved adept in this department, as shown in its virtuous cycle of developers, users and advertisers. It’s living up to its camera-company designation.

Further in support of Snap lenses’ commercial viability, eMarketer reports that 52 percent of Snapchat users say AR-based product visualization helps them make purchase decisions. This amplifies during eCommerce-heavy lockdowns and in a “touchless” post-covid world.

To quantify this, AR Insider’s research arm, ARtillery Intelligence, pegs Snapchat as the market-share leader for the estimated $1.4 billion that will be spent on AR ad campaigns this year. But Facebook could catch up when adding up all of its properties, including the mighty Instagram.

We’ll continue to track this horse race, including reports and revenue forecasts. Meanwhile, It should be noted for the sake of transparency that Snap commissioned the above NRG survey, so take it with the appropriate salt tonnage. Its methodology and integrity appear to be intact.